Sorry But This Is Not 1997 for the Stock Market

Stock-Markets / Stock Markets 2015 Mar 14, 2015 - 04:27 PM GMTBy: Sy_Harding

Several months ago I wrote of how super bull markets that last nine or ten years have been once in a generation situations, the last ones being those of the 1920’s and the 1990’s, but that there were enough similarities to 1997 in the current bull market that it could possibly make it into that category.

Several months ago I wrote of how super bull markets that last nine or ten years have been once in a generation situations, the last ones being those of the 1920’s and the 1990’s, but that there were enough similarities to 1997 in the current bull market that it could possibly make it into that category.

In 1997, the 1990’s bull market had also been underway for six years, which had the market already overvalued by traditional measurements. However, investors were convinced it was under the protection of the Fed and the ‘Greenspan Put’, and the bull market accelerated further to the upside (into what became the infamous 2000 bubble).

The current market is likewise overvalued by the same traditional measurements, and investors are convinced it is under the Fed’s protection via the ‘Bernanke/Yellen Put’.

In another similarity, the 1990’s bull market had begun with the economy in recession, with government debt and budget deficits at scary record highs. However, by 1997 the anemic economic recovery was accelerating, and the budget deficits were coming down.

This time around, the economy has also been pulling anemically out of recession, the market is in a six-year bull market, and Federal budget deficits are coming down from record highs.

Unfortunately, the other positive developments that seemed to be in place several months ago have faded away quite dramatically.

Last fall, it looked like the economic recovery was accelerating dramatically, as it had in 1997. GDP growth jumped from a recessionary - 2.1% in the first quarter of 2014 to 4.5% in the second quarter, then 5.0% in the third quarter. It looked to be headed toward robust growth above 6%, as was seen in 1997 (and which continued to 2000).

However, economic growth has suddenly plunged again, back down to only 2.2% in the fourth quarter, and is forecast to come in as low as 1.7% in the first quarter of 2015, as negative economic reports continue for the first three months of 2015.

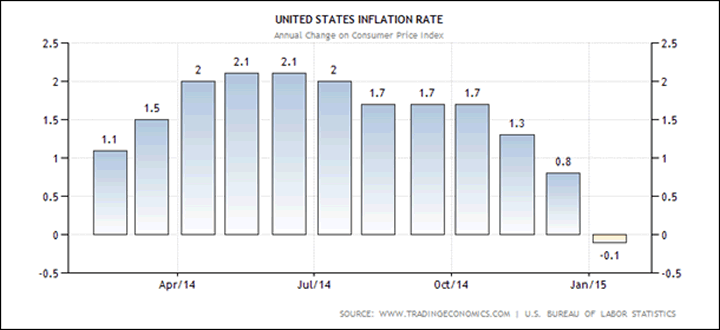

In yet another negative turnaround, the rate of inflation, which climbed toward the Federal Reserve’s stated target of 2% last summer, has plunged since, all the way into negative (deflationary) territory in January.

And Friday’s report is that the Producer Price Index unexpectedly came in at - 0.5% in February, its fourth straight monthly decline, versus the consensus forecast for a rise of 0.4%.

The inflation rate in 1997 averaged 2.2%, and the Fed says it needs 2% inflation now to support economic growth. Unfortunately, while it looked last summer like it might get its wish, inflation is now moving in the opposite direction again, and aggressively enough to be raising deflation concerns.

The result is that, while last summer the situation was beginning to look bullishly like 1997, in the six months since the economy has taken on a much more worrisome appearance.

The stock market, focused more on the intentions of the Fed than on the economy, has also taken on a worried look, anxiously awaiting the Fed’s FOMC meeting next week, whether it will indicate that the ‘Yellen Put’ remains in place, or if the Fed will signal it is close to raising interest rates regardless of the market’s concern.

It is a potential lose-lose scenario. If the economy is slowing so much the Fed does not dare go ahead with its plan to begin raising interest rates as early as June, the stock market traditionally does not like a slowing economy. That was seen in the 20% market correction in 2011, even as the market supposedly remained under the protection of the ‘Bernanke Put’. Yet if the Fed remains resolute in believing the time has come to begin raising interest rates, the market does not like rising interest rates.

These latest situations, added to previous concerns about valuation levels and investor complacency, feed into my warnings to “Remain bullish – but watchful”, and expectation that the market in 2015 is going to experience a substantial correction with a significant low in the October/November period.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2015 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.