Bitcoin Price Drifting Towards Depreciation

Currencies / Bitcoin Feb 20, 2015 - 03:04 PM GMTBy: Mike_McAra

In short: speculative short position, stop-loss at $273, take-profit at $153.

In short: speculative short position, stop-loss at $273, take-profit at $153.

A new security standard for cryptocurrencies has been proposed by the Cryptocurrency Certification Consortium, we read on CoinDesk:

A group composed of developers and security professionals has proposed a set of rules aimed at standardizing security protocols used by companies that handle or store digital currencies for their clients.

The proposal, created by the Cryptocurrency Certification Consortium (C4) and formally unveiled on 11th February during the DevCore bitcoin development conference in Boston, Massachusetts, aims to provide an industry-level standard by which exchanges and wallet providers can operate.

The Cryptocurrency Security Standard (CCSS) draft proposal calls for 10 standardized approaches to key and seed generation, storage and usage, proof-of-reserve and security audits, among other areas. The framework consists of three levels per section, with each grade signifying a higher degree of security based on the proposed guidelines.

This might look like the kind of security improvements we have frequently mentioned in our commentaries. Definitely, having a standard discussed and agreed on by the industry seems more favorable to having the current “all for themselves” situation. The pooling of knowledge of market participants might help them come up with proposals Bitcoin-related companies will be able to work with.

The discussed proposal is still not one that will be broadly accepted, at least it doesn’t seem so, but it certainly shows that the industry is thinking actively on how to improve the security of client funds. If this proposal is developed or we see new ones being put forward and actually implemented, these would be further steps to make Bitcoin a safer means of payment.

It will be very interesting to see how this plays out, especially in light of the ongoing work on Bitcoin regulation.

For now, let’s take a look at the charts.

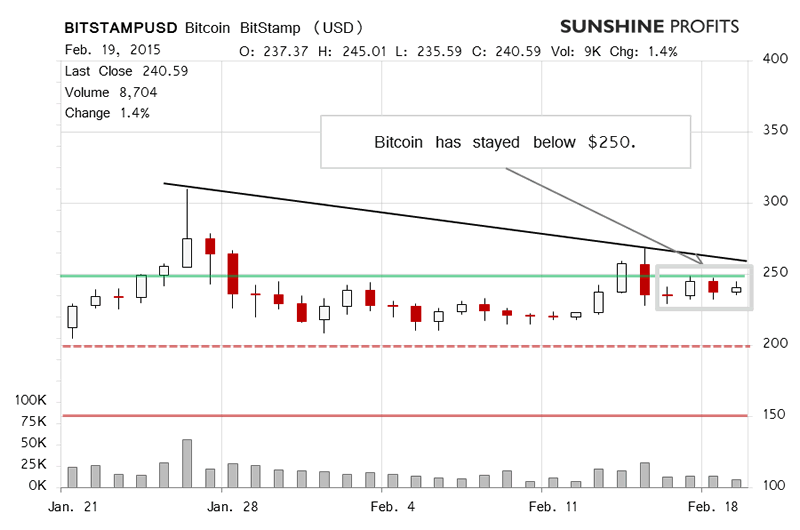

Yesterday went up but definitely not strongly. Particularly not in terms of volume which was lower than on the day before. Overall, the picture yesterday was very much of a continuation of the general trend. As such, our comments from two days back remain much up to date:

(…) we’ve seen a move down with yesterday’s gains partially reversed and the volume in the range of what we saw yesterday (…). We’re quite close to $250 but we still think that this by itself is not necessarily a bullish development. Moreover, as Bitcoin moved up above $250, failed to hold up, fell, moved up again but failed to reach this level again, it seems that we might actually be in a much more bearish environment that one might think based on first impressions.

Today, we’ve seen slightly more action (this is written after 10:00 a.m. ET) as far as volume is concerned. The move has been up but not very strongly so. Bitcoin is still below $250 (green line on the chart) and also below the possible declining trend line (black line). This suggests that the downtrend might still be in place. Even if Bitcoin goes above $250 on relatively low volume for one or two days, we might not see a change in the short-term outlook if there’s no confirmation in volume.

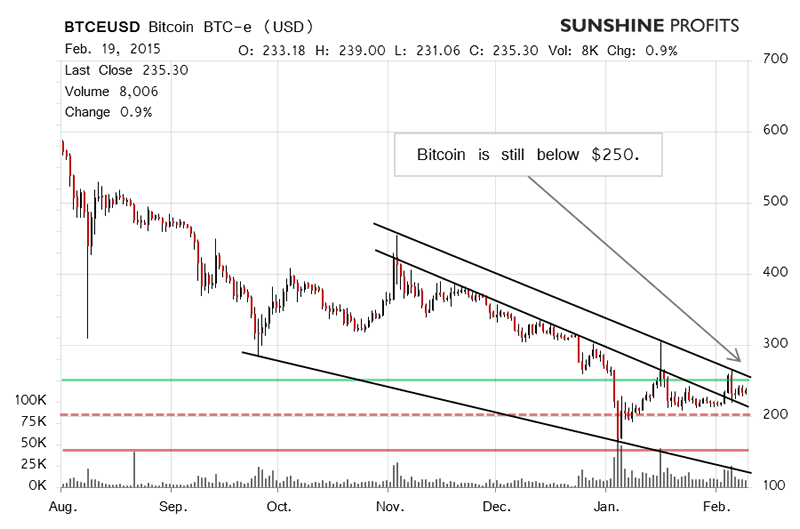

On the long-term BTC-e chart, we saw no important changes yesterday. The action was similar to what we had seen in the previous couple of days – not much in terms of price or volume. Bitcoin is still below $250 (green line), below the possible declining trend line (highest black line). It very much seems that our comments from Wednesday are still valid:

In the recent days, we’ve only seen limited strength and it seems that the recent two moves up were followed by declines.

Right now, Bitcoin is between two possible parallel trend lines, below $250. This is not a bullish reading. Of course, in the market everything can change in a spin of the wheel but since the $250 has not been breached and we’re right after a possible local top, it would seem that short positions are still more favorable. (…)

Today, we’ve seen some appreciation but it’s not been strong. The volume is already higher than yesterday but not very strong as such. The situation is slightly different than on BitStamp in that the volume has risen more sharply on BTC-e but the price appreciation has been slightly weaker. This is not a major difference and we still think that we haven’t quite seen the beginning of the next big move on both exchanges yet.

Summing up, we think speculative short positions might be the way to go.

Trading position (short-term, our opinion): short position, stop-loss at $273, take-profit at $153.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.