Students Getting a PhD in Subprime Debt - U.S. Debt Breaking Bad Part 3

Personal_Finance / Student Finances Mar 02, 2015 - 03:26 AM GMTBy: James_Quinn

In Part One of this three part article I laid out the groundwork of how the Federal Reserve is responsible for the excessive level of debt in our society and how it has warped the thinking of the American people, while creating a tremendous level of mal-investment. In Part Two I focused on the Federal Reserve/Federal Government scheme to artificially boost the economy through the issuance of subprime debt to create a false auto boom. In this final episode, I’ll address the disastrous student loan debacle and the dreadful global implications of $200 trillion of debt destroying the lives of citizens around the world.

In Part One of this three part article I laid out the groundwork of how the Federal Reserve is responsible for the excessive level of debt in our society and how it has warped the thinking of the American people, while creating a tremendous level of mal-investment. In Part Two I focused on the Federal Reserve/Federal Government scheme to artificially boost the economy through the issuance of subprime debt to create a false auto boom. In this final episode, I’ll address the disastrous student loan debacle and the dreadful global implications of $200 trillion of debt destroying the lives of citizens around the world.

Getting a PhD in Subprime Debt

"When easy money stopped, buyers couldn’t sell. They couldn’t refinance. First sales slowed, then prices started falling and then the housing bubble burst. Housing prices crashed. We know the rest of the story. We are still mired in the consequences. Can someone please explain to me how what is happening in higher education is any different?This bubble is going to burst." – Mark Cuban

Now we get to the subprimiest of subprime debt – student loans. Student loans are not officially classified as subprime debt, but let’s compare borrowers. A subprime borrower has a FICO score of 660 or below, has defaulted on previous obligations, and has limited ability to meet monthly living expenses. A student loan borrower doesn’t have a credit score because they have no credit, have no job with which to pay back the loan, and have no ability other than the loan proceeds to meet their monthly living expenses. And in today’s job environment, they are more likely to land a waiter job at TGI Fridays than a job in their major. These loans are nothing more than deep subprime loans made to young people who have little chance of every paying them off, with hundreds of billions in losses being borne by the ever shrinking number of working taxpaying Americans.

Student loan debt stood at $660 billion when Obama was sworn into office in 2009. The official reported default rate was 7.9%. Obama and his administration took complete control of the student loan market shortly after his inauguration. They have since handed out a staggering $500 billion of new loans (a 76% increase), and the official reported default rate has soared by 43% to 11.3%. Of course, the true default rate is much higher. The level of mal-investment and utter stupidity is astounding, even for the Federal government. Just some basic unequivocal facts can prove my case.

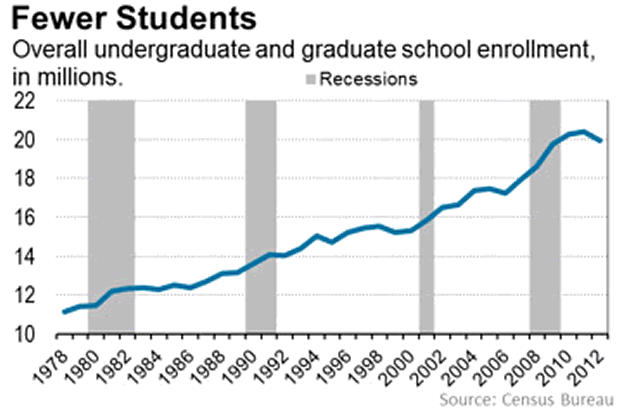

There were 1.67 million Class of 2014 students who took the SAT. Only 42.6% of those students met the minimum threshold of predicted success in college (a B minus average). That amounts to 711,000 high school seniors intellectually capable of succeeding in college. This level has been consistent for years. So over the last five years only 3.5 million high school seniors should have entered college based on their intellectual ability to succeed. Instead, undergraduate college enrollment stands at 19.5 million. Colleges in the U.S. are admitting approximately 4.5 million more students per year than are capable of earning a degree. This waste of time and money can be laid at the feet of the Federal government. Obama and his minions believe everyone deserves a college degree, even if they aren’t intellectually capable of earning it, because it’s only fair. No teenager left behind, without un-payable debt.

According to National Center for Educational Statistics, colleges and universities will award 1 million associate’s degrees and 1.8 million bachelor’s degrees in 2014-2015. So they are admitting more than 5 million in the front end, with only 2.8 million ever earning a degree. That means almost 50% never graduate, confirming the SAT predictive results. Then there is the fact an associate’s degree and most of the liberal arts degrees awarded qualify the graduate for a fry cook job at Burger King. What is even more fascinating in this episode of absurdity is the fact undergraduate enrollment has fallen by 930,000 in the last two years and stands only 700,000 higher than when Obama took office. A critical thinking person might ask how student loan debt could grow by $500 billion when college enrollment only grew by 700,000. That is $711,000 per additional student in college. Something doesn’t add up.

The Federal government couldn’t possibly have doled out $500 billion to anyone with a pulse as a way to manipulate the national unemployment rate lower, because anyone in school is not considered unemployed. Do you think the $500 billion was spent on tuition and books? Or do you think those "students" used it to for hookers, blow, booze, iGadgets, HDTVs, online poker, weed, fantasy football entry fees, and Linkedin stock? – Whatever it takes to boost GDP. With default rates already at all-time highs and accelerating skyward, with $131 billion of loans already in serious delinquency, you don’t need a PhD from the University of Phoenix (where default rates exceed 30%) like Shaq to realize the American taxpayer is going to get it good and hard once again.

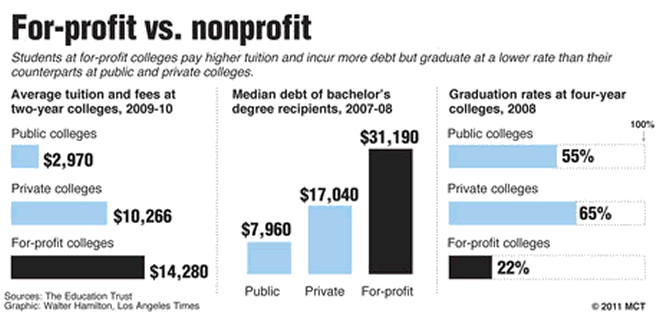

It seems the for-profit diploma mills and community colleges account for a huge percentage of loan defaults. They are nothing but bottom feeders in a feeding frenzy of Federal loans. The five schools in the country with the highest level of defaulters from 2011 through 2014 are as follows:

- University of Phoenix – 45,123

- ITT Technical Institute – 11,260

- Kaplan University – 10,684

- DeVry University – 9,081

- Ivy Tech Community College – 7,237

These institutions of lower learning spend more annually on marketing than Ivy League business schools generate in total revenue. They are nothing more than swindlers, gaming the Federal loan system, and dispensing virtually worthless diplomas, and leaving its students deep in debt. The true consequence of providing easy money to people who shouldn’t be in college has been to drive up tuition rates at all colleges and universities. Without this $500 billion infusion of illusion, demand would drop, the diploma mills would go out of business, and legitimate institutions would have to lower tuition rates to attract students. But that’s not how Obama and his administration roll.

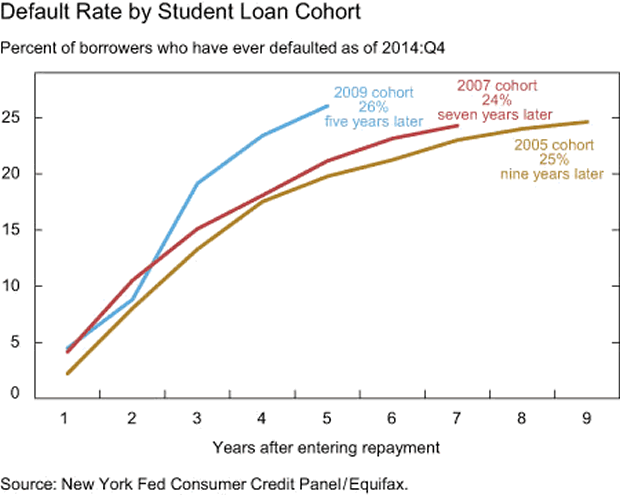

The biggest scam is the reported default rate disseminated by the Fed and regurgitated by the mainstream media. There are over 7 million borrowers in default on a federal or private student loan. Roughly a third of Federal Direct Loan Program borrowers have been forced into choosing alternative repayment plans to lower their payments. The reported 11.3% delinquency rate is based on total student loans outstanding. In reality 50% of the loan balances are held by students still in school, in their grace period, in deference, or in forbearance. They haven’t been required to make a payment yet. Of course the loans in deference or forbearance due to unemployment or economic hardship are essentially an allowable delinquency. The true delinquency rate on loans in the repayment cycle is 23%. This strongly implies that taxpayers will be on the hook for at least $250 billion of losses.

The long term impact on borrowers is also dire. Student loan debt cannot be extinguished in bankruptcy. It will follow them throughout their lives. Defaulting on a federal student loan has serious consequences. Unlike other consumer credit, borrowers in default on a federal student loan might see their tax refund taken and their wages garnished without a court order. The impact on their credit rating will keep them from buying a home. The pure volume of student loan debt is currently restricting household formation, first time home buyers, marriages, and consumer spending. The unintended negative consequences of issuing hundreds of billions in bad debt have far outweighed the ephemeral short term fake benefits. But short-term appearances are all that matter to the ruling class.

As of the fourth quarter of 2014, 11.3% of all borrowers were in default, with an additional 7% of borrowers having defaulted in the past. Another 6% of borrowers were in earlier stages of delinquency, but not yet defaulted; fully 37% of borrowers had at least one missed payment on their credit report. The chart below shows the cohort of student loans since 2005. Each cohort has progressively worse default experience. Roughly one quarter of each of the cohorts has defaulted as of the fourth quarter of 2014. The default rate of the 2009 cohort has surpassed that of the earlier cohorts much more quickly. Based on historical trends, the 2009 cohort will experience close to a 40% default rate. And this is before Obama unleashed the torrent of subprime student loan debt.

Only an Ivy League educated Princeton economist could examine the facts presented and conclude these were brilliant fiscal policy decisions which have boosted economic activity and fended off another Depression. A rational thinking person would conclude these desperate reckless measures will result in far worse outcomes when the debt dominoes begin to fall.

We are in a World of Debt

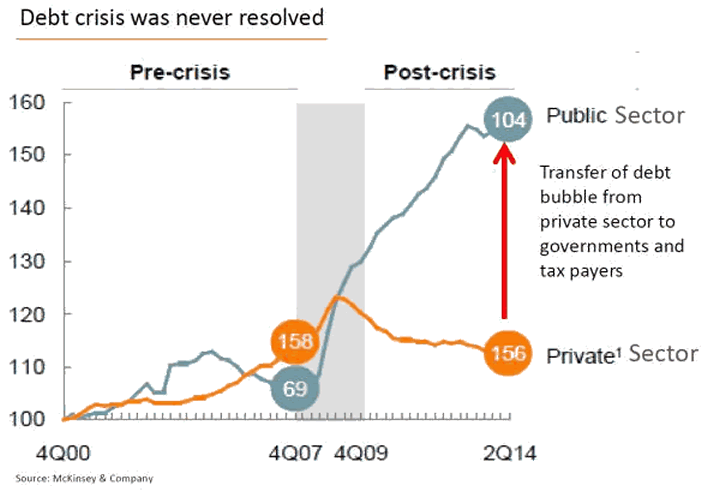

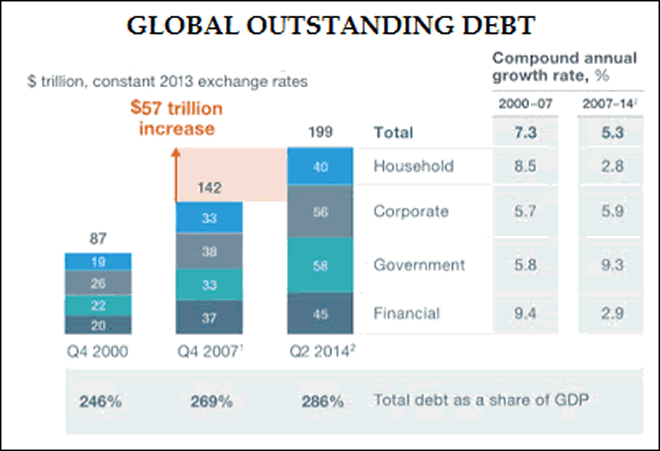

"After the 2008 financial crisis and the longest and deepest global recession since World War II, it was widely expected that the world’s economies would deleverage. It has not happened. Debt continues to grow. Since 2007, global debt has grown by $57 trillion, raising the ratio of debt to GDP by 17 percentage points." – McKinsey

It seems McKinsey is making the mistake of thinking like a logical sentient human being, rather than intellectually dishonest central bankers, criminally psychotic Wall Street CEOs, greedy myopic mega-corporation CEOs, or captured cowardly politicians. In a world run by honest, intelligent, rational people who cared about the long-term sustainability of our economic system, the actions taken after the 2008 debt fueled implosion would have been far different than the actions taken by the psychopathic, greedy, ego maniacal, hubristic moneyed interests over the last six years.

The 2008 worldwide financial crisis was produced due to excessively easy monetary policy, which caused the largest debt driven mal-investment in housing, automobiles, and Chinese produced crap in world history. It was done purposely by a uber-wealthy ruling class who call the shots, rig the game, reap the benefits, and deny responsibility when their machinations create havoc and suffering across the globe for the masses.

The consequences of this debt bacchanalia should have been the orderly liquidation of the Wall Street entities that created the crisis, the writing off of trillions in bad debt, corporate and personal bankruptcies of businesses and people who borrowed recklessly, a sharp steep economic decline to cleanse the excesses, and politicians who immediately began the process of reducing budgets and addressing long term unfunded unpayable liability promises. Instead, the psychotic oligarchs did not want to lose any of their power, wealth or control over the proletariat. They have done the exact opposite of what needed to be done. You must deleverage to solve a crisis caused by excessive debt. The oligarchs have succeeded in further raping and pillaging the working class, but have only delayed the final reckoning and guaranteed a debt apocalypse when their futile schemes fail again. And fail they will.

Arrogant condescending central bankers, narcissistic Wall Street psychopaths, crooked bought off politicians, and narrow-minded government apparatchiks across the developed world have colluded to add $57 trillion of additional debt to the existing Himalayan Mountain of unpayable debt we started with in 2008. We’ve entered the NIRP phase of the currency debasement race for the bottom.

Households throughout the developed world have acted in a relatively rational manner by paying down credit card debt and attempting to live within their means, because their real wages continue to decline and they are receiving no return on their savings. The moneyed interests continue to prey on the desperate and financially ignorant in their last ditch desperate attempt to loot the remaining treasure from the U.S.S. Titanic, hijack the remaining lifeboats, and leave the American people to sink into the frigid murky depths.

Corporate titans have added $18 trillion of debt as they take on debt to buy back their overpriced stock, artificially enhancing earnings per share and boosting their own compensation packages. Investing in their business is passé. We’ve entered a new paradigm where driving your stock price higher is all that matters to the Ivy League MBA executives. The Financial sector has shifted most of their toxic debt onto the Federal Reserve balance sheet and the backs of the American taxpayer.

The governing bodies of Japan, the EU, and the US have accounted for the vast majority of the $25 trillion increase in debt by the government sector. Total world debt as a percentage of World GDP is now approaching 300%. In 2000, the percentage was 185%. This level of debt can’t be sustained at zero interest rates, let alone normalized rates of 5%. Something that can’t be sustained won’t be. It is mathematically impossible for $200 trillion of debt to ever be repaid. It’s just a question of who gets screwed. And if the moneyed interests have their way, it’ll be you.

Everyone loves a boom. The party from 1996 to 2000 was a blast. Remember your moronic brother-in-law boasting about getting rich day trading. The bust was a bummer and your brother-in-law had to get a job at Wendy’s. The highly educated academics at the Fed couldn’t allow the pain or consequences to last. They made it their sole responsibility to create another boom from 2003 to 2008. It was a real doozy. The hangover afterwards was going to be epic.

The party should have been over, but Ben and Janet know better than the rest of us. Ben is a self-proclaimed expert on the Great Depression. Pain isn’t fun. Corrections and adversity must be banned. They have now created the most all-encompassing debt fueled contrived boom in history, with debt, stocks, and real estate all outrageously overvalued. The party has been going on for over five years. The inevitable collapse will be earth shatteringly horrendous. The public will be shocked once again. The anger, disillusionment, and shattering of confidence in the powers that be will be monstrous. This time there will be blood.

"The boom produces impoverishment. But still more disastrous are its moral ravages. It makes people despondent and dispirited. The more optimistic they were under the illusory prosperity of the boom, the greater is their despair and their feeling of frustration. The individual is always ready to ascribe his good luck to his own efficiency and to take it as a well-deserved reward for his talent, application, and probity. But reverses of fortune he always charges to other people, and most of all to the absurdity of social and political institutions. He does not blame the authorities for having fostered the boom. He reviles them for the inevitable collapse. In the opinion of the public, more inflation and more credit expansion are the only remedy against the evils which inflation and credit expansion have brought about." – Ludwig von Mises

Despite the non-stop propaganda campaign waged by the ruling class through their media mouthpieces about a non-existent economic recovery, the papering over of the gaping funding holes through the issuance of $57 trillion more debt, the waging of wars against terrorists we created to distract the masses, conducting coups against our latest perceived enemies, and the blatant rigging of financial markets to extract the remaining wealth of the nation from the people, the crack-up boom is nearing its endgame. The system is exceptionally fragile. Confidence in leaders is waning. The people are growing weary of the lies and their restlessness will morph into anger when the economic collapse resumes. You can sense things are not right. Trust in the system has turned to suspicion and cynicism. The growing anger in the nation and the world is palpable. Violent protests are a daily event, even if the mainstream media doesn’t report them.

Yellen, Draghi, and Kuroda speak as if they know what they are doing, perform confidently when on stage, but continue to act in desperate manner five years into a supposed economic recovery. The emergency measures they continue to employ and expand upon reveal their angst and inability to implement a monetary solution. Their only tool is the printing press and when confidence in their infallibility dissipates, the system will fail. The stench of fraud, cronyism, corruption, and hypocrisy of the moneyed interests permeates our degraded culture of materialism, greed and criminality. The party was fun while it lasted, but it is reaching its sordid drunken climax in the near future. There is no means of avoiding the final collapse of this Federal Reserve created boom.

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved." – Ludwig von Mises

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2015 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.