Currency Wars Deepen - IMF Concedes End to U.S. Dollar Hegemony

Currencies / Currency War Mar 09, 2015 - 02:35 PM GMTBy: GoldCore

- Dollar has declined as reserve currency over past decade from 70% of global reserves to 61%

- Dollar has declined as reserve currency over past decade from 70% of global reserves to 61%

- Chinese yuan is growing in stature as international currency

- IMF deputy director calls for de-dollarisation in emerging markets

- Many countries have begun de-dollarising

- BRICS development bank – rivaling the IMF and World Bank – is now operational

Currency wars and the growing trend away from dollar dominance in international finance, particularly in emerging markets, was highlighted in an interesting CNBC article this morning entitled “Is the Dollar Losing its Clout Among EMs?”

It refers to the deliberate and stated policy of “de-dollarisation” around the world, the decline in the use of the dollar in international trade and as a reserve currency and the emergence of the new BRICS bank.

The article quotes best-selling author and Pentagon insider, Jim Rickards. Rickards says that the status of the dollar as a reserve currency is still solid despite its decline over the past decade and despite the rise of other currencies in international transactions.

“The dollar is declining as a trade currency, but it remains strong as a reserve currency. Right now, it’s around 61 percent of global reserves, versus 70 percent over a decade ago” he said.

Meanwhile, figures from the BIS and SWIFT show that the yuan is now among the top ten traded currencies in the world. While this is significant it should be seen in the context that the dollar still being used in 80% of global trade.

Chinese ambitions in this area are clear, however. China is negotiating currency settlement deals in local yuan with many of its trading partners. Zero Hedge ran an article last week on a billboard advertisement in Bangkok from the Bank of China declaring the RMB to be “the world currency”.

“And it’s true,” they added, “the renminbi’s importance in global trade and as a reserve currency is increasing exponentially, with renminbi trading hubs popping up all over the world, from Singapore to London to Luxembourg to Frankfurt to Toronto.”

Last month the Deputy Managing Director of the IMF, Japan’s Naoyuki Shinohara, openly stated that emerging markets in Asia should begin the process of de-dollarisation “to mitigate against external shocks and constraining the central bank’s ability as lender of last resort.”

This is interesting as the IMF has historically been one of the main agents of dollar hegemony. We believe it demonstrates the level of risk now extant in the system that the IMF should be promoting a move away from the dollar, possibly towards Special Drawing Rights (SDRs).

China and Russia have negotiated currency arrangements excluding the dollar in recent years. Kazakhstan has also explicitly announced a process of de-dollarisation, in an attempt to bolster the local currency, the tenge.

Russia is in negotiations with India and Egypt to settle their trade in local currencies.

The BRICS development bank is now operational which will see countries who avail of it repaying loans probably in yuan, given that China provides over 40% of the funding. It will act as a rival to the IMF which may explain why the IMF is taking a more inclusive approach to currency reserves.

Currency wars are set to intensify and competitive currency devaluations accelerate. When that happens, gold will again become an important monetary and geo-political asset for central banks and a vital safe haven asset for investors and savers.

Updates and Award Winning Research Here

MARKET UPDATE

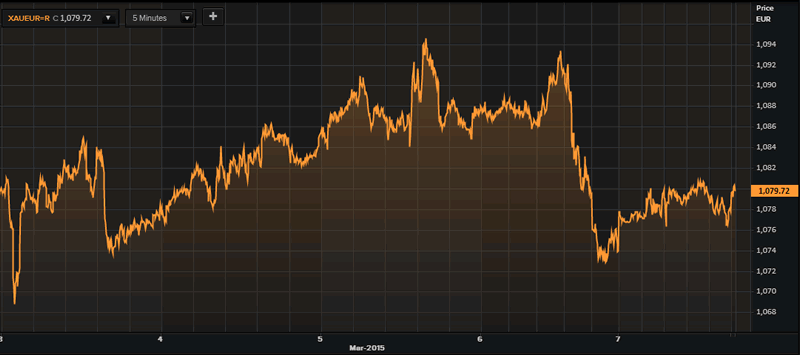

Today’s AM fix was USD 1,173.75, EUR 1,077.97 and GBP 776.86 per ounce.

Friday’s AM fix was USD 1,196.50, EUR 1,090.60 and GBP 787.85 per ounce.

Gold fell 2.7% percent or $32.30 and closed at $1,165.70 an ounce Friday, while silver slid 2.1% or $0.34 to $15.87 an ounce. Gold and silver finished down for the week -3.75% and -4.22% respectively.

Gold in Euros – 5 Days (Thomson Reuters)

Gold for immediate delivery rose and then dropped back as the U.S. dollar’s rally and Friday’s nonfarm payrolls report increased speculation that the U.S. Fed will raise interest rates sooner rather than later.

Spot gold climbed 0.5 percent to $1,173.26 an ounce in late morning trading in London. It fell nearly 2.7 percent on Friday, its biggest one day drop since Oct. 1, 2013.

On Friday, the yellow metal reached its lowest price since December 1st, at $1,163.45 per ounce just after the U.S. nonfarm payrolls were released. The U.S unemployment rate reached its lowest level since 2008.

Asian premiums on the SGE have climbed to between $5 and $6 this morning up from $4 to $5 in the prior session.

Silver for immediate delivery fell to its lowest in 8 weeks at $15.69 an ounce in earlier trade before trading up 0.1 percent at $15.92. Palladium was up 0.5 percent at $819.75 an ounce, while platinum fell to $1,145.95 an ounce reaching its lowest price since July 2009.

HOW TO STORE GOLD BULLION – 7 KEY MUST HAVES

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.