A Math-Free Guide to Higher and Safer Investing Returns

Stock-Markets / Investing 2015 Feb 24, 2015 - 03:28 PM GMTBy: Casey_Research

By Andrey Dashkov

By Andrey Dashkov

I can make you instantly richer, and safely, by explaining a finance concept with a story about a dog.

There’s a hole in your pocket you probably don’t know about. You may feel instinctively that something is wrong, but unless you look in the right place, you won’t find the problem. The money you’re losing doesn’t appear in the minus column on your account statements, but you’re losing it nevertheless.

Frustrated? Don’t be. I’m going to tell you where to look and how to stop the drainage.

Volatility is every investor’s worst enemy. Over time, it poisons your returns. Unlike a 2008-style market drop, though, volatility poisons them slowly. There’s no obvious ailment to discuss with friends or hear about on CNBC. You only see it when you compare how much you lost to how much you could have earned—and looking back at your own mistakes is not a pleasant thing to do.

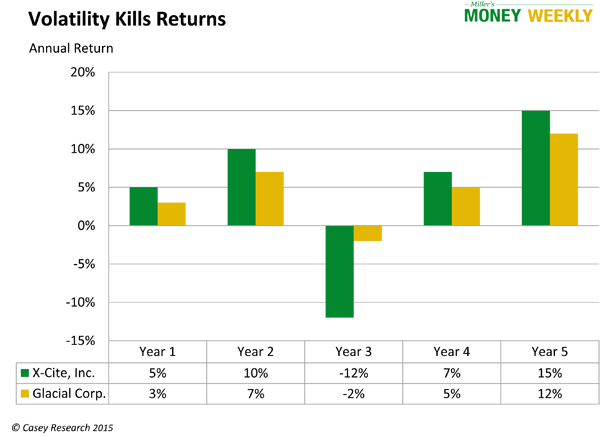

So instead let’s imagine two fictional companies: X-Cite, Inc., an amusement-park operator with a volatile stock price that adventurous investors love; and Glacial Corp., a dull, defensive sloth of a corporation whose stock returns are consistent but often lower than those of its more glamorous counterpart.

Average return on both companies’ stocks was 5% for the past five years, but Glacial’s was less volatile. Safety is comfortable, but doesn’t higher volatility mean higher potential returns? Sometimes, but not always. When you accept high volatility, your returns might be higher at times, but they also might be lower. In other words, higher volatility generally means greater risk.

Nothing new so far, but the oft-overlooked point is that boring stocks make you richer over time.

The chart below shows each stock’s annual return over a five-year period.

At first glance, Glacial Corp. appears to be the loser. It underperformed X-Cite in four out of five years. Both stocks returned 5% on average during these years, and X-Cite was almost always voted the prettiest girl in town. But for Year 3, it would be easy to persuade investors to buy X-Cite stock. Few would give Glacial a second glance.

Hold for the punchline: X-Cite, the stock your broker would have a much easier time selling you (before you read this article), would actually make you poorer. Let me explain.

I won’t get into any supercharged math here. Glacial is better because it makes you richer eventually. After five years, the total return on X-Cite is 25%. Not bad. Glacial? 27%. If you invested $10,000 in both (assuming no brokerage fees or taxes), at the end of Year 5 you would have earned $2,507 on X-Cite or $2,701 on Glacial.

| Year-End Account Balance | ||

| X-Cite, Inc. | Glacial Corp. | |

| Year 1 | $10,500 | $10,300 |

| Year 2 | $11,550 | $11,021 |

| Year 3 | $10,164 | $10,801 |

| Year 4 | $10,875 | $11,341 |

| Year 5 | $12,507 | $12,701 |

| | | |

| Total return | 25% | 27% |

Where does the extra $194 come from? It comes from lower volatility. Although X-Cite looks like a winner most of the time, it has a higher standard deviation of returns. Note that X-Cite’s stock price dropped 12% in Year 3. The following year it increased 7%, while Glacial Corp.’s stock price only increased 5%—yet Glacial is still worth more from Year 3 onward. Why? X-Cite’s 7% jump is based on the previous year’s low.

But I promised to keep this note math-free, so imagine a person walking a dog instead. The shorter the leash, the less space the dog has to run around. The longer the leash, the more erratic the dog’s path will be. Standard deviation measures how much data tend to scatter around its mean—the path. As we just saw, low standard deviation also pays you money.

I could stop right here and hope that you take this lesson to heart, but I won’t. As much as I love describing finance concepts using clever company names and dogs, I want you to start making money right now.

I said this advice could make you instantly richer, and “instantly” doesn’t mean “maybe sometime in the future.” In the latest issue of Money Forever, we shared an opportunity to invest into a vehicle built to outperform the market by managing volatility. I was extremely excited to present it to our paid subscribers because I knew they’d love to earn more by risking less. Who wouldn’t?

So please pardon my blatant self-promotion. I work in an industry where 80% of the time the market is obsessed with the wrong stock, and the noise drowns out the right idea. I can silence the cacophony for you, though, and show you where to find the right ideas. And that goes beyond our most recent pick, although you do need it in your portfolio. Money Forever’s mission is to make your money last—plain and simple. We think this pick will go a long way toward doing just that.

You can check it out and access our full portfolio immediately by subscribing risk-free to Money Forever. It’s about the price of Netflix, but unlike Netflix we won’t bother you if you decide to cancel. In fact, we’re so confident that the Money Forever portfolio can help you “earn more by risking less” that we’ll refund 100% of the cost if you decide to cancel within the first three months. And we’ll even prorate your refund after that—it’s a no-lose proposition. Click here to start earning more by risking less now.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.