The ECB Should End QE Next Month

Interest-Rates / Quantitative Easing Mar 16, 2015 - 10:59 AM GMTBy: EconMatters

Mario Draghi backed into Unenviable Corner

Mario Draghi backed into Unenviable Corner

This was an instance where the markets pushed Mario Draghi in a direction that really wasn`t necessary, an area he knew deep down was fruitless, and in the end will be proven to be a complete waste of time, forestalling the inevitable structural changes required for Europe to grow in a competitive fashion over the next decade.

Germany, South Korea & United States

Where are the Apple`s and Samsung’s of Europe? This is the real problem for European growth, they don`t produce innovative companies that compete on a global basis. There is no Silicon Valley for Europe. Germany has great engineering minds, and their country’s business prospects reflect their competitive innovation in this area, Germany has been a dominant player in the luxury automobile market for decades. Subsequently the problems facing Europe are really country specific and it revolves around which countries have educational, cultural and business infrastructural systems in place that cultivate competitive and innovative new business models that can compete for market share on a global basis with the likes of China, South Korea, Germany and the United States.

Read More >>Six Days Until Bond Market Crash Begins

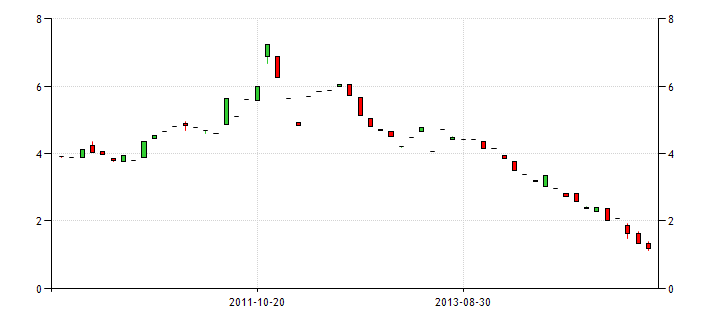

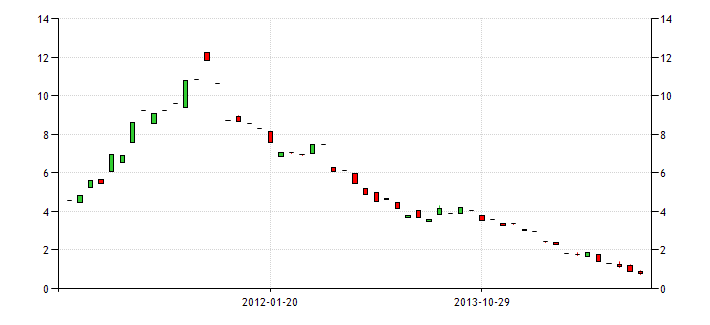

German 10-Year Bond Yield

France Serial Underachiever

France has immense resources at its disposal but as a country is a serial underachiever in terms of competing in areas of innovation beyond the fashion and cosmetics Industry. They should be much more prominent in promoting technological and scientific advancements and offering up entirely new industries for the next century. If alternative energy and green energy focus is where France feels comfortable investing and promoting as a society then start at the grass roots, educate your citizens in the sciences to dominate this industry, and invent the next paradigm for solar technology and energy storage battery technology. Start producing the next generation of Elon Musk’s from your country`s vast educational, cultural and financial resources.

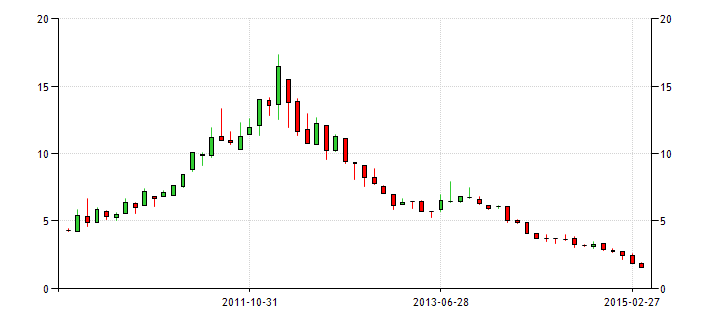

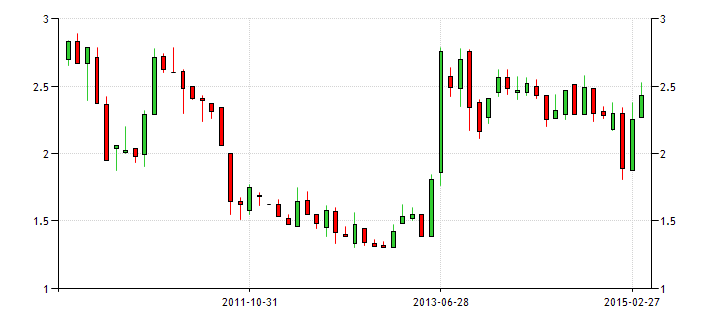

France 10-Year Bond Yield

Shale Technology Didn`t Just Fall from Heaven

In short be the very best in some industry that generates real competitive advantage on a global scale, be the Apple or Samsung of Solar. But it starts with having the right structural environment for industry to build upon, i.e., Silicon Valley in the United States, Advanced Engineering in Germany, and Technological Commitment and Innovation in South Korea. For example, the United States has become the experts on Shale Technology revolving around the energy industry, and the US dominates in their understanding and development of this advancement in energy extraction techniques. This didn`t happen by accident! The Free Market system of Capitalism set the stage for Shale Development in the United States as high energy prices motivated the entrepreneurial spirit and created innovative technological advancements to meet these energy demands from the marketplace.

Read More >>The Swiss 10-Year Bond Illustrates Central Banks` Flawed Monetary Policy

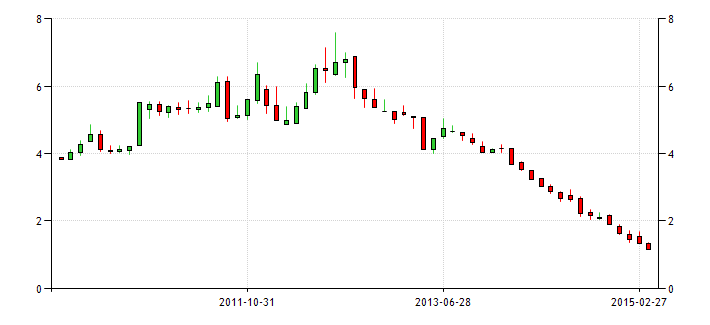

Italy 10-Year Bond Yield

Germany & the European Union Laggards

This is the real problem and is country specific within the European Union, there is basically Germany and everyone else, most of the laggards of the European Union just aren`t very innovative, or offer any competitive industries that the world needs on a large enough scale to move the needle in regards to promoting real country growth and revenues. This is the real issue with Europe, one of structural environment, and providing the necessary infrastructure in the laggards of the European Union to compete over the next century on an ever changing global landscape.

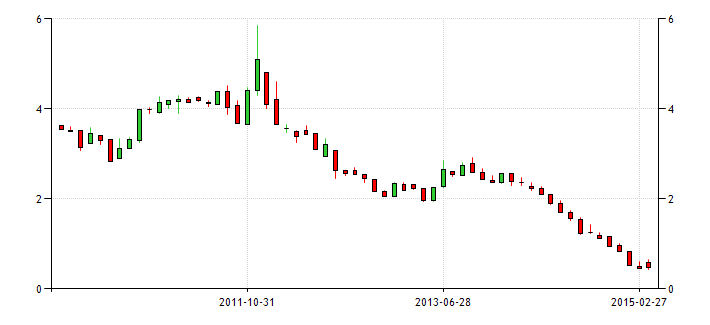

Portugal 10-Year Bond Yield

On the other hand Mario Draghi buying German Bunds pushing the yield on the 10-year bond from 30 basis points to 20 basis points is just beyond absurd, and frankly very dangerous. The reason this is dangerous is the fact that Germany is already a very strong economically structured economy, and their currency is in effect through a weaker Euro being far too undervalued compared to the strong economics of the country. This is going to result in even stronger growth for Germany, and they risk having an over-heating economy, and an inflation problem down the road which is specific to Germany. The ECB instead of buying bonds to push already extraordinarily and unsupportable bond yields any lower would have been better served by issuing new “European Educational Bonds” to build ‘science academies’ or ‘business entrepreneurial development programs’ or ‘engineering programs’ in Poland, Italy, Portugal, Spain, Ireland and many of the other underperforming European countries.

Read More >> The Bond Market Has Reached Tulip Bubble Proportions

Spain 10-Year Bond Yield

South Korean Business Strategy & Model

The South Korean government made a concerted effort to develop industries that would compete for market share on a global basis. You cannot stroll through the appliance department these days and not realize South Korea`s advancement and influence in this area where they were not even a player 20 years ago. This didn`t happen by accident, South Korea analyzed what model they needed to employ from a structural and environmental business climate standpoint, promoted this landscape through investment, education and cultural commitment, and now are dominate players on a global scale in many industries. This is what Europe needs to do from a structural business strategy standpoint.

Belgium 10-Year Bond Yield

European Politicians & Structural Reforms

Mario Draghi got talked into this European QE nonsense when it wasn`t required because European politicians keep trying to kick the can down the road on real European structural reforms. Europe already had a QE program, as they benefitted immensely from the QE programs in the United States. The fund flows and derivative effects of the US QE Programs, being that the United States and European financial markets are very closely aligned, flowed through to Europe on a grand scale. Therefore, an additional QE program just isn`t going to have much positive effect in real terms because bond yields are already historically and insupportably low for the long term in Europe.

Read More >>Were European Bonds Mispriced in 2012 or are they Now?

Ireland 10-Year Bond Yield

Germany Risks Overheating Economy & Runaway Inflation

The benefit of a weaker Euro may seem appealing for the short term, but it isn`t really a solution to Europe`s structural problems, and in fact may exacerbate the structural differences between the strong and weak countries in the European Union. This could result in runaway inflation in the stronger European countries and increased trade imbalances between European Member countries that only widen the economic inequity, social and political interests’ gap. The Euro has already been devalued considerably, European Bonds are at unsupportable levels, and it is pretty apparent that a QE program in Europe just isn`t needed at this point, there is nothing more for it to do!

Greece 10-Year Bond Yield

Europe Wants Growth Then Raise Interest Rates: Healthy Capital Rates Motivates Healthy Capital Allocation Strategies that Promote Real Growth Projects in the Actual Economy

Singapore 10-Year Bond Yield

The supposed goals of a European QE Program have already been accomplished through essentially market front running by financial institutions and players, and as soon as it began, its end is already in sight. The biggest QE in Europe and the United States was the lowering of interest rates to zero, once the zero bound is reached, the only real stimulus to actually motivate real investment growth and fund flows into growth oriented projects it to raise interest rates. This changes and motivates financial players to find alternative financial returns as opposed to just yield chasing opportunity returns in bond to borrowing cost leverage paper market plays.

South Korea 10-Year Bond Yield

European QE is Dead On Arrival

I am not sure how long Mario Draghi can carry on this QE Charade but it is quite obvious that the benefits have already been gained, there is nothing more to be gained from the program, and I am sure it will continue on a couple more months for appearances sake. But I look for European QE to end much sooner than they anticipated when rolling out this program. They talked about it for so long, built up the front-running momentum for years, that when it finally gets installed, all the intended results have already been essentially front run by financial markets. European QE is a massive instance of a Buy the Rumor, and Sell the News event.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2014 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.