Stock Market New Highs With Weak Breadth

Stock-Markets / Stock Markets 2015 Feb 23, 2015 - 10:40 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend - Bull Market

Intermediate trend - Is the 7-yr cycle sketching an intermediate top?

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. They are important adjuncts to the analysis of daily and weekly charts which ultimately indicate the course of longer market trends.

NEW HIGHS WITH WEAK BREADTH

Market Overview

Last week the market was mostly focused on Greece; would they or wouldn't they reach an accord with the EU? By Friday, the situation appeared almost resolved with the conclusion likely on Monday. The market was optimistic and closed at a new high, but breadth left a lot to be desired. Perhaps this was only caution on the part of traders until after Monday, but negative divergence in the A/D indicator always casts some doubt about the validity of the trend. Consequently, we need to see what takes place next week before rendering judgment.

By Friday's close, a near-term projection had been reached and this would be a logical point to wait for the Greek situation to be fully resolved.

Indicators survey

Momentum: The weekly MACD has continued to move up and is just about ready to make a bullish cross. The daily MACD is also slightly higher.

The weekly SRSI has made a bullish cross and is slightly positive, but looks tentative. The daily continues to trade at the very top of its range.

Breadth: In spite of the new high in the SPX, my daily A/D oscillator continues to show negative divergence and a lack of upside momentum.

Structure: Best guess still in primary wave III.

Accumulation/distribution: The short-term pattern shows no distribution. The long-term could be turning into an accumulation pattern.

XIV: which was extremely oversold, rallied about six points over the past two weeks.

Cycles: The 7-year cycle will become a threat to the market uptrend if and when it starts to assert itself.

Chart Analysis

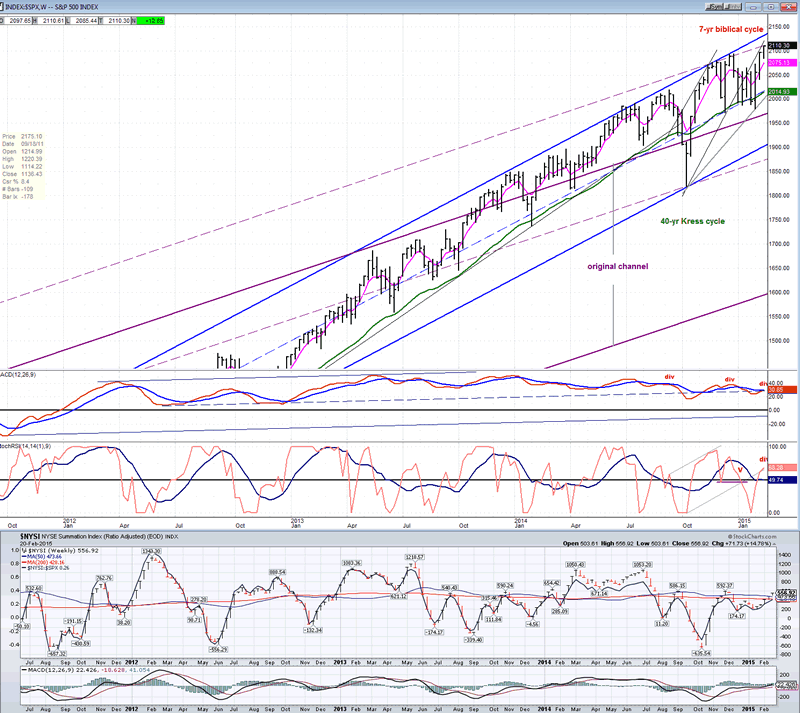

We start with the weekly SPX (chart courtesy of QCharts.com, including others below) with the McClellan Summation Index (courtesy of StockCharts.com) posted underneath it.

Over the past two weeks, SPX made a new high and the weekly prices have drawn closer to the top of its intermediate channel. This trend line has been tested 6 or 7 times in the past 3+ years, and each time it has caused the index to pull back down to the mid-channel line or lower. Only a couple of times did it continue to the very bottom of the channel. On the last pull-back, the middle of the range was tested 6 times before the bulls regained enough control to send SPX to a new high. With the new high approaching the top of the channel, we could logically expect that the index will meet with resistance once again if it continues to rise to 2130-2140.

Approximately two years ago, the MACD ceased making new highs along with price, making a series of lower highs instead. This is long-term deceleration which should be reflected in the price pattern sooner or later. The SRSI started to show the same deceleration pattern about 6 months ago; and on Friday, the new high in SPX created double negative divergence in the McClellan Summation index. What follows should help define the intermediate trend.

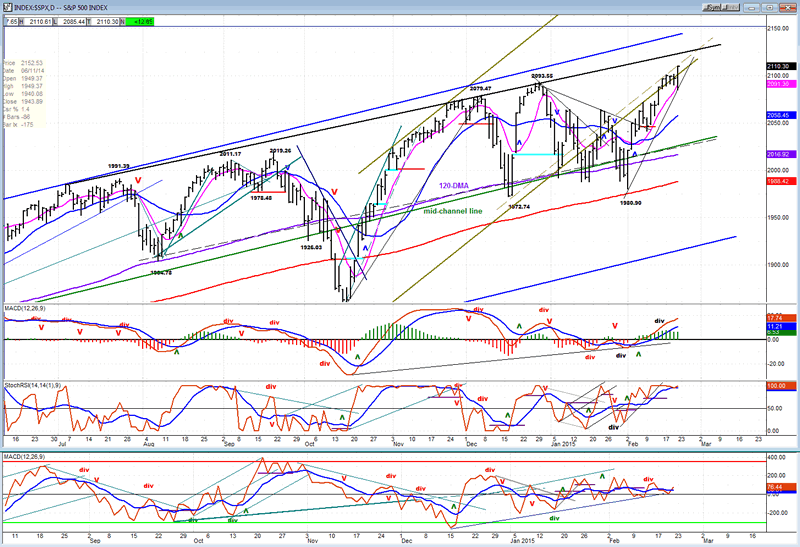

On the daily chart, SPX is running into the resistance created by the bottom trend line of the up-channel from the October low. Even if it goes through, it will be challenged by two more trend lines which are connecting former tops. However, it is unlikely that a serious decline will occur until some clearly visible price deceleration takes place, meaning that short-term tops need to pull away more and more from the top channel line. So far, this has not happened.

The lower oscillator (A/D) is showing negative divergence, but this may simply reflect caution on the part of traders who are waiting for confirmation that the Greek deal is sealed. It is also possible that "selling on the news" will occur. In any case, we need to wait another day or two to gain a better understanding of what the market wants to do next.

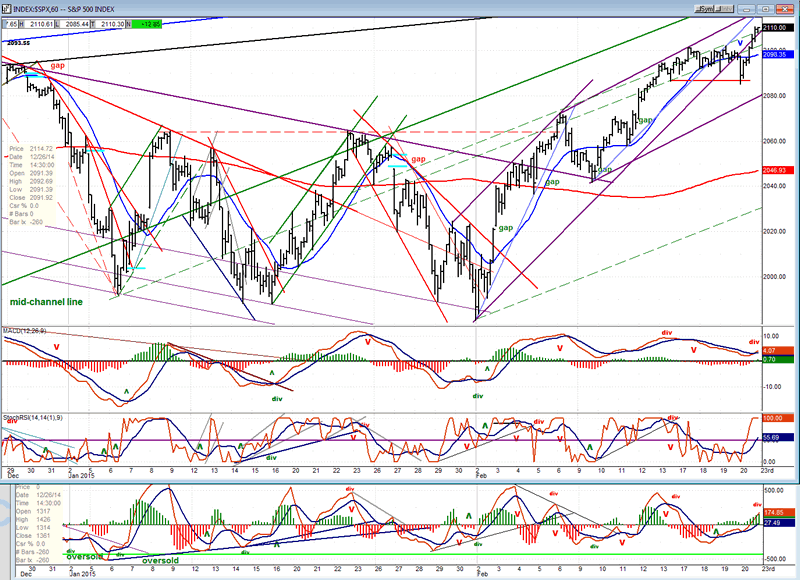

On the hourly chart, we can see that the uptrend from 1981 has already angled over from its initial trend and that the index has even traded outside its original channel, but on Friday, it was trying to bounce back into it. The various trend and channel lines that can provide resistance and stop the uptrend appear at the top of the chart. Moving through all these would be a sign that after a two month pause, acceleration of upside momentum is starting again, and this could fetch much higher prices. It would also improve significantly the condition of the MACD and A/D oscillators which are currently reflecting technical weakness and displaying negative divergence.

Sentiment Indicator

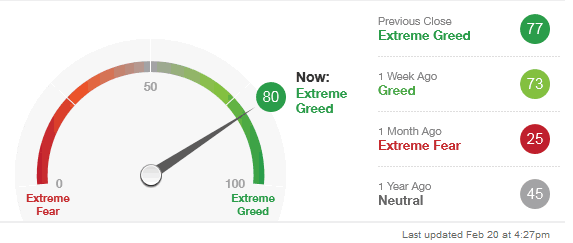

I have found another sentiment indicator to replace the SentimenTrader which is no longer available (for free). It is based on the interpretation of 6 indicators. We'll follow it for a while and see if it suits our purposes. The current reading has not reached its maximum potential, but it is at a level which has caused reversals before.

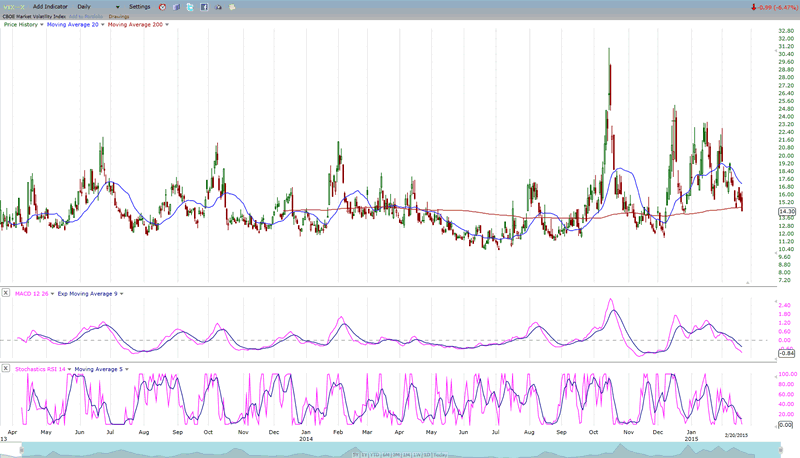

VIX (NYSE Volatility Index) - Leads and confirms market reversals.

We have not looked at the VIX for a while. The divergences with SPX are not as pronounced as they are on its inverse version, but they are still there. You can see it best on the last daily trade which remains well above the December low, even though the SPX just made a new high. I interpret that to mean that SPX may have trouble going much higher and is more likely to pull back in the near future.

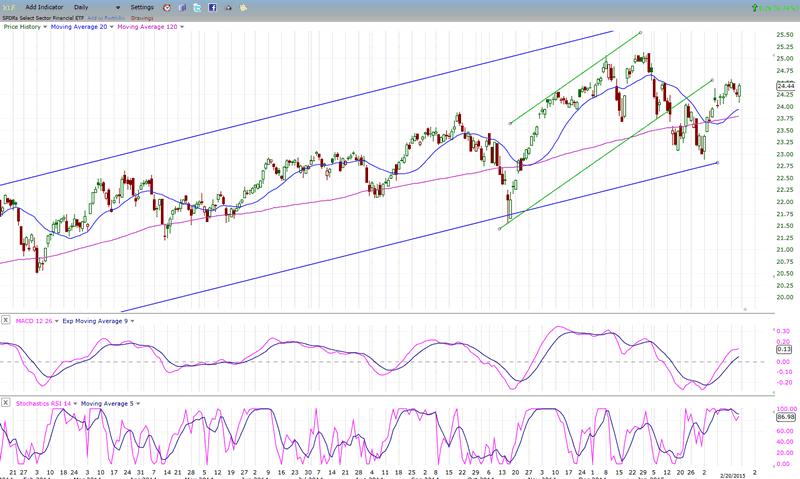

XLF (Financial Sector SPDR) - Historically a market leader.

Unless XLF continues to move up, it is telling us that SPX may be reaching a top. It did rally with the index after the latter reversed at 1980 but it is well shy of its high while SPX is making new highs.

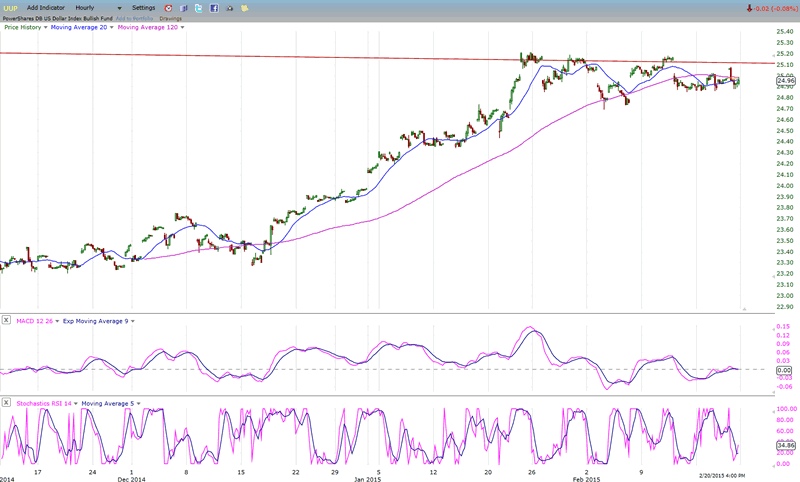

UUP (dollar ETF)

On the hourly chart, we can see more clearly the consolidation pattern that UUP is making just below the top line of its broad - and lengthy - corrective channel. The improvement in the MACD with the SRSI at its low could be warning that UUP is getting ready to extend its rally.

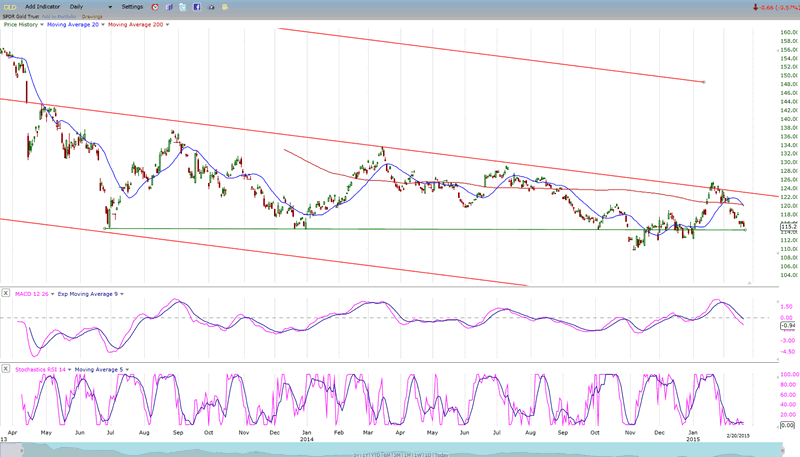

GLD (Gold trust)

GLD has retraced to a near and long term support level. It needs to turn up from here. If it does not, breaking this important price level would most likely signify that it is ready to continue its long-term decline.

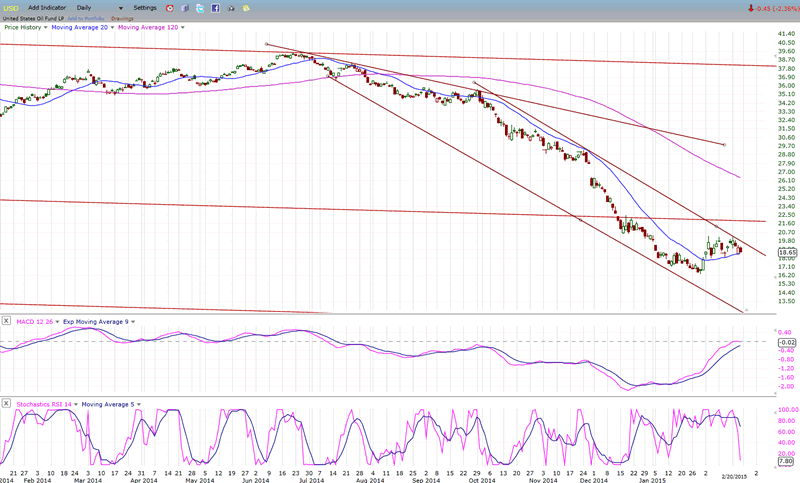

USO (US Oil Fund)

USO found support at the bottom of its declining channel, and this has temporarily arrested its steep correction. During the pause, it traveled the width of the channel and, having reached the other side, may be ready to resume its decline. The SRSI has already given a sell signal and if the MACD follows that with a bearish cross, it will suggest that UUP may be ready to move toward its next target of about 13.00.

Summary

Last week, SPX extended its advance to 2110, but breadth is not supporting the move with the daily A/D oscillator barely moving up and continuing to show negative divergence. Unless this improves (and quickly) the index will not be able to continue on its upward path. This would create some doubt about the index's ability to move much higher -- at least, right away.

FREE TRIAL SUBSCRIPTON

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.