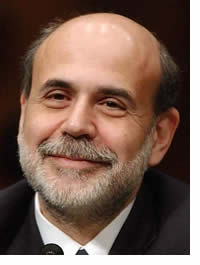

Ben Bernanke Soaking the Rich at Harvard

Economics / Money Supply Jun 06, 2008 - 12:16 AM GMTBy: John_Browne

This week I watched Fed Chairman Ben Bernanke charm the rain soaked graduating class of Harvard, my Alma Mater. As he spoke, I was reminded of an anecdote that President Franklin Roosevelt was alleged to have made during the commencement speech he gave at Harvard in 1936. Amidst a similar downpour, Roosevelt apparently said, “Well, Harvard sure knows how to soak the rich!” Fittingly, Bernanke graduated from Harvard in 1975, and his current policies are doing just that.

This week I watched Fed Chairman Ben Bernanke charm the rain soaked graduating class of Harvard, my Alma Mater. As he spoke, I was reminded of an anecdote that President Franklin Roosevelt was alleged to have made during the commencement speech he gave at Harvard in 1936. Amidst a similar downpour, Roosevelt apparently said, “Well, Harvard sure knows how to soak the rich!” Fittingly, Bernanke graduated from Harvard in 1975, and his current policies are doing just that.

The Fed Chairman sought to reassure the new graduates, and the nation at large, that the current economic situation is much rosier than the one presented to his graduating class more than 30 years ago. Among the factors that he listed that will prevent a replay of the 70's is the more sophisticated and positive influence of the Fed itself. Apparently, self doubt is not one of his burdens.

The Fed Chairman sought to reassure the new graduates, and the nation at large, that the current economic situation is much rosier than the one presented to his graduating class more than 30 years ago. Among the factors that he listed that will prevent a replay of the 70's is the more sophisticated and positive influence of the Fed itself. Apparently, self doubt is not one of his burdens.

In the 1970s unemployment reached 9 percent, inflation 10 percent, and oil rose by almost four times in just five years. Despite a similar fourfold increase in oil since 2003, Bernanke maintains that inflation has averaged only 3.5 percent over the past four quarters. So while the price of oil has followed a similar trajectory, he asks us to believe that our current inflation rate is only one third of the rate in the 1970's?

But even at 3.5 percent, Bernanke said inflation is a significant concern to the Fed. Wall Street cheerleaders seized upon this remark immediately as an indication that the Fed was serious about a stronger dollar and curbing inflation. Other than the hard looks and the rumpled brow that Bernanke was able to muster at the speech itself, I am not sure where this seriousness is manifest.

So much for the “hoopla”, but what of reality?

There will be much debate over what was behind the increased verbal engagement that both the Treasury Department and the Federal Reserve put on display this week. From what I gather, the economic authorities have begun a coordinated campaign to try to reduce inflationary expectations, and in so doing, hold the lid on actual inflation. Although this is a fool's errand, the Fed Chairman opened with a compelling gambit. In his Harvard speech Bernanke sought to magnify the myth that inflation is of concern to the Fed. In reality, inflation is his one and only weapon and ally.

In my opinion, for more than a decade the Federal Reserve has operated under the principle that a naturally corrective recession is politically unacceptable. As a result, they have shown an inclination to pump in massive amounts of liquidity at the first sign of economic distress. In so doing they have not only tolerated inflation, but purposely created it.

In pursuing this liquidity campaign, the Fed has been careful to cover its tracks. To disguise the underlying increase in money supply (which is direct evidence of inflation), M3 was withdrawn from publication earlier in this decade. So much for open government! Next, the inflation figures were systematically doctored or “cooked” to deliver a politically acceptable number. However, as prices rise across the board, this official number is increasingly disregarded. Recently, even well know establishment figures such as Bill Gross of PIMCO have said that inflation figures “were not reflecting” Main Street prices.

Some observers feel the U.S. “real” inflation is now running well above the relatively benign official figures of around 2 to 4 percent, and is trending closer to the 10 percent levels seen in the 1970s. If you believe this, as I do, then the statistics would show that the American economy is currently contracting and is in recession.

It is therefore likely that the Fed is actually facing stagflation, with “real” financial inflation running at over 10 percent and economic contraction at the same time. However, as long as the statistics don't report this truth, the Fed has done its job, at least as far as it is concerned.

The key question is whether the recession could get worse and even threaten such a severe depression that even the best statisticians could not conceal it. A key determinate is likely to be the depth of the mortgage crisis.

Last week, Case-Shiller announced findings that the value of residential housing in America had decreased in value by some 14.3 percent over the past year. Applying that figure to the official total ($23 trillion) value of the U.S. housing stock, gives a reduced dollar value of some $3.3 trillion, or the equivalent of 23 percent of the massive $14 trillion U.S. economy, as measured by GDP. In other words American consumers have seen a paper reduction in their aggregate wealth equal to almost a quarter of U.S. annual economic production! It is quite a staggering figure and must cause our government very considerable concern. For now at least, Bernanke can get away with his pleasantries.

Meanwhile, we should all realize that the U.S. dollar is destined to continue along its long-term decline line. We should expect the Fed to add strong anti-inflation talk to their strong dollar talk, while actively following policies that will have the opposite effect.

In summary, Bernanke was heralding a liquidity spree that will surely soak anyone with wealth either denominated or generated in U.S. dollars!

For a more in depth analysis of our financial problems and the inherent dangers they pose for the U.S. economy and U.S. dollar denominated investments, read my new book “Crash Proof: How to Profit from the Coming Economic Collapse.” Click here to order a copy today.

By John Browne

Euro Pacific Capital

http://www.europac.net/

More importantly make sure to protect your wealth and preserve your purchasing power before it's too late. Discover the best way to buy gold at www.goldyoucanfold.com , download my free research report on the powerful case for investing in foreign equities available at www.researchreportone.com , and subscribe to my free, on-line investment newsletter at http://www.europac.net/newsletter/newsletter.asp

John Browne is the Senior Market Strategist for Euro Pacific Capital, Inc. Mr. Brown is a distinguished former member of Britain's Parliament who served on the Treasury Select Committee, as Chairman of the Conservative Small Business Committee, and as a close associate of then-Prime Minister Margaret Thatcher. Among his many notable assignments, John served as a principal advisor to Mrs. Thatcher's government on issues related to the Soviet Union, and was the first to convince Thatcher of the growing stature of then Agriculture Minister Mikhail Gorbachev. As a partial result of Brown's advocacy, Thatcher famously pronounced that Gorbachev was a man the West "could do business with." A graduate of the Royal Military Academy Sandhurst, Britain's version of West Point and retired British army major, John served as a pilot, parachutist, and communications specialist in the elite Grenadiers of the Royal Guard.

John_Browne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.