The Simplest Long-Term Investment Strategy You'll Ever See

InvestorEducation / Exchange Traded Funds Feb 20, 2015 - 02:40 PM GMTBy: DailyWealth

Dr. Steve Sjuggerud writes: Is your goal as an investor to beat the market?

Dr. Steve Sjuggerud writes: Is your goal as an investor to beat the market?

If your answer is yes, I have news for you...

Not every investor can beat the market. And in many cases, trying to beat the market can shatter your long-term gains...

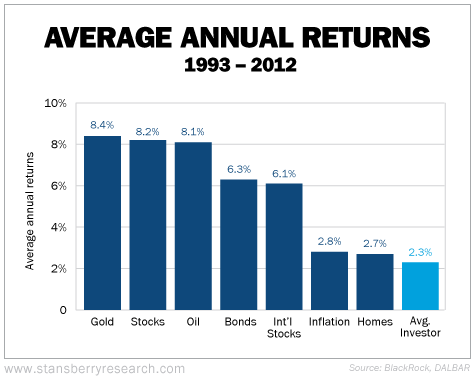

The truth is, most investors don't come anywhere near beating the market. The chart below tells the story. It shows just how bad returns have been for the typical investor over the past two decades...

While U.S. stocks increased 8.2% a year over this period, the average investor saw less than a third of those gains... just 2.3% a year.

That's actually much worse than it seems over two decades of investing. After 20 years, a $10,000 investment at 8.2% turns into $48,367... a 384% return. The same investment at 2.3% a year turns into just $15,758... a 58% gain.

Said another way, the average investor earned just 15% of the long-term gain on stocks over this 20-year period.

There are plenty of reasons why the typical investor underperforms... High fees, lack of diversification, and trading in and out of the market at the worst possible times are culprits.

The last point is key... investors tend to buy into stocks at the top and sell at the bottom. It crushes their long-term returns.

ETFs can't solve that psychological barrier. But they do offer an easy way to make long-term investment decisions.

Whether you'd like to build a simple portfolio of 60% U.S. stocks and 40% bonds or a complex portfolio with a dozen asset classes, ETFs are a great tool.

You see, ETFs are easy to buy and sell. And more than 1,000 trade in the U.S. So you can invest in just about anything you'd like.

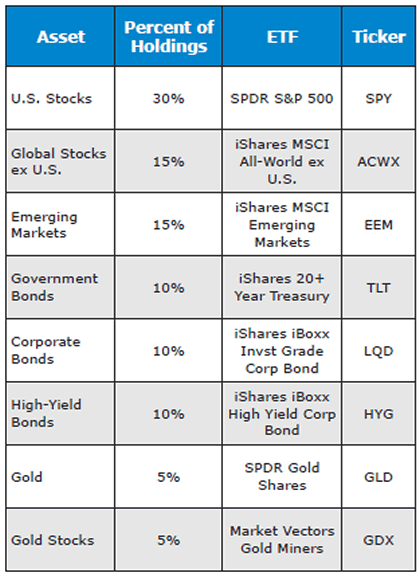

Take a look at the table below. It shows a mock long-term portfolio... And how you could build it in just a few minutes with just a few transactions fees using ETFs...

Now, I'm NOT saying you should invest in this portfolio. Or that this is the right portfolio for you over the long term.

But I will say that if you bought this portfolio today, and held for 20 years, you'd likely beat the average investor (who earns just 15% of the market's performance).

The great thing about ETFs is that they allow you to find the portfolio mix that's right for you. And they allow you to build that portfolio quickly and easily.

Good investing,

Steve

P.S. Most investors don't realize how powerful a tool ETFs can be. Over the past few years, I've used seemingly "boring" ETFs to generate huge gains for my readers – we're currently up 339% in the ProShares Ultra Health Care Fund (RXL), for example. That's why I recently filmed an educational event all about using ETFs. In it, I share how we've managed to make such big gains (without using options)... along with my three favorite ETFs right now. You can watch this presentation completely FREE here. (Or, for a written transcript, go here.)

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.