Bird Doo; Yellen Goes to Congress

Stock-Markets / US Federal Reserve Bank Feb 24, 2015 - 02:06 PM GMTBy: Gary_Tanashian

The best one by far is the un-photoshopped Loretta Mester in all her natural hawkish glory. Note the piercing eyes, the aerodynamic features and the focused intensity. Also I must say, at 56 she has a youthful dynamism about her. If she were Fed chief and told me to jump I’d ask ‘how high?’… or if she told me to print I’d ask ‘how much?’

The best one by far is the un-photoshopped Loretta Mester in all her natural hawkish glory. Note the piercing eyes, the aerodynamic features and the focused intensity. Also I must say, at 56 she has a youthful dynamism about her. If she were Fed chief and told me to jump I’d ask ‘how high?’… or if she told me to print I’d ask ‘how much?’

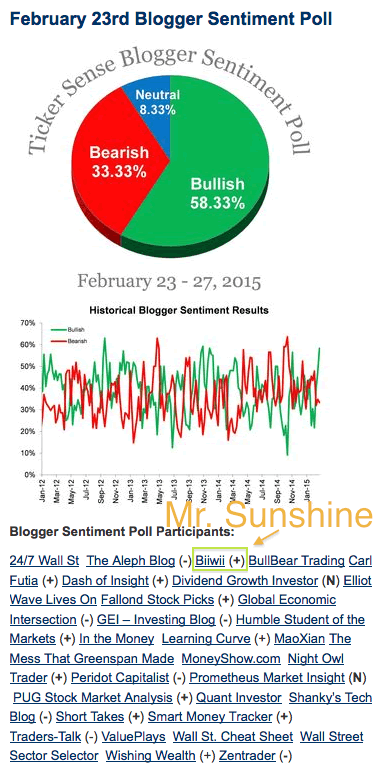

Okay, moving on; the funny Hawk at the top is going to gulp down a mic in front of Congress and the media are all over it. The lead article in the graphic above would actually turn your friendly blogger into a nice contrary indicator, what with his status among the majority that were bullish on the S&P 500 at the last polling by Tickersense.

Let me tell you what this is… it is a question that comes in each week about the view on the S&P 500. Are you bullish, bearish or neutral over the next 30 days? I just honestly answer the question each week (including more than my share of ‘neutrals’, which always makes me feel wishy washy, but is accurate in that it is probably a stance more people should have on the market as it implies impartiality in not defending a bias).

Well, during what we were calling the ‘swing phase’ (jagged ups and downs in a sideways trend) in January I was neutral for most of the time pending a break of the swing. The swing broke to the upside and what am I gonna write, bearish? The US stock market gave its bullish signals a couple of weeks ago and it is still bullish. It could end today or it could accelerate. The markets decide and we should just interpret.

Back on the Yellen media mucking…

Yellen could strike a Hawkish tone before congress

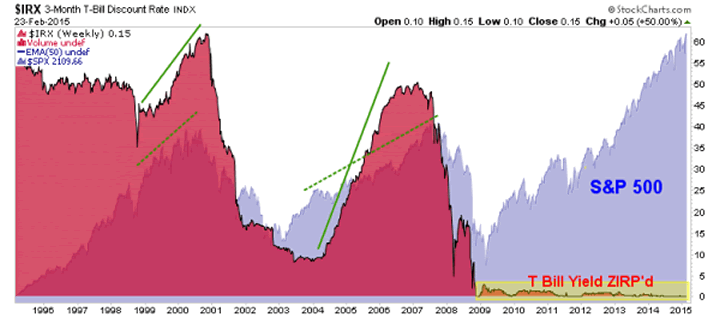

Yes, this whole mid-year rate hike drama has been one for the record books as far as media obsession is concerned. This chart still begs us to keep perspective on what has already been a Hawk-free picture for 6+ years now. Ooh, they are going to raise the Funds rate by a lousy 1/4 point in June… let’s write about it obsessively and turn it into something. Let’s make some chicken salad out of chicken shit.

Anyway, the article trots out Bullard’s Jawbone on how strong data since the meeting (and Minutes) may have altered Fed members’ Dovish perceptions. I sometimes criticize a day trader mentality, but these people seem to want us all to be day traders, jerking in an out of the markets every day with every diametrically opposed Jawbone and every crosscurrent instigated by the black boxes. Do Fidelity, eTrade, Scottrade and the other brokers have some secret photos of various Fed members?

Three things Yellen could say to surprise investors

Yeh yeh, I know, you guys have got to write about something when a super Dove former right hand woman to the previous super Dove goes before Congress. Can’t you just feel the media’s swelling, itching brain thinking thinking thinking… always thinking? And instigating. Here in Boston we’d say ‘they ahh just makin’ shit up as they go along’.

The swelling brain goes on to mis-title its own segment ‘Dollar weakness is making an impact’ (don’t they edit over there? If I ran my sites the way they run their massive media empire…) and talks about the strong dollar. Then there is some static about auditing the Fed, which I did not even bother to read.

Nor did I bother with Yellen’s dashboard indicators because none of it matters. As the IRX/SPX chart above shows, there is no causal relationship between rate hikes and a bearish stock market until well into a rate hiking cycle. Now with the asymmetrical policy inputs of the last 4+ years mainlined into markets already (Doves on steroids) we cannot discount it being different this time. The S&P 500 looks very conspicuous to the IRX since 2008. But nothing the Photoshopped Hawk above says in front of Congress is going to matter a bit, beyond any short-term twitches the black boxes may be programmed to execute.

People should simplify, but those taking the mainstream media even a bit seriously are consuming complexity.

Other than all of the above, I have no real opinions on the matter.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.