Stock Market New All Time Highs

Stock-Markets / Stock Markets 2015 Feb 22, 2015 - 10:26 AM GMTBy: Tony_Caldaro

The market started the holiday shortened week at SPX 2097. It made a new high on Tuesday, pulled back some, then another new high on Thursday, pulled back on options expiration Friday, then ended the week at new highs. For the week the SPX/DOW were +0.65%, the NDX/NAZ were +1.85%, and the DJ World index was +0.85%. On the economic front reports again came in biased to the downside. On the uptick: industrial production, building permits, leading indicators and weekly jobless claims improved. On the downtick: the NY/Philly FED, the NAHB, housing starts, the PPI, capacity utilization, and the monetary base. Next week we get reports on Q4 GDP, the CPI and more housing.

The market started the holiday shortened week at SPX 2097. It made a new high on Tuesday, pulled back some, then another new high on Thursday, pulled back on options expiration Friday, then ended the week at new highs. For the week the SPX/DOW were +0.65%, the NDX/NAZ were +1.85%, and the DJ World index was +0.85%. On the economic front reports again came in biased to the downside. On the uptick: industrial production, building permits, leading indicators and weekly jobless claims improved. On the downtick: the NY/Philly FED, the NAHB, housing starts, the PPI, capacity utilization, and the monetary base. Next week we get reports on Q4 GDP, the CPI and more housing.

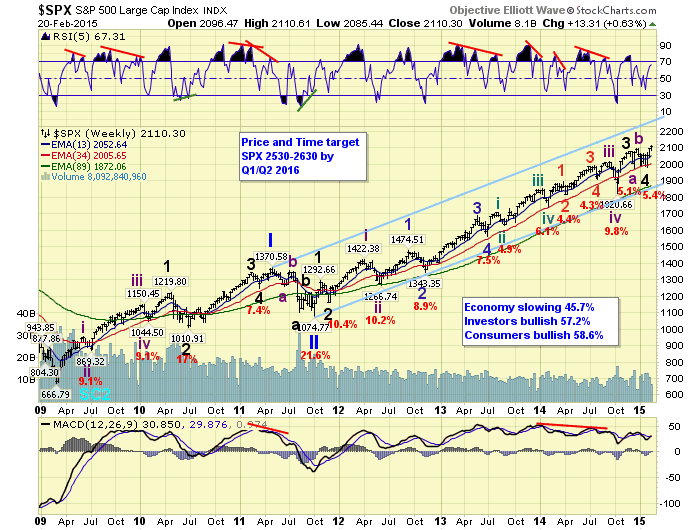

LONG TERM: bull market

We continue to label this six year bull market as a five Primary wave Cycle wave [1]. Primary waves I and II completed in 2011, and Primary III has been underway ever since. The five Major waves that created Primary I had a subdividing Major 1 and simple Major waves 3 and 5. The five Major waves that are creating Primary III appear to be alternating with that pattern. Thus far we have a simple Major 1, a subdividing Major 3, and potentially a subdividing Major 5 underway. When Primary III does conclude we should see a steep correction for Primary IV, then another advance to new highs for Primary V. This suggests this bull market still has a ways to go in time and price.

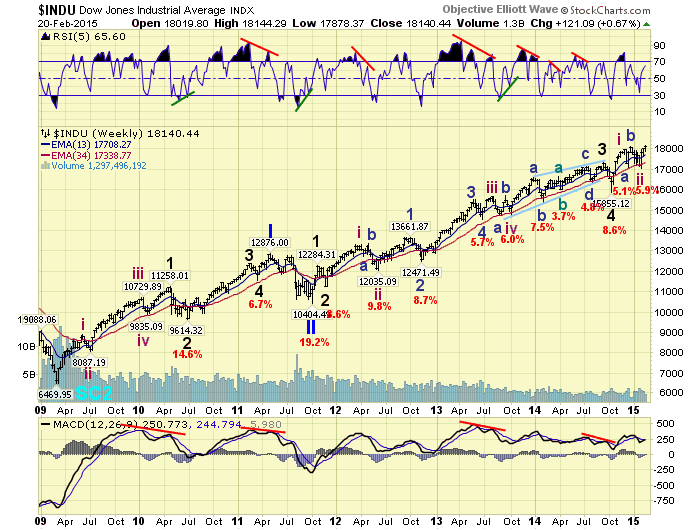

During the October 2014 10% correction the OEW group had a lengthy discussion on the wave pattern for Primary III. There have been so many waves (trends) during this 3+ year advance that the pattern offered several possibilities. We arrived at three potential counts, posted them on the SPX/DOW/NAZ charts, and gave them a probability of 70%, 20% and 10% respectively. With the recent new all time highs in 2015, the latter two counts were eliminated. The past couple of weeks, however, the OEW group has arrived at another alternate count. This is count suggests the October correction was the end of Major 4, and Major 5 began then. It is posted on the DOW charts.

The long awaited new all time highs in the DOW was finally achieved on Friday. This is the last index, of the four major US indices, to hit all time highs in 2015. As promised we are now posting our next long term target for this bull market: SPX 2530 to SPX 2630 by Q1/Q2 2016. This target will be posted on the SPX weekly chart, like the ones in the past that have been achieved.

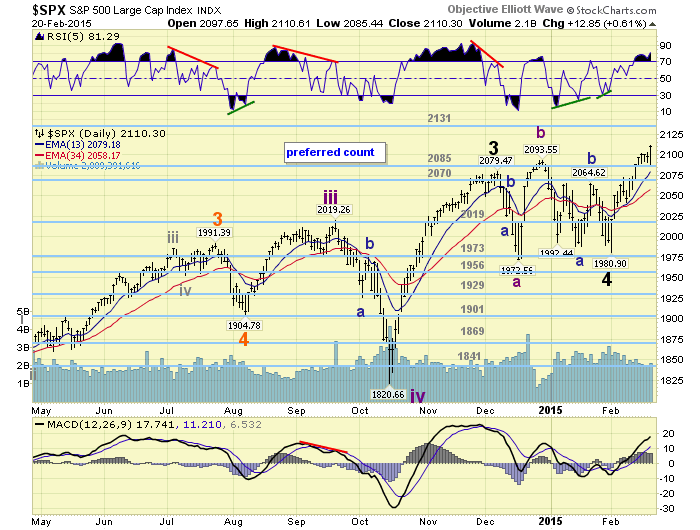

MEDIUM TERM: uptrend

After what appears to be an irregular Major wave 4 flat, between early-December and early-February, the market kicked off an uptrend from the SPX 1981 low. We had observed an impulse wave in its early stages, first one this year, and the market triggered a WROC uptrend signal. Since that low the market has advanced about 6.5% in just two weeks.

Our preferred count, posted above, suggests the market is currently in Major wave 5 of Primary III. When the current uptrend concludes it may be all of Major wave 5, or as we suspect just Intermediate wave one of Major 5. The reason we believe Major wave 5 will subdivide is twofold. First, this would create an alternate pattern for the Major waves of Primary waves III and I. Second, the ECB’s EQE program, which begins next month, should last until at least September 2016. During this entire bull market the only time we had a Primary wave correction was when there wasn’t a QE program ongoing, or even considered. Nevertheless, let’s see how the market acts after the EQE program starts. Medium term support is at the 2085 and 2070 pivots, with resistance at the 2131 and 2198 pivots.

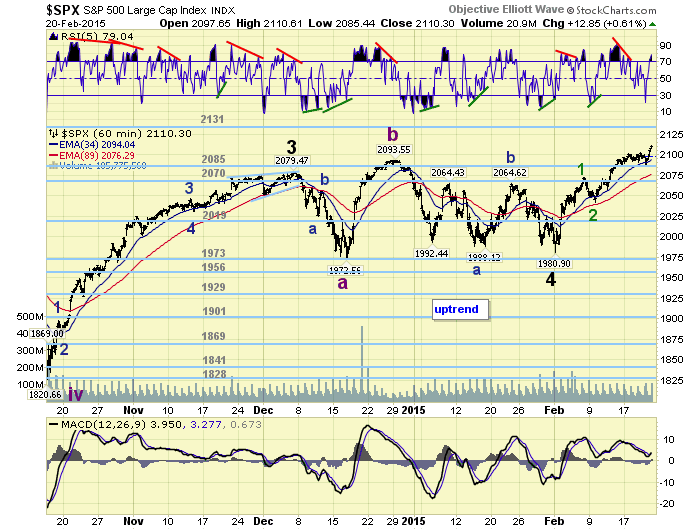

SHORT TERM

We were counting the impulsive advance from the recent SPX 2042 low as it unfolded. Friday, however, the market pulled back a bit more than expected for that short term count, even thought it held the 2085 pivot and then rallied to new highs. As a result we must now count four completed waves, with the fifth underway, from the downtrend low at SPX 1981. Unfortunately there are three possible ways of counting this pattern. First, this fifth wave up will end this uptrend. Second, this fifth wave up will complete Minor wave 1 of this uptrend. Third, this fifth wave up is actually Minute wave iii of Minor 3 for this uptrend.

The first possibility suggests the maximum this uptrend could reach is SPX 2145. The fifth wave (2085-2145) can not be longer than the third (2042-2102), when the third is shorter than the first (1981-2072). We give this count a 10% probability, as it appears too short, overall, for Intermediate wave one of Major 5.

The second possibility we give a 30% probability. Should Greece fail to deliver a letter on Monday that falls within the expected guidelines, the EU could put a halt to Friday’s drafted four month loan extension. The market would likely then selloff dramatically, retracing Friday’s entire rally. The third possibility we give a 60% probability. It suggests SPX 2072 and SPX 2042 completed Minor waves 1 and 2. Then SPX 2102 and SPX 2085 completed Minute waves i and ii, and Minute wave iii is currently underway. Whatever happens on Monday will likely determine which of these two short term counts are in play. Short term support is at the 2085 and 2070 pivots, with resistance at SPX 2111 and the 2131 pivot. Short term momentum rose to overbought on Friday and ended there.

FOREIGN MARKETS

Asian markets were all higher on the week for a net gain of 0.7%.

European markets were mostly higher for a net gain of 0.9%.

The Commodity equity group were mixed and finished mixed on the week.

The DJ World index is in an uptrend and gained 0.85% on the week.

COMMODITIES

Bonds look like they are in a downtrend and they lost 0.5% on the week.

Crude looks like it is in an uptrend, but lost 3.5% on the week.

Gold look like it is in a downtrend and it lost 1.9% on the week.

The USD remains in a weakening uptrend and gained 0.2% on the week.

NEXT WEEK

Monday: Existing home sales at 10am. Tuesday: Case-Shiller, Consumer confidence, and FED chair Yellen testifies before the Senate with the semiannual report to Congress. Wednesday: New home sales, and FED chair Yellen testifies before Congress. Thursday: weekly Jobless claims, the CPI, Durable goods orders, and the FHFA housing index. Friday: Q4 GDP (est. +2.1%), the Chicago PMI, Consumer sentiment, Pending home sales, and FED vice chair Fischer gives a speech. Best to your weekend and week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2015 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.