Alan Greenspan Warns Crude Oil Price Hasn't Hit Bottom Yet

Economics / US Economy Mar 13, 2015 - 04:56 PM GMTBy: Bloomberg

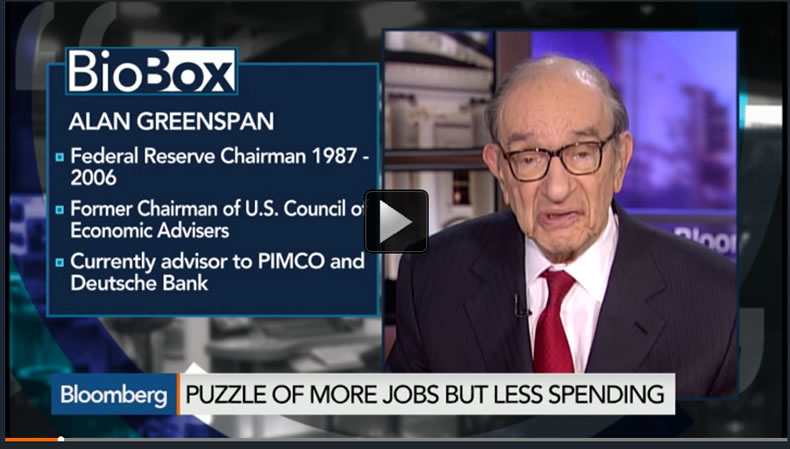

Former Federal Reserve Chairman Alan Greenspan Alan Greenspan spoke with Bloomberg Television's Betty Liu about the outlook for oil, the U.S. economy and the dollar.

Former Federal Reserve Chairman Alan Greenspan Alan Greenspan spoke with Bloomberg Television's Betty Liu about the outlook for oil, the U.S. economy and the dollar.

Greenspan told Betty Liu that oil hasn't hit bottom yet: "We are at the point now where, at the current rate of fill, we’re going to run out of room [at our domestic facility in Cushing, Oklahoma] by next month. And then the question is -- where does the crude go? Because everyone's forecast as to what was going to happen when prices collapsed was a sharp curtailment in shale oil production. That has not happened. The weekly figures, which are produced by the Energy Information Agency through March the 6, show a continued rise in domestic crude production and it has got no place to go, because we can’t legally export the way we would for most products. We can do a little exporting and Canada, but essentially, we’re bottling up a huge amount of crude oil in the United States."

On the stronger U.S. dollar, Greenspan said: "A stronger dollar tends to suppress general domestic price level. But the problem here is that we are not quite certain where the problem on the exchange rate comes from, whether it is a strong U.S. economy, which is a questionable issue, or a weak rest of the world, which is a little more credible."

BETTY LIU: Chairman Greenspan, thank you so much for joining me this morning. We're hoping you can solve some of this mystery as to why we are adding jobs, and it looks great, but we are not spending? What is going on here?

ALAN GREENSPAN: Well, it's unfortunately very simple but not a good story. It's turning out that we're using more and more people at the margin to produce less and less. Productivity, which is output for man hours as we conventionally measure it, is running at a very low rate of increase. And that's the critical variable in the economy over both the short-term and the long-term.

So what we are confronted with right now is a very serious problem caused by the fact that capital investment is falling far short of the requirements necessary to keep the capital stock growing, and therefore productivity. It is not working.

LIU: So how do we reverse that? What exactly is behind that, Chairman?

GREENSPAN: Well, I've on many occasions indicated that the best way to standard this is to track it backwards. There's a very tight relationship between the stock of nonresidential, private stock and output per hour. They move together parallel all the time for very good reasons. But that capital stock requires capital investment. And capital investment, in turn, is being crowded out by a very substantial increase in government expenditures. Basically, entitlements -- because both parties, both the Republicans and the Democrats, don't want to talk about it largely because it is considered the third rail of American politics. You touch it and you lose.

LIU: Well, so that makes perfect sense. So it might come down to cutting some costs, right, to cost controls, Chairman. Top of your list, I know you've mentioned entitlement spending. You know, you've got Medicare, Social Security. The No. 1 thing that you think that we need to cut our costs on is what?

GREENSPAN: Well, the basic issue is the entitlements and the reason it's a problem is that people put money in their own funds and their employers' funds plus interest and that is what they perceive they et back , and therefore they are entitled to it because it is their money.

The only problem is that's not what we are doing. We're not creating enough funding for the Social Security trust funds, and the same thing goes for Medicare Part A. And we're not funding this. So long as we are not funding this, we are dollar for dollar crowding out capital investment.

LIU: Dr. Greenspan, some look at these numbers though, I mean noot just jobs, but the lack of productivity, as you just pointed out. Also, the spending decline that we are seeing. But also the strength of the dollar, as perhaps delaying the Fed policy on raising interest rates. I know that you don't speculate, you don't want to interfere on Janet Yellen's job, but all those factors combined -- do they foreshadow a longer wait on moving on monetary policy?

GREENSPAN: Well, you're merely repeating what is probably going on in the internal discussions of the Federal Open Market Committee. And I won't comment on that.

LIU: OK. Understood. The higher dollar, though, Dr. Greenspan, is that going to have - or do you belive it's going to keep the lid on inflation?

GREENSPAN: What do you mean? As productivity or what' going to keep a lid?

LIU: The higher U.S. dollar. OK, so we just talked about how the higher U.S. dollar should be reducing import cost for many companies. It's not so far. But if it does, is that going to help alleviate some of the inflationary pressures and, possibly, the need - again, not forecast raising interest rates or not -- but the need to tighten?

GREENSPAN: Yes, there's no question. A stronger dollar tends to suppress general domestic price level. But the problem here is that we are not quite certain where the problem on the exchange rate comes from, whether it is a strong U.S. economy, which is a questionable issue, or a weak rest of the world, which is a little more credible.

Remember, we're -- the exchange rates in the global economy are a zero sum game. As the dollar goes up, someone else goes down. What we are seeing is a significant weakening obviously in the euro. We are seeing it in the ruble; we're seeing it in the yuan. So it's a very, very complex problem of international trade and international capital flows. And it's not altogether clear that the U.S. can readily make major changes in the dollars exchange rate, because it's such a critical currency that the types of actions that we would have to take are probably are outside the realm of where we would think it's good policy.

LIU: All right, well, Dr. Greenspan, we're going to approach another topic that has effect on inflation. That is oil prices. Dr. Greenspan, stay with me for a moment. We've got to just take a commercial break.

With Dr. Alan Greenspan, the former Fed chairman.

(BREAK)

LIU: You're watching IN THE LOOP live on Bloomberg Television and streaming on mobile and bloomberg.com. Good morning, I’m Betty Liu.

America has a massive surplus of oil and there may soon be nowhere to store all of it. That’s according to the International Energy Agency. And inventories are at a record 485 million barrels, skyrocketing in the last few months as demand has fallen. At the same time, the volume of oil at America's largest storage facility in Cushing, Oklahoma, has a most tripled since October. What does this mean? Possibly lower prices yet still.

Still with me is former Fed chairman Alan Greenspan. And Chairman, I know that oil is something that you have been watching very closely. You say it’s extremely important for us to be watching what happens to oil. You believe we still haven’t hit rock bottom here, right?

GREENSPAN: That’s correct, Betty. If you look at the data, as you just pointed out, our major domestic facility is in Cushing, Oklahoma, which is delivery point for West Texas Intermediate crude contracts. We are at the point now where, at the current rate of fill, we’re going to run out of room in Cushing by next month.

And then the question is -- where does the crude go? Because everyone's forecast as to what was going to happen when prices collapsed was a sharp curtailment in shale oil production. That has not happened. The weekly figures, which are produced by the Energy Inter-Nation (sic) Agency through March the 6, show a continued rise in domestic crude production and it has got no place to go, because we can’t legally export the way we would for most products. We can do a little exporting and Canada, but essentially, we’re bottling up a huge amount of crude oil in the United States.

So that the West Texas Intermediate price is running $10 a barrel on the Brent crude, which is the global price. And that basically means that we are creating great abnormalities in the system. And unless and until we find a way to get out of this dilemma, prices will continue to ease because there’s no place for that oil to go except for into the markets. And spot crudes are especially vulnerable because of so-called contango is a very high level, and that implies that there’s a very, very significant set of pressures on the spot price.

LIU: But, Dr. Greenspan, what about this theory though? When it seems inevitable that we’re going to see this huge oversupply and oil prices come down even more, isn’t that eventually going to hit U.S. production? It might be a very sharp crash in the number of rigs that get closed down but eventually the market will adjust?

GREENSPAN: Well, remember, the rigs that have been closing down have not been affecting the capacity to produce crude yet. And the reason is that most of them -- the ones which are not multiple well related, you’re getting the inefficient ranks shutting down but the capacity to basically build an oil expansion remains there. And frankly, I had expected it to turn down or ease a number of weeks ago and these numbers keep rising.

Now, it is perfectly credible that, because the cost of crude, especially I should say for shale crude which is more expensive than standard old-fashioned crude, those numbers are high -- $55 or $65 a barrel. There is some, Eagle Ford shale, which going under $50 a barrel. But there's not much room under there before cash flow turns negative. At that point, they shut down and it could be quite abrupt, as you point out.

LIU: Right, that’s right. It could be very abrupt. Then, Chairman Greenspan, if nothing is done here short of, let's say, a lift of our export ban on crude, what could we expect from OPEC?

GREENSPAN: Well, I think that OPEC is no longer the price leader. I wrote a long editorial -- op-ed piece last week or so in which I pointed out that essentially what is happening is that, because of the advent of shale, which is a very much more flexible type of facility to expand and contract crude, that the marginal global price-making mechanism has moved to the United States away from OPEC. And I think that that’s going to continue unless and until prices fall below the cost of crude production from shale, which is very significantly above where, for example, the Saudi crudes. There’s some Saudi crudes which can be lifted at less than $1a barrel in the Ghawar fields, the huge Ghawar field in Saudi Arabia. We're lucky if we can get $40

LIU: That’s incredible. That is a great point; it’s incredible and it sort of brings to light just how complicated the situation is.

Dr. Greenspan, thank you so much for joining us this morning. The former Federal Reserve chairman, Alan Greenspan.

**CREDIT: BLOOMBERG TELEVISION**

Copyright © 2015 Bloomberg - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Bloomberg Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.