Bitcoin Price Reversal?

Currencies / Bitcoin Mar 14, 2015 - 04:19 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

IBM might be working on the adoption of blockchain to serve traditional currencies, we read on the Reuters website:

International Business Machines Corp is considering adopting the underlying technology behind bitcoin, known as the "blockchain," to create a digital cash and payment system for major currencies, according to a person familiar with the matter.

The objective is to allow people to transfer cash or make payments instantaneously using this technology without a bank or clearing party involved, saving on transaction costs, the person said. The transactions would be in an open ledger of a specific country's currency such as the dollar or euro, said the source, who declined to be identified because of a lack of authorization to discuss the project in public.

(...)

"When somebody wants to transact in the system, instead of you trying to acquire a bitcoin, you simply say, here are some U.S. dollars," the source said. "It's sort of a bitcoin but without the bitcoin."

This is interesting since IBM would be the first large company we know of to start work on actually developing a new type of blockchain transactions. So far most of the works has been done by startups and more established companies usually steered clear of Bitcoin, except for payments integration. IBM seems to be looking to come up with a new kind of blockchain, the essential part of the Bitcoin ecosystem, to create a vehicle for easy money transfers. It will be very interesting to see whether the company will be able to come up with a solution which would make the payment value less volatile than it is now.

On the one hand, a system without wild currency fluctuations might be beneficial to those who are not that much interested in Bitcoin as a currency but rather as a payment system. On the other, most of the development in the cryptocurrency space seems to be revolving around Bitcoin. So, by coming up with a system of their own, IBM could actually miss out on a lot of the benefits that would come from a variety of extensions to the Bitcon system. One way or another, this shows that some of the big players in the tech market are interested in Bitcoin enough to work on the system on their own.

For now, we focus on the charts.

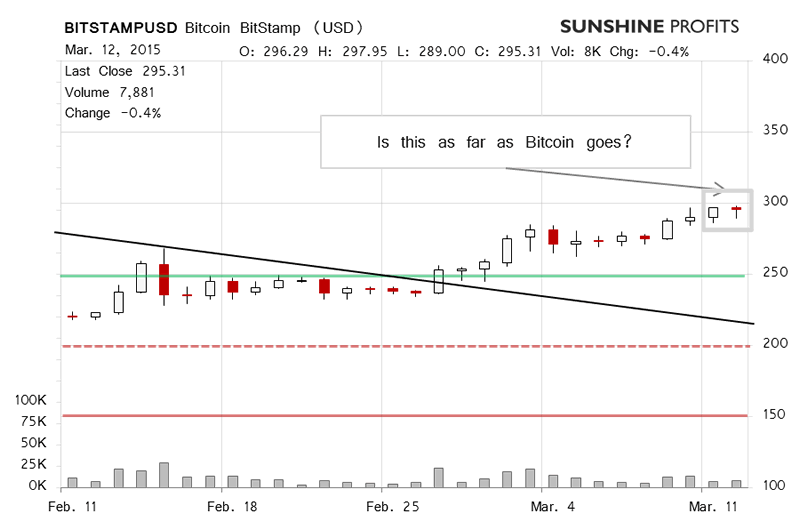

On BitStamp, we saw a first day of depreciation yesterday. The volume was similar to what we had seen on the day before and Bitcoin started moving out of the overbought zone. This looked like a possible reversal but yesterday we wrote:

Is today a tipping over point? It might be, but we wouldn't bet on it just now. Based on the recent developments and the lack of volume today, we would expect either several days of subdued volume before more declines or a temporary move higher. This is our best bet at the moment. It is possible that we will see a stronger move above $300, but we would bet on this at the moment. The situation is pretty tense.

And the situation remains tense today as Bitcoin has depreciated slightly so far (this is written around 12:30 p.m. ET) but the move hasn't been really strong. We might be seeing a breather after a prolonged rally. The size of the move doesn't support a very bearish outlook just now. We would like to wait for a slightly more pronounced move lower before betting on a further move down.

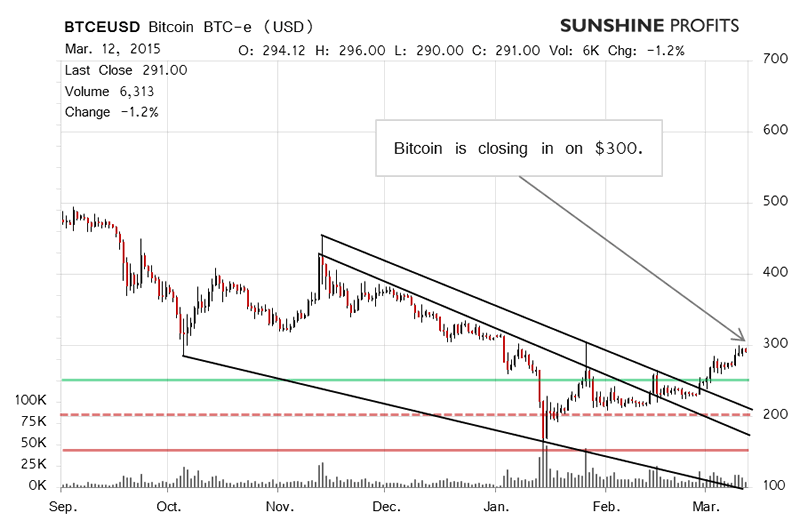

On the long-term BTC-e chart, we see that the recent action looks like a pause below $300. Yesterday, we wrote:

The situation has become slightly more bearish today but not enough to go short, in our opinion. Our assessment now is that we might see a period of trading around $300 before possible declines or a short-term move above $300 followed by a reversal and more declines. We don't rule out a continuation of the rally just now but the overbought levels combined with the $300 potential psychological level might indicate that the rally is coming to an end.

Today has certainly been an indication of a pause or even more declines. The main level to observe now is $300. If we see a strong move above it, the rally might continue. However, we wouldn't bet on this. It seems that the rally might be running out of steam. If we in fact see a failed move above $300 or more declines from where Bitcoin is trading now, we might consider hypothetical short positions.

Summing up, we don't support any speculative positions.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.