The Paper Money Titanic Sinks At Dawn!

Stock-Markets / Fiat Currency Mar 19, 2015 - 01:49 PM GMTBy: DeviantInvestor

What Titanic? The RMS Titanic, or any of the following:

What Titanic? The RMS Titanic, or any of the following:

- A titanic quantity of derivatives – say 1,000 Trillion dollars. A derivative crash was at the center of the 2008 market meltdown. It could happen again since there is now more debt, leverage, and risk than in 2008.

- A titanic accumulation of debt – global debt is approximately $200 Trillion. Global population is about 7,000,000,000 so there is about $28,000 in debt per living human being. If global debt were backed by all the gold mined in the history of the world, an ounce of gold would back $36,000 in debt. Gold currently sells for less than $1,200. Gold is undervalued and there is an excess of debt.

- A titanic increase in debt in the past decade. Official US debt increased by over $10,000,000,000,000 in the past ten years. What did the US gain from the increase of $10 Trillion in debt? Are debt accumulation and expense policies materially different in Europe or Japan? Was the debt used to create productive assets or was it just flushed down the toilet into non-productive expenditures? THE BENEFIT IS GONE, BUT THE DEBT REMAINS. This debt accumulation policy is neither good business nor sustainable.

- A titanic bond bubble. Since interest rates are currently at multi-generational lows, or 700 year lows in Europe, or perhaps all-time lows, that strongly suggests a bubble in bonds. Would you buy a bond from an insolvent government knowing the government will pay you next to nothing in interest over the next ten years? Further, the government is guaranteeing a devalued currency so any dollars, euros, or yen you eventually receive will be worth much less in purchasing power than today.

- A titanic currency bubble in the US dollar, which just hit a 12 year high after a parabolic rise since May last year. Experience with parabolic rises suggests extreme caution.

- A titanic collapse in the crude oil market. Supply is strong, demand is weak, and prices have fallen to about $45 from about $105 last June. The last time crude oil prices fell was from July to October 2008, a most difficult time.

The titanic creation of paper assets such as bonds, currencies, and stocks has created substantial risk. That risk has spilled over into the crude oil, gold and silver markets since they are strongly influenced by the paper derivative markets – paper contracts for crude oil, paper gold, and paper silver. Leverage and derivatives magnify risk. The instability will eventually create a second version of the 2008 recession/depression.

MORE SPECIFICS:

Business Inventories to Sales Ratio looks like 2008: This ratio is discussed here. When people and businesses are buying less inventories increase and that affects businesses down the chain including manufacturing, retail, and transportation.

More Crazy Stuff Coming: Read David Stockman’s article.

Margin Debt on US stock exchange: Margin debt peaks along with S&P 500 index. See discussion here.

Ten Year Yields: Yields are low in the United States and Europe. German five year yields went negative this week and ten year yields are less than 0.3%. Such negative yields would have been unthinkable a few years ago. I think a titanic disappointment is coming. Martin Armstrong discussed negative interest rates in his article, “Negative Interest Rates – Brain-dead Thinking that Will Implode the World.”

S&P Earnings per Share versus price: Graham Summers discusses in his article, “This Divergence is Worse Than That of The 2007 Top.”

S&P Prices up 200% in Six Years: The S&P 500 Index has been levitated by central banks “printing” money. In March of 2009 the S&P was below 680 and today it is above 2,000. See this article for discussion and warning.

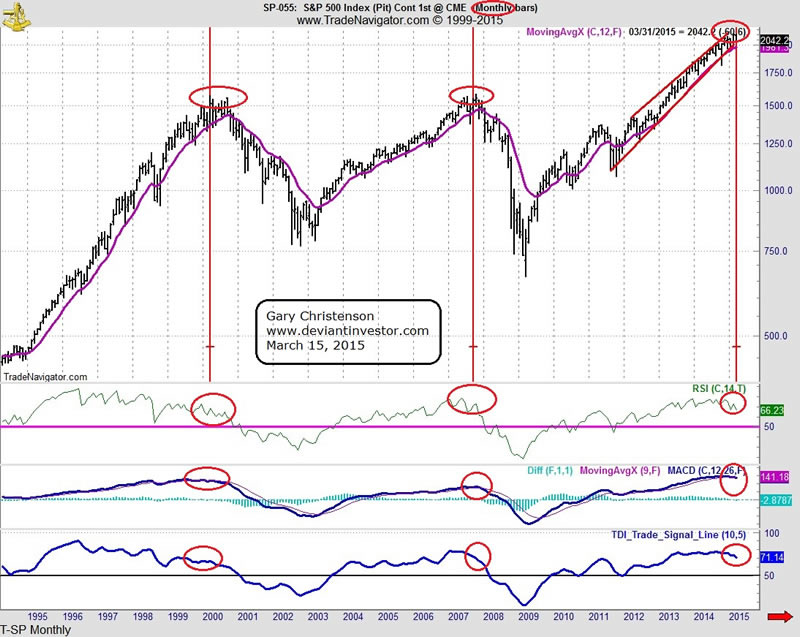

Examine this monthly chart of the S&P 500 for a 20 year perspective. The chart shows three massive tops in 2000, 2007, and 2015. I have circled the “over-bought” conditions shown in three technical indicators at the bottom. Note that all three have “rolled over” as they did in 1999-2000, and 2007. Perhaps the final peak has occurred or perhaps it is still a few months away, but regardless it is a time for caution.

Bill Bonner has written about crash conditions and specifics surrounding the 2008 crash, here and here. Regarding September 15, 2008 he quoted

Representative Paul Kanjorski of the 11th congressional district of Pennsylvania:

“The Treasury opened up its window to help and pumped $105 billion into the system. And it quickly realized it could not stem the tide.

We were having an electronic run on the banks. They decided to close down the operation… to close down the money accounts. […]

If they had not done so, in their estimation, by 2 p.m. that day $5.5 trillion would have been withdrawn. That would have collapsed the US economy. Within 24 hours, the world economy would have collapsed.

We talked at that time about what would have happened. It would have been the end of our economic and political system as we know it.

People who say we would have gone back to the 16th century were being optimistic.”

CONCLUSIONS:

Our financial system has titanic problems, leverage and debt worse than 2008, and is vulnerable to a crash. Large icebergs lie ahead and I suspect that our financial ship has already been struck by several – crude oil price collapse, dollar parabolic rally, Greek exit from the Euro, and escalating war in the Ukraine. Ten minutes after the RMS Titanic struck the iceberg and began filling with water, the “party was still on” for almost all of the passengers on the Titanic. Less than three hours later the “unsinkable” Titanic was gone.

Over 100 years later some items have been recovered from the Titanic. Three items that survived the icy depths were diamonds, gold, and silver.

Repeat: Lives were lost, paper stock certificates were gone, bonds did not survive, dollar bills were destroyed, but gold and silver endured the sinking of the Titanic over a century ago.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.