Rising Interest Rates are a “wild card.” Here’s how to play it…

Interest-Rates / US Interest Rates Mar 13, 2015 - 02:52 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: This week's trading featured a three-day losing streak for U.S. markets on fears that the Fed may hike interest rates earlier than expected, with the Dow, S&P 500, and Nasdaq shedding around 1.24%, 1.50%, and 1.57% respectively.

Keith Fitz-Gerald writes: This week's trading featured a three-day losing streak for U.S. markets on fears that the Fed may hike interest rates earlier than expected, with the Dow, S&P 500, and Nasdaq shedding around 1.24%, 1.50%, and 1.57% respectively.

Bring it on!

I've pointed out repeatedly since the financial crisis began that the "good is bad" meme followed by traders – which triggers market dips with every piece of significant good news, thanks to paranoia that the Fed will seize on that news to raise rates – only creates buying opportunities for investors with the right tactics.

Today, that could be you.

The week's collapse creates three massive opportunities. I'm going to explain to you exactly what they are, why they exist, and most importantly, why they're being overlooked by insiders and mainstream investors alike.

Here's what they're all missing – and here's your opportunity.

The Market's Dangerous Addiction

I make no bones about it: Three successive Fed chairs – Greenspan, Bernanke, and Yellen – have allowed the markets to become addicted to cheap money the way a drug addict relies on chemicals to get through the day.

Rather than seek a way out, these Fed chairs facilitated an "all-gain-no-pain" rally based on tens of billions of dollars a month in stimulus and cheap money.

It's been so powerful that it's done exactly what they wanted and created a reality distortion vortex that's caused millions of investors to dismiss bigger structural issues while allowing politicians on both sides of the aisle to play a trillion-dollar version of Three-Card Monte.

Unfortunately, I think the real game is more like Whack-A-Mole. You and I both know there will eventually be hell to pay. There always is. Just not tomorrow.

But here's the thing: Wall Street would have you believe that a return to "normal rates" via a hike of any kind would lead to a massive market correction, an assumption I've always found really interesting.

The Real Truth About Raising Rates

The historical precedent behind the effects of rate hikes on the stock market is much more nuanced than Wall Street lets on. In fact, the most recent and pertinent examples we have point to exactly the opposite happening – rate hikes causing rallies in their immediate aftermath.

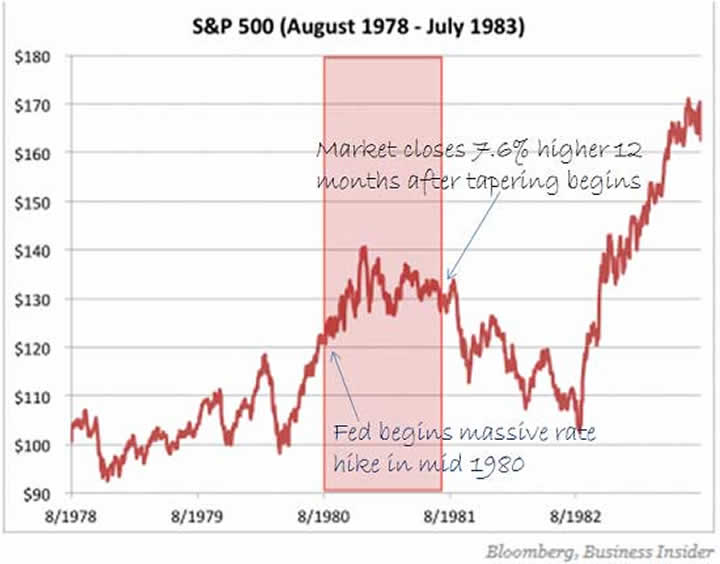

Look back to early 1980. A sense of economic malaise in the country turned to downright panic as inflation soared. And yet the stock market was in the middle of an impressive bull run, showing strength that was widely out of step with almost every other economic indicator (much like today).

Then, in the spring of 1980, Fed Chairman Paul Volcker drew up experimental designs for a rate hike on a scale that would be unthinkable to Janet Yellen today. Volcker began a rate hike that would see rates climb to 19.03%… and stocks rallied through December.

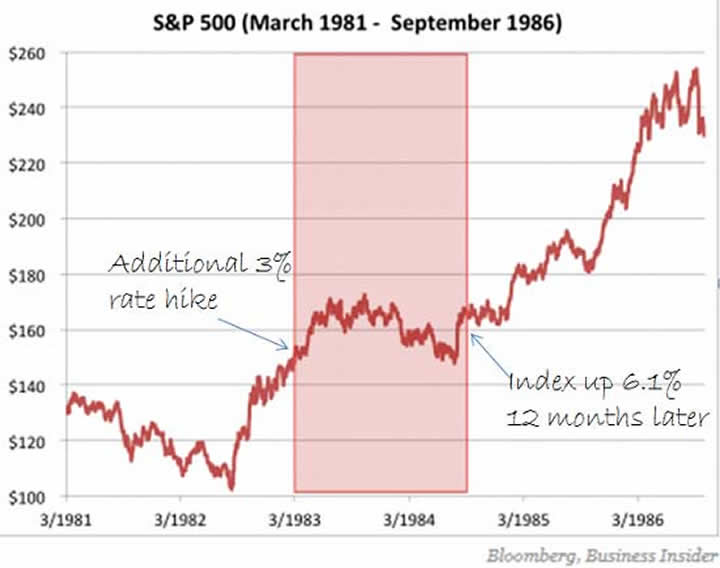

In mid-1983, the Fed decided to increase rates again in pursuit of an even more ambitious 11.44% target over the 8.50% it had already achieved. The result? The S&P 500 surged immediately, and it was still up 6.1% twelve months later compared to its pre-rate hike levels.

I could cite more examples (the Fed's $8.4 billion in fiscal tightening in 1987, the doubling of rates just before the stock market boom of the late '90s), but I think you get the idea.

Rate increases can actually be bullish.

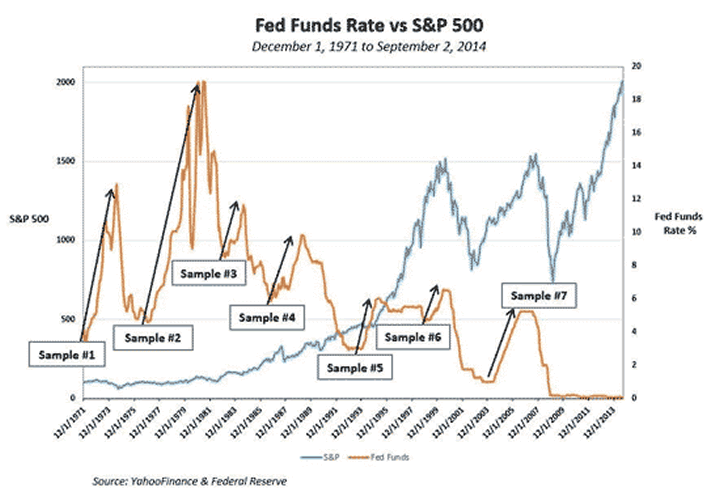

In fact, if you look at the Fed Fund Rates dating all the way back to Dec. 1, 1971, you can see that quite clearly.

According to my colleague Sid Riggs, Director of Research and Performance Measurement at Money Map Press, the markets actually went up, gaining an average of 13.47% during six of the last seven periods where the Fed raised rates. The only time the S&P 500 didn't rise alongside rising rates was all the way back in 1970, when the Fed Funds Rate increased from 3.71% to 12.92%. I hardly think the Fed has the gall to jack rates by that much today.

For all of the power that unnatural stimulus has to juice the markets artificially, traders seem to have forgotten that getting the financial house in order is really the great hope here.

That means panic selling is an opportunity to buy.

I see three great ways to play the last gasps of Fed stimulus – and the eventual return to normal rates.

Three Stocks That Resist Rate Pressure

If markets oblige Wall Street's expectations – but defy history thanks to the special circumstances of the most severe stimulus addiction I've seen in my investing lifetime – the swoon will be a sharp one, and you'll need to be ready.

The best choices will be our "must haves."

We've talked about these at length many times. These are the companies that supply services and products that are indispensable to humanity, and thus are recession-resistant, even immune.

Here are three to get you started.

Becton, Dickinson and Co. (NYSE: BDX) develops, manufactures, and sells a wide array of medical supplies and devices, instrument systems, diagnostic products, and lab equipment. The majority of its products are single-use only, meaning the company benefits from re-orders on a consistent basis. It's perfectly positioned behind our Demographics Trend, as the aging global population will create a demand for BDX's healthcare services that is larger than ever. It offers a dividend yield of 1.70%, which is more than reasonable considering the ultra-low level of risk the stock carries.

American Water Works Co. Inc. (NYSE: AWK) provides water and wastewater services to residential, commercial, industrial, and public consumers in both the United States and Canada. Because everyone relies on running water, AWK makes a perfect "must have" example – and like BDX, its services will only grow in demand as the world's population continues to grow exponentially (the Demographics Trend at work again). Its dividend yield is currently at 2.40%.

ABB Ltd. (NYSE: ABB) is a global leader in power and information technologies. Because of its role in almost every stage of the development, construction, and implementation of projects like smart grid technologies, power grids, and improvements of operations at chemical plants, ABB also provides services that humanity can't do without. It offers a healthy yield of 2.80%.

In closing, I know it's tough not to get wrapped up in the moment, especially when markets are getting carried out feet first like they did Tuesday. But try your best.

The point at which the markets reach maximum despondency is almost always the perfect time to buy.

Source :http://moneymorning.com/2015/03/13/rising-rates-are-a-wild-card-heres-how-to-play-it/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.