"Audit the Fed"? We've Already Done That (Well, Kind of)

Politics / US Federal Reserve Bank Feb 26, 2015 - 05:33 PM GMTBy: EWI

Our conclusion: The Fed is not in control of the economy -- here's why

Our conclusion: The Fed is not in control of the economy -- here's why

If there's one thing the Federal Reserve Board of the United States is not known for, it's assertive language. After all the obfuscation and verbal sidestepping, Fed speak is usually as easy to comprehend as Marlon Brando's Godfather character Don "Mumbles" Corleone.

But on February 24, Fed chairwoman Janet Yellen was 100% candid in expressing her disapproval of the controversial bill known as "Audit the Fed" -- legislation that would open the central bank up to full government regulation and scrutiny:

"I want to be completely clear.

I strongly oppose 'Audit the Fed'"

No - Confusion - There!

But, whatever side of the bill you stand on -- nay or yay -- for us, the prospect of pulling back the curtain on the most elusive quasi-government body seemingly besides the C.I.A. is irrelevant. Because we at Elliott Wave International have long since conducted our own "audit" of the Fed -- and the results are like nothing you've ever heard before from the mainstream pundits.

The purpose of our "audit" was simple: Determine, once and for all, if the most powerful monetary institution on the planet does, in fact, have the power to control the U.S. economy or marketplace.

We published our findings in a 30-plus page eBook titled "Understanding the Fed," a compilation of excerpts from the selected works of EWI president Robert Prechter -- including his 2002 best-seller Conquer the Crash and several past Elliott Wave Theorist publications. This riveting report articulates in no uncertain terms that the two main tools in the Fed's arsenal -- interest rate policy and money creation -- will be, and always have been, futile against the forces of deflation.

These two passages from the "Understanding the Fed" eBook set this radical claim in motion (excerpted from Chapter 13 of Conquer the Crash):

"The problems that the Fed faces are due to the fact that the world is not so much awash with money as it is awash with credit... For the Fed, the mass of credit that it has nursed into the world is like having raised King Kong from boyhood as a pet. He might behave, but only if you can figure out what he wants to keep him satisfied.

"Conventional economists excuse and praise this [Federal Reserve] system under the erroneous belief that expanding money and credit promotes economic growth, which is terribly false. It appears to do so for a while, but in the long run, the swollen mass of debt collapses of its own weight, which is deflation, and destroys the economy."

In the decade since Conquer the Crash first brought these assertions to light, the Fed has only lived up to its limitations.

First, from 2003 to 2007, the central bank attempted to remove the froth from the bubbling housing market and cool the overheated credit sector via 17 interest rate HIKES -- from a half-century low of 1% to 5.25%. Yet, in 2007-2009, the top blew off both sectors anyway.

Hoping to finesse the economy into a "soft" landing, the Fed then adopted the opposite tactic: Slashing rates 10 times between 2007 and 2008 to a record low of 0%, and from 2009 to 2012, embarking on the largest inflationary campaign in history via three rounds -- $4.5 Trillion -- of quantitative easing (QE).

Yet, again, all of these measures failed to prevent:

- The worst financial meltdown since the Great Depression

- A full-blown bear market in oil and commodity prices, which stand at a 6- and 12-year low respectively

- A stalled housing and jobs market

- An inflation rate that has been running below the Fed's 2% target for nearly three years

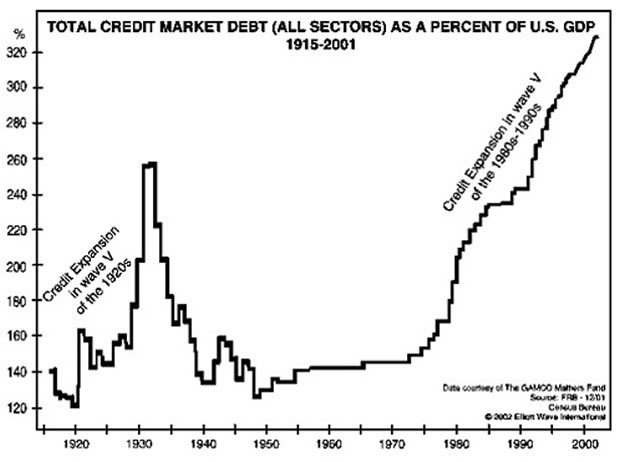

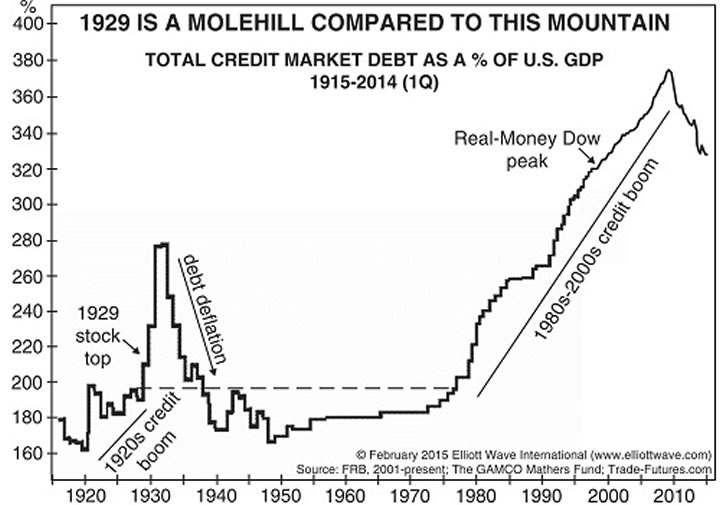

And, as our updated chart of "Total Credit Market Debt as a Percentage of GDP" below shows, the deflationary scenario outlined in Conquer the Crash -- when "the swollen mass of debt collapses of its own weight" -- is also coming to pass:

Whatever action Congress decides to take regarding "Audit the Fed," the fact remains: One of the most comprehensive and objective inventories of the Fed's actual economy-saving abilities is not on Capitol Hill. It's right here, in EWI's 30-plus page "Understanding the Fed" eBook.

The best part is, the entire report from start to mind-blowing finish is available to all Club EWI members, 100% free.

This article was syndicated by Elliott Wave International and was originally published under the headline "Audit the Fed"? We've Already Done That (Well, Kind of). EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.