Crude Oil Price Double Top or Further Rally?

Commodities / Crude Oil Feb 19, 2015 - 10:29 AM GMTBy: Nadia_Simmons

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil moved lower after the market's open weakened by concerns over the situation in Ukraine and Greece, the commodity rebounded as weaker U.S. dollar supported the price. As a result, light crude gained 1.08% and climbed above an important resistance, but is it as bullish as it seems at the first sight?

Yesterday, after the market's open, the price of crude oil moved sharply lower as growing concerns over the situation in Ukraine and Greece weighed on investrs' sentiment. As a reminder, pro-Russian rebels and government forces continue fight in east Ukraine, dampening hopes that a ceasefire will hold end the conflict. Additionally, talks between Greece and euro zone finance ministers broke down on Monday, which fueled worries about demand for oil in a unstable European economy. In response to these circumstances, the commodity dropped to an intraday low of $50.81. Despite this decline, light crude rebounded supported by a weaker greenback, which made the commodity cheaper for holders of other currencies. As result, light crude reversed and climbed above $54, but did this upswing change the very short-term picture? (charts courtesy of http://stockcharts.com).

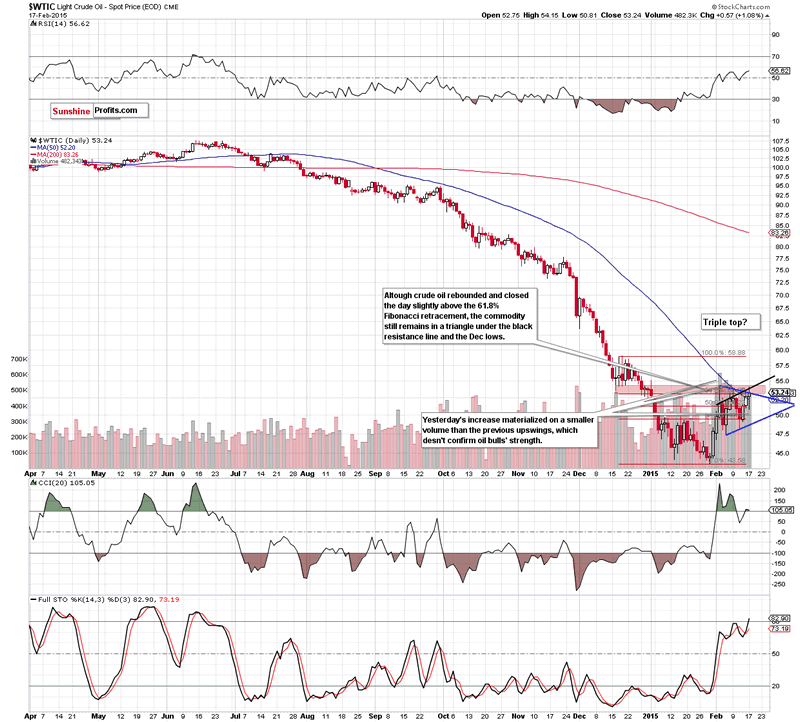

Looking at the daily chart we see that although crude oil moved sharply lower after the market's open, the commodity rebounded, which resulted in an increase above the upper line of the blue triangle. With this upswing, light crude also climbed above the black resistance line (based on daily closing prices), but as it turned out later in the day, this improvement was only temporary and oil bulls didn't manage to push the commodity higher. As a result, crude oil reversed and slipped below the previusly-broken lines, invalidating a breakout, which is a negative signal. On top of that, yesterday's increase materialized on smaller volume than the previous upswings, which doesn't confirm the strength of the market and makes the breakout above 61.8% Fibonacci retracement less bullish than it seems at the first sight. Additionally, we should keep in mind that crude oil is still trading under the Dec lows and the Feb high of $54.24, which means that the probability of a double top and reversal is still in play. Taking all the above into account, we think that as long as there is no daily close above the upper line of the blue triangle and the black resistance line further rally is doubtful.

Did yesterday's upswing affect the medium-term picture? Let's check.

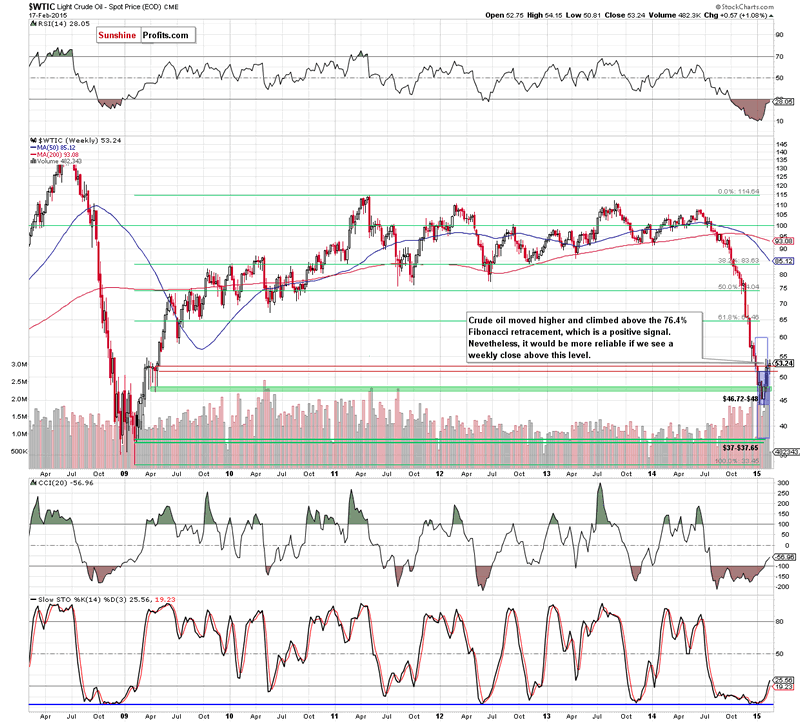

From this perspective, we see that yesterday's increase resulted in an invalidation of the breakdown under the 76.4% Fibonacci retracement. Although this is a positive sgnal, we saw similar price action in the previous weeks. Back then, despite such improvement, oil bulls didn't manage to push the commodity higher, which resulted in a pullback to the support zone based on Apr 2009 lows. Taking this fact into account, and combining it with the very short-term picture, we still believe that as long as the commodity is trading below $53.13-$54.24 further improvement is questionable and another pullback (in the coming days) is likely.

Summing up, although crude oil moved higher once again, yesterday's increase materialized on smaller volume than the previous upswings, which suggests that oil bulls might getting weaker. Taking this fact into account, and combining it with an invalidation of the breakout above the upper line of the blue triangle and the black resistance line, it seems to us that another pullback from here in the coming days is likely.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions.

Thank you.

Nadia Simmons

Sunshine Profits‘ Contributing Author

Oil Investment Updates

Oil Trading Alerts

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Nadia Simmons and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Nadia Simmons and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Nadia Simmons is not a Registered Securities Advisor. By reading Nadia Simmons’ reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.