EU Warns Ireland and Euro Zone of Debt Dangers

Stock-Markets / Eurozone Debt Crisis Feb 26, 2015 - 12:24 PM GMTBy: GoldCore

- High “structural” unemployment, high levels of public and private debt and a still vulnerable banking sector are weighing on the Irish economy

- High “structural” unemployment, high levels of public and private debt and a still vulnerable banking sector are weighing on the Irish economy

- Report further casts doubt on the “recovery” narrative being touted by governments, banks and vested interests across the world

- Levels of spin and denial not seen since before the crash of 2008

A report by the EU to be published today reviewing the economies of European countries has identified various problems in the most European economies – including Ireland.

In-depth reviews initiated by the European Commission (EC) found “excessive macroeconomic imbalances” continue in 16 countries.

The EC on Wednesday sent a strong signal to Member States to carry out structural reforms and to continue consolidating their public finances.

High unemployment, high debt levels and “residual concerns” in the banking sector pose the greatest risk to Ireland’s economy. The significant dependence of SMEs on bank finance and still very high debt levels were also cited as concerns.

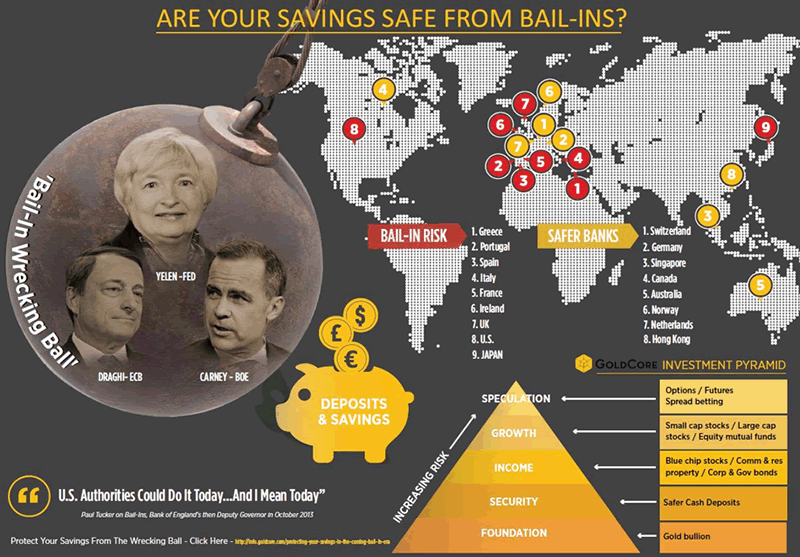

In December, Moody’s warned that Irish and European banks are vulnerable in 2015 due to weak macroeconomic conditions, unfinished regulatory hurdles and the risk of bail-ins according to credit rating agencies.

The report conflicts with the narrative put forth by the government and by economists working in the banking and finance sector and by other vested interests that the worst is over and Ireland is “in recovery.”

Ireland has been “in recovery” despite no notable decline in debt levels, no notable decrease in full time unemployment, an acceleration in home foreclosures, and public services like healthcare deteriorating in an unprecedented crisis.

The same narrative is being spun across Europe where the public is told that the “green shoots” of spring are here. Meanwhile state assets are flogged to favoured corporations and the public are forced to pay stealth taxes and forced to pay again for utilities already provided for through taxes.

The ECB is about to begin an enormous money-printing scheme to kickstart the economy despite the fact that the same strategy failed in Japan and has yet to bear fruit in the U.S. Except in that it bolstered the stock markets which was of little consequence to much of the wider public but, oddly, happened to benefit the financial and banking sector enormously, once again.

Money printing is not the practice of a healthy economy. Money printing is an act of total desperation. Neither Ireland, nor anywhere else in the over-indebted Western world is “in recovery”. But it looks like wealth will continue to be extracted from the public on the pretext of recovery for as long as the charade can continue.

The report advises the Irish government to take “decisive action” to address the imbalances. We wonder what action the EU thinks is open to the government. High unemployment and private debt is not going to be eased by any government initiative other than lowering taxes.

Public debt problems can only be eased by raising taxes. Given that the entire banking system is insolvent the only action open to the government is to throw its weight – and our money – behind the banking system.

The report adds that Irish Water, the company overseeing the privatisation of the water that Irish people already pay for through high taxes, may not pass a test by Eurostat, the EU statistics agency, to keep it off the government books.

This will put pressure on the government to cut other services, already woefully inadequate, to meet troika requirements on public spending.

Most likely undiscussed in the EU report is the role it has played in Ireland’s long, drawn-out recession. High taxes in Ireland are stifling economic activity and the ability of households to pay their debts.

These high taxes are a direct result of EU institutions bullying the Irish government into taking losses made by large European banks onto the back of Irish taxpayers.

While Ireland, the EU and the western world are in serious crisis one would never suspect as much when listening to the pronouncements of government officials, banks and other vested interests.

The cosy narrative of “recovery” should not be rocked by little boys pointing out “the Emperor has no clothes”!

The levels of spin and denial are reminiscent of the run-up to the 2007 crisis. We and many others were ignored for highlighting the dangers facing the Irish and global economy then and are being ignored again now.

When the inevitable occurred the same “experts” who ridiculed us insisted that nobody could have foreseen the crisis. The same looks likely to happen again.

We may be wrong this time – we seriously doubt that though.

However, prudence would dictate that the warnings of those with a proven track record – and who are not part of the political and financial establishment that bankrupted this country – should be carefully considered.

Must-read guide and research on bail-ins here:

Protecting Your Savings In The Coming Bail-In Era

MARKET UPDATE

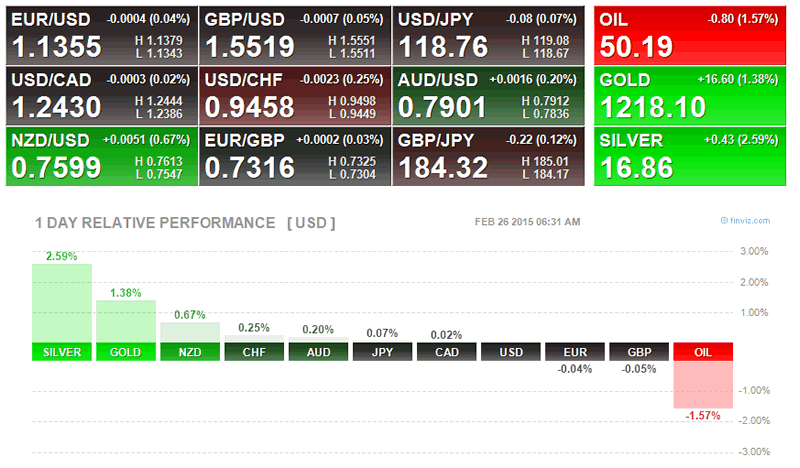

Today’s AM fix was USD 1,220.00, EUR 1,073.66 and GBP 785.58 per ounce.

Yesterday’s AM fix was USD 1,206.50, EUR 1,062.06 and GBP 777.99 per ounce.

Gold rose 0.37% percent or $4.40 and closed at $1,204.60 an ounce on yesterday, while silver surged 1.79% percent or $0.29 closing at $16.54 an ounce.

Finviz.com

Gold prices are up 1.3% in early European trade, pushing above the $1,218 per ounce mark. Gold snapped four days of losses yesterday and appears to be basing at the $1,200 level. Support was seen here in recent days despite the absence of Chinese demand.

Spot gold was up 1.1 percent at $1,217.95 an ounce in early London trading, after hitting a session high of $1,219.90. Singapore gold had threaded water prior to slight gains towards the end of the session. On the Comex, U.S. gold for April delivery climbed 1.3 percent to $1,217.40 an ounce.

Silver was up 1.6 percent at $16.78 an ounce. Spot platinum rose 1.5 percent at $1,185.99 an ounce, and palladium climbed 0.6 percent at $808.75 an ounce earlier touching $814.35 an ounce, its highest since January 14th.

Chinese buyers were notably active in both gold and silver overnight in Asia, MKS said in a note this morning. Premiums on the Shanghai Gold Exchange (SGE) remained firm around $4-$5 an ounce over the global spot price.

China’s gold imports from Hong Kong rose in January from the previous month, data showed today, reflecting increased demand ahead of the Lunar New Year. Net gold imports from Hong Kong climbed to 76.118 tonnes last month from a three month low of 71.381 tonnes in December.

Palladium hit its highest since mid-January this morning at $814.35/oz. Resistance is seen at its 200-day moving average at 814.40 and a close above this level could see a very sharp move to the upside.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.