Government Bonds - The Most Crowded Trades on Wall Street

Interest-Rates / International Bond Market Mar 17, 2015 - 07:07 AM GMTBy: EconMatters

The most crowded trade on Wall Street, the globe, or a beach in Brazil is the Bond Yield Chasing/Price Appreciation trade. This sector or asset class is an absolute bubble, the magnitude of which has never been seen in a mainstream asset class, and one that is deemed conservative and safe by investors which makes the tail risk for these assets off the charts. We literally are looking at an 8 sigma event down the road in this asset class.

The most crowded trade on Wall Street, the globe, or a beach in Brazil is the Bond Yield Chasing/Price Appreciation trade. This sector or asset class is an absolute bubble, the magnitude of which has never been seen in a mainstream asset class, and one that is deemed conservative and safe by investors which makes the tail risk for these assets off the charts. We literally are looking at an 8 sigma event down the road in this asset class.

Liquidity Bubble

It is driven by a liquidity bubble, there is just far too much capital via cheap money sloshing around financial markets with no place to go, and this has been the case for the last five years. And now that Japan and Europe have jumped on the QE bandwagon the last several years, the liquidity bubble just keeps growing. Investors have made a boatload of money over the last 7 years with Global ZIRP and each year they keep needing bigger asset storage places to put all this paper wealth.

Read More >>The Bond Market Has Reached Tulip Bubble Proportions

Central Banks Irresponsible Promotion of Risk Seeking Behavior

The problem is that central banks let this get so out of hand and frankly are freaking clueless as to the magnitude of the problem that they have created that future losses on European bonds alone I surmise makes all European banks completely insolvent once these bonds that have little to no reserves set aside to offset future losses are marked to market 10 years from today.

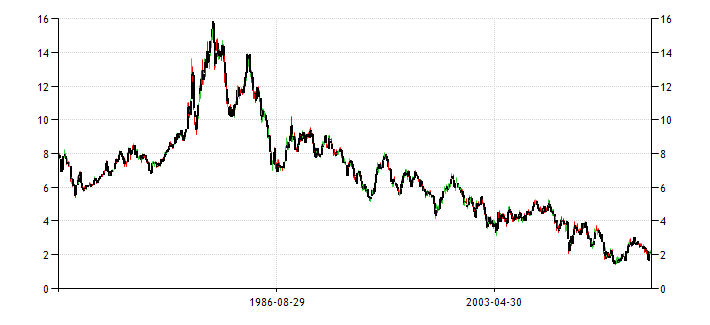

US 10-Year Bond Yield (1970-2015)

Read More >>Watch As All the Bond Rats Jump Ship before FOMC Meeting

Complacency

The fact that financial markets have become so complacent due to a leading Central Bank in the US Fed being ultra-dovish that even in changing language for a rate hiking cycle they will go out of their way to be seen as dovish. This is ridiculous, is the financial system that fragile after 7 plus years of ZIRP? It shouldn`t matter to financial markets whether the Fed will bend over backwards for a 25 basis point rate hike at this stage of the recovery process! This should be worrisome to the Fed regarding just how far markets are off sides with dovish complacency, and the ridiculous need for hand holding from the Federal Reserve.

Read More >>Countdown to Bond Market Crash

Laziness of Investors

Bond investors look at the world this way they have all this money and they need to invest it somewhere; they cannot store these types or vast sums of money in cash. It requires too much work to research alternative investments, they refuse to put this money to work for lending, infrastructure investments, growth projects, capital expenditure investments like power plants; all these type investments are considered riskier than just an electronic transfer into bonds with ZIRP.

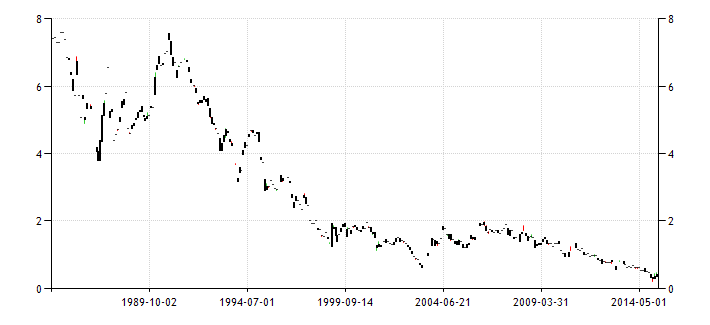

Euro Area 10-Year Bond Yield

Reinforcing Nature of Bond Bubble

The problem with this mentality is the bubble keeps growing, yields keep going lower, and investors not only are not losing money they are making money, further re-enforcing the mentality that these are the best places to put capital to work as investments. You know the logic that house prices can never go down! This further reinforces their mentality of bonds being safe stores of capital value regarding principal; that big deal bonds sell off and they lose 2.4% on the investment! Moreover, given all the profits they have made in the past and the fact that they have stored this capital ‘safely’ adds to the bond complacency trade and is an additional part of the problem.

Read More >> European Bond Market: Bubble of all Bubbles!

European Bond Market: Bubble of all Bubbles!

It is the degree of bond prices now relative to historical norms where bond investors are underestimating their exposure. It doesn`t matter if you have to work harder to find alternative investment options to bonds but these investors better make this choice because it takes a substantial lead time to put in the work on these type investment strategies. Not to mention that unwinding some of these bond positions will take years, and not months!

Germany 10-Year Bond Yield

Debt-to GDP Ratios

By the time that the Debt to GDP Ratios start to matter again on outright and blatant insolvency risks; that these bond holders are going to have to take major haircuts on these positions becomes a legitimate concern given their cost structure of abnormally low interest rates. The liquidity trap ensures that when everybody exits the principal losses on some of these humongous bond portfolios and positions is going to be well above 50%, not the 2.4% that they have in their current models.

Risk Premium Completely Abolished in ZIRP World

The US keeps pushing out more and more debt each year, they keep having to raise the debt ceiling every year, what happens in 2018 when the entitlement`s curve starts kicking in? This event is just three years away! By having cost basis or artificially low central bank subsidized entry costs on some of these bond positions at current valuation levels, the losses on these investments which should never have been encouraged by Central Banks are going to be in the 6 sigma range once the entitlements’ curve kicks in regarding the true nature of the US`s debt obligations. This brings to the forefront what is currently lacking in the bond models that bond premiums are supposed to represent for investors – the haircut factor.

Japan 10-Year Bond Yield

European & Japanese Bonds: 8 Sigma Plus Risk Profile

This is the US, forget about European and Japanese Bonds there is no hope for even haircuts for these bond holdings. There is no bond valuation model that makes any of these holdings worth 10 cents on the dollar in just 10 years from now! It doesn`t matter whether there is inflation right now, central banks need to discourage ‘haircut investments’ of all kind. This is how financial markets crash with derivatives: losses beget losses, leverage exacerbates the problem, CDS`s, Asset Margin Collateral, Options Spike, Volatility Explodes, Counterparty Risk soars, and distrust of the system causes the entire financial system to implode like the 2007 financial crisis. But this time all central banks have no more tools, the entire world is at ZIRP Warp Mode.

Poor Capital Allocation Investment Hurts Both Sides of the Debt-to-GDP Equation

France 10-Year Bond Yield

Inflation will rear its ugly head again, but this is the least of Central Banks concerns it is the amount of Global Debt that continues to pile up relative to GDP. If central banks incentivized actual investment with all this cheap money in growth producing projects the world and financial system might have a fighting chance. But this is counter-intuitive to their logic so they keep rates artificially low, incentivizing poor capital allocation strategies, continuing building the bond bubbles. This sets the stage for 6 sigma events at the minimum because the yields are so out of whack with historical norms. The debt keeps piling onto governments` balance sheets because interest rates and borrowing costs are so low negatively reinforcing proper addressing of the escalating government debt. Therefore no need for structural reforms, and voila Central Banks just reinforced the bubble getting bigger and bigger until market forces make it pop due to the realization that haircuts are the only way out!

The Haircut Era for Bond Holders

Consequently the Bond bubble is not only a crowded trade, an overcrowded trade, a bubble of historic proportions but it will cause the entire crash of the financial system if it continues at its current pace of massive expansion; and is certainly the next global recession to hit financial markets. It will be the cause for 401ks becoming 201ks or less sometime over the next 10 years as the liquidity bubble, leads to the bond bubble, leads to the re-pricing bubble based upon historical valuation norms; that ultimately leads to what I call the “Haircut Era” for bondholders!

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2014 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.