Bitcoin Price Might Stay below $250

Currencies / Bitcoin Feb 24, 2015 - 05:57 PM GMTBy: Mike_McAra

Briefly: speculative short position, stop-loss at $273, take-profit at $153.

Briefly: speculative short position, stop-loss at $273, take-profit at $153.

Rakuten, a Japanese electronic commerce company, with $5.3 billion in revenue for 2013, might be warming up to Bitcoin, we read on the Wall Street Journal website:

Japanese e-commerce giant Rakuten is considering accepting the virtual currency bitcoin as payment, founder and Chief Executive Hiroshi Mikitani said.

"We are thinking about it, and we probably will," Mr. Mikitani said at the Rakuten Financial Conference in Tokyo, where panelists discussed crypto-currencies and other alternatives to cash and credit cards. "We would like to be open."

Mr. Mikitani declined to specify when the company might decide, saying it was a trade secret.

Rakuten is one of the largest Japanese companies to take an interest in bitcoin and other digital currencies. It has formed a department to study digital currencies and invested in bitcoin-related ventures in the U.S., including San Francisco-based Bitnet Technologies.

This is one of the first bigger companies based outside of the U.S. making possible preparations to accept the cryptocurrency. This is positive news as it shows that there are leading companies all over the world thinking on Bitcoin adoption. This might help Bitcoin get wider recognition.

As we have frequently stressed, Bitcoin is still not really well know, nor is it actually very convenient for simple transactions. But this is mainly due to the fact that the cryptocurrency is relatively young. Improvements will have to be made as far as security and ease of use are concerned. Adoption by an increasing number of companies might help solve another aspect of the problem - that not that many companies are actually taking Bitcoin.

With more firms expressing their interest or downright accepting Bitcoin, it will become increasingly present in the worldwide payment system. We still have years before it might become an alternative to credit card transactions or money transfers but we're seeing business making a move closer to cryptocurrencies, slowly but perhaps consistently.

For now, we focus on the charts.

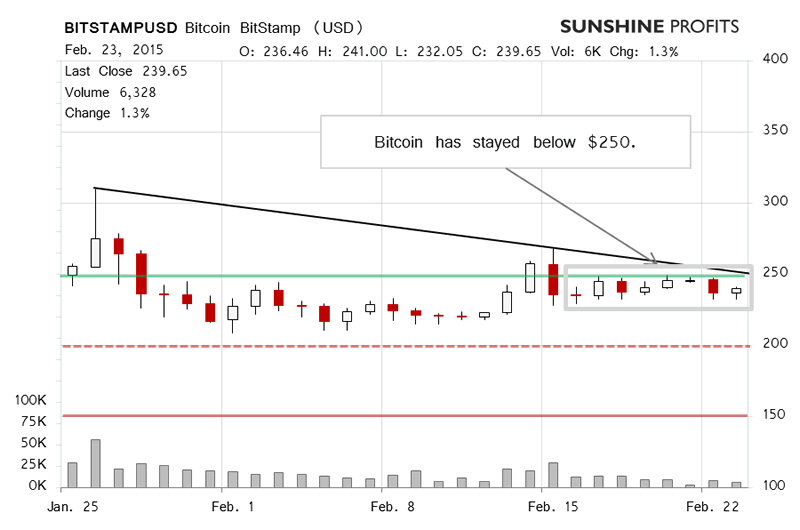

On BitStamp, we saw appreciation but one of a very modest magnitude. The volume was down but not by much and it was overall relatively moderate. Bitcoin remained below $250 (green line) and the possible declining trend line (black line). Our comments from yesterday remain up to date:

(...) The weekend generally left us with the sense that the previously bearish outlook became slightly more bearish. This might not yet be the point where Bitcoin begins to fall but we still anticipate the cryptocurrency to move down during the next more significant swing.

Today, the action has been less volatile than yesterday (...). Bitcoin has barely moved and the volume has been weak. Righ now, we would expect Bitcoin to trade under $250 for another couple of days before declining more significantly.

Today, we've seen Bitcoin relatively flat, slightly to the downside (this is written around 10:00 a.m. ET). The volume hasn't been strong, and all the action doesn't suggest a strong move taking place just now. Generally, not much has changed in the last couple of days. We've seen up and down trading but $250 has shown itself to be a relatively strong barrier. The situation being as it is, it seems that we've seen failed moves above $250, which would suggest a possible further move down along with the general trend.

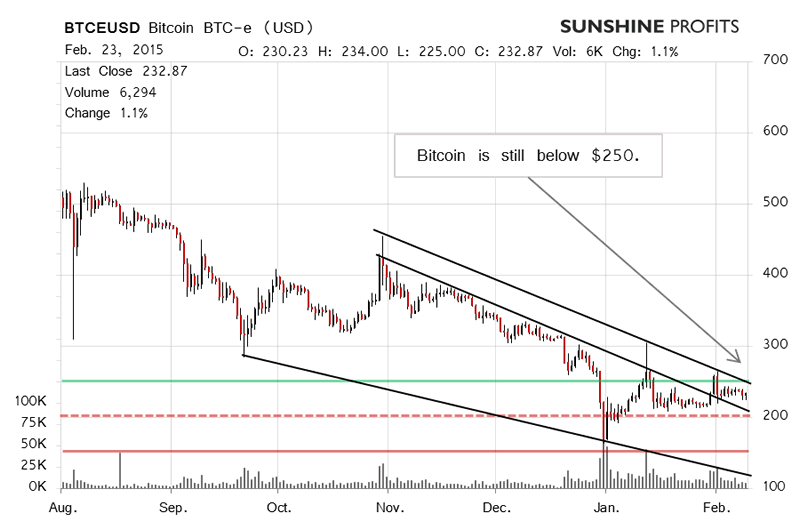

On the long-term BTC-e chart, we saw weak action yesterday, today has also been relatively weak and the situation now seems pretty similar to what it was yesterday:

It now seems that yet another move up, a weak one at that, was followed by a decline on increased volume. The magnitude of the move doesn't quite suggest a strong move just now but it would seem that the next big move might follow the general trend which has been to the downside.

With Bitcoin below the possible declining trend line (highest black line in the chart) and below $250 (green line), with the most recent local top lower than the previous one, we might just as well see a continuation of the downtrend. We would expect Bitcoin to stagnate some more before resuming the move down. This is our best bet at the moment. $200 (dashed red line) might be the level to observe as far as the next move to the downside is concerned.

Summing up, we think speculative short positions might be the way to go.

Trading position (short-term, our opinion): short position, stop-loss at $273, take-profit at $153.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.