U.S. Dollar and Investing in Gold Stocks

Commodities / Gold and Silver Stocks 2015 Feb 22, 2015 - 10:42 AM GMTBy: Richard_Mills

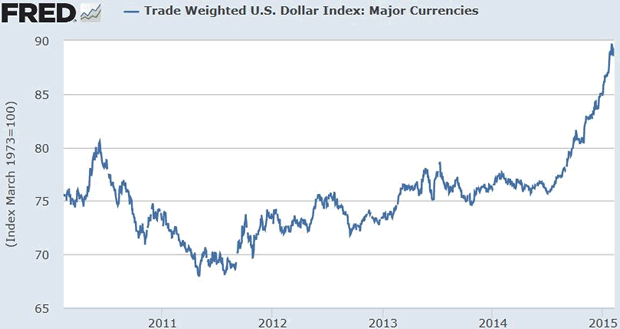

Duck Quacks and Golden Echoes - The US Dollar, on a slippery slope for years, has reversed and broken out against every major currency and developing economy currency . A global wide quantitative easing (QE) is happening. Almost every central bank (Sweden's Riksbank became the 14th central bank to ease monetary policy in 2014) is now creating money as fast as they can potentially leading to a global liquidity storm.

Duck Quacks and Golden Echoes - The US Dollar, on a slippery slope for years, has reversed and broken out against every major currency and developing economy currency . A global wide quantitative easing (QE) is happening. Almost every central bank (Sweden's Riksbank became the 14th central bank to ease monetary policy in 2014) is now creating money as fast as they can potentially leading to a global liquidity storm.

A strong dollar helps Americans by making imports cheaper and curbing inflation - U.S. import prices fell 2.8% in January, are now down 8% yoy and January's consumer price inflation is expected to be less than 1%.

However a strong US$ hurts U.S. based multinationals who have overseas earnings in those very same currencies that have taken such a severe beating versus the soaring U.S.$.

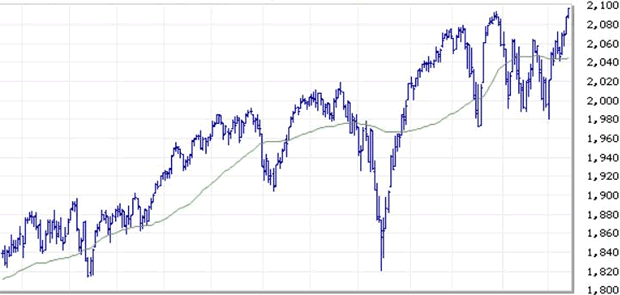

Over 85% of companies have lowered guidance for 2015 and t he S&P 500 looks ready to turn over - despite a 'last gasp' headline record breakout - based on:

- Observance of decreased volume

- Rather tame market breadth

- Overvaluation

- Earnings collapse

The dollar's surge is reducing earnings, bringing those declining yen, pesos, dinars, francs etc. home isn't doing any good for bottom lines, in fact it could be an earnings disaster in the making.

"The S&P 500 Index has traded inversely to the currency moves over recent years, and it has become increasingly negatively correlated. One reason, we believe, is that a growing share of revenue and profits for U.S. corporations comes from overseas--and that share seems likely to increase with the globalization of the economy." Jeremy Schwartz, U.S. Dollar Strength Continues to Impact U.S. Multinationals

"Virtually every currency in the world devalued versus the U.S. dollar, with the Russian ruble leading the way. The outlook for the year will remain challenging. Foreign exchange (FX) will reduce fiscal 2015 sales by 5% and net earnings by 12%, or at least $1.4 billion after tax." A.G. Lafley, Procter & Gamble chairman, president and CEO

Amy Hood, Microsoft's CFO said: "Our guidance is based on our current view of FX rates. Should the U.S. dollar strengthen beyond those assumptions, as it did this quarter, we would see additional negative impact to earnings, revenue, our balance sheet and our contracted-but-not-billed balance."

Profits are the largest driver of stock prices. S&P profits are, in this authors opinion, going to collapse. The vacation, the time spent visiting La La Land appears over, mainstream investors might want to start exiting Disneyland.

John Hussman, of Hussman funds, in an article titled 'Extreme Overvaluation and the Inventory Problem' says: "Our estimate of prospective 10-year S&P 500 annual nominal total returns has declined to just 1.4%, suggesting that even the dismal 2% yield-to-maturity on 10-year bonds is likely to outperform equities in the decade ahead."

Consider

There's a whole sector out there, way off just about every investors radar screen, that might be set to start showing immense profits.

This sector has costs in vastly weakened local currencies yet sells their product in U.S. dollars - revenue is in dollars while costs are occurred in countries where exchange rates have depreciated by significant amounts over the past year.

These same corporations have also been working very diligently over the last few years getting costs under control and the fall in oil prices will have a significant impact on profitability.

I'm talking gold miners. Those currently unloved and much scorned multinational corporations whose blood is running in the streets. They work in faraway places flung across the globe paying capex and opex in depreciated currencies yet reaping their golden rewards in a soaring U.S. dollar.

The gold mining sector is going to stand head and shoulders above all others - after the billions of dollars in inglorious write-downs are finished and investor confidence returns. A good point to make here is the write downs are non-cash and have no impact on day-to-day operations. They reflect bad decision making during the heady good times when gold spiked to almost $1,900.00 an ounce.

The globes major gold mining companies are definitely getting their act together and thanks to plunging energy prices and much weaker local currencies miners will definitely have improving margins. They'll need them, with a US$1,300.00 per ounce gold price needed just to break even for most gold miners the industry is currently not generating any, let alone acceptable returns for its investors.

"The focus is now on generating sufficient returns for shareholders rather than production growth. While that might sound like common sense, it's an attitude that has been sorely lacking from the sector over the past decade." Motley Fool

By whatever valuation metric you choose to use, the gold exploration, project development and mining industry is trading at levels we haven't seen in a very long time.

Good news, higher gold prices or news coming from operational efficiencies (cost cutting initiatives and better capital allocation - cutting exploration and non-critical spending) impacting the bottom line might make investors take notice of the one sector showing improving margins versus the possible widespread earnings carnage to come on the S&P500.

Here's a few links to a whole host of other major concerns that makes me think we're in for a gold bull market resurgence.

- Is Russia Planning a Gold-Based Currency?

- Golden Dragons Grand Strategy

- Golden Gains come After the Pain

- What's Your Edge?

- Dear Harry Dent: Wanna Bet?

Something else to think about from Dave Forest of Pierce Points:

" Official Comments Show This Gold Market Is Priming

Critical news in the ongoing saga over India's gold imports this week. Showing that a major return in bullion demand may be closer than anyone was expecting.

The Wall Street Journal broke the story that a long-awaited cut in India's gold import duties is brewing. With key government officials now pushing for a reduction in these tariffs.

According to the Journal, the pressure is coming from India's trade ministry. Which has reportedly asked the country's finance ministry to reduce gold tariffs, according to an unnamed "top official" within the government.

Even more important is the possible scale of the tax cuts. With reports suggesting that the trade ministry is seeking a reduction in tariffs to just 2%. A substantial cut from the current 10% duty.

The move is coming as pressure mounts from India's bullion and jewelery sector to increase domestic sales. And as I noted last week, demand from consumers seems to back up this sentiment -- with gold imports expected to have increased 50% for the fiscal year ending March 31.

If these high-level negotiations prove successful, it would almost certainly be a trigger for gold imports to rise further. After all, imports in the 2011-12 fiscal year were over 1,000 tonnes -- and that was at a time when gold prices were running as much as 50% higher than today.

With bullion currently selling much cheaper, a tax cut could spur a lot more buying -- and help the global gold price in the process. Watch for news over the next week on a final decision from the finance ministry.

Here's to a golden recovery,

Dave Forest"

The quest for gold

From SNL Metals & Mining's 2014 edition of 'Strategies for Gold Reserves Replacement' comes the following...

Over the past two dozen years mining companies have discovered 1.66 billion ounces of gold in 217 major gold discoveries. That's a lot of gold!

But it wasn't enough - there were 1.84 billion ounces produced over the same period. That's a shortfall of 180 million ounces of gold for reserve replacement over the 24 year period or a shortfall of 7.5m ozs a year.

The amount of gold discovered and the number of major discoveries has been trending downward - from 1.1 billion ounces in 124 deposits discovered during the 1990s to 605 million ounces in 93 deposits discovered since 2000.

"The amount of potential production from these major discoveries is particularly concerning when looking at the discoveries made in the past 15 years. Assuming a 75% rate for converting resources to economic reserves and a 90% recovery rate during ore processing, the 674 million ounces of gold discovered since 1999 could eventually replace just 50% of the gold produced during the same period.

However, considering that only a third of the discovered gold has been upgraded to reserves or has already been produced, and that many of these deposits face significant political, environmental or economic hurdles, the amount of gold becoming available for production in the near term is certainly much less.

Between 1985 and 1995, 27 mines with confirmed discovery dates began production an average of eight years from the time of discovery. The time from discovery to production increased to 11 years for 57 new mines between 1996 and 2005, and to 18 years for 111 new mines between 2006 and 2013.

The length of time from discovery to production is expected to continue trending higher: 63 projects now in the pipeline and scheduled to begin production between 2014 and 2019 are expected to take a weighted-average 19.5 years from the date of discovery to first production." Kevin Murphy, mining.com

This bit from an article titled ' High Grading; The Implications Of Turning Ore To Waste' by Brent Cook and Chris Wilson

"When we factor in the effects of shelved and stalled projects, reduced or cancelled exploration programs, downward re-calculation of reserves and resources using lower gold prices and higher cut-off grades, and the likelihood that high grading will ultimately result in lost ounces, then it is clear that the long term thesis of Exploration Insights is more valid than ever: that the major gold miners are not replacing the ounces mined and that ultimately they will be forced to buy future resources and reserves. The logical follow-on, as and when the industry starts to return to health, is that any genuine discovery, especially the higher margin ones in politically stable jurisdictions, will be extremely valuable."

The fact is major mining companies do not make discoveries. Discoveries are instead made by old time prospectors and our junior resource companies. Unfortunately junior exploration spending has been slashed by over 60% in the last few years and the large gold discoveries needed by the world's major gold miners to replace mined reserves were already few and far between.

"Mine production reached a record of 3,114.4t - a level that we expect will signal a plateau over 2015. From dipping to a 10-year low in 2008, mine production grew by an average of 4.7% per year to 2013 as the supply pipeline swelled, fuelled by the decade-long rise in the gold price from 2001-2011. However, that pace of growth declined last year: mine production grew by just 2%. The sharp falls in the gold price in 2011 and 2013 prompted a severe cut back in the development of new mining projects, with producers focusing instead on cost cutting and rationalisation. So although production will remain at - or close to - this record level for next year (2015), the potential for existing operations to generate greater volumes of output is limited.

Central bank net purchases amounted to 477t in 2014, 17% or 68t above 2013's 409t. This represents the second highest year of central bank net purchases for 50 years, after the 544t addition to global gold reserves reported in 2012." Gold Demand Trends, World Gold Council

Conclusion

Fact - Juniors find the deposits, they own the world's future gold mines the gold miners need to replace their reserves.

"It seems inevitable that the mining industry's response to 2013's gold price crash will be detrimental to mine supply levels in future years." Thomson Reuters GFMS

What is your best bet for high returns from the coming resumption, the continuation of gold's bull market and the anticipated increase in mergers and acquisitions (M&A) by the major miners looking for the higher margin deposits in politically stable jurisdictions? The answer, in this author's opinion, would be to own the junior resource companies that have these types of deposits. But to reap the greatest rewards you need to get in ahead of the herd. That would be now.

Urban myth/legend says duck quacks don't echo. That's wrong, they do. The same as a dog's bark or a cat's meow echo's.

Something else that echoes and has for millennia - I can hear it getting louder and louder instead of fading - is an absolute truth proven through several thousand years of financial and political crisis, it's found in a quote from J.P. Morgan:

"Gold is money, everything else is credit."

"Gold is money, everything else is credit."

"Gold is money, everything else is credit."

Golden echos should be on everyone's radar screen. Are they on yours?

If not, maybe you should.By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2015 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.