Bitcoin Price Suggests Yet Another Move

Currencies / Bitcoin Feb 17, 2015 - 05:01 PM GMTBy: Mike_McAra

In short: speculative short position, stop-loss at $273, take-profit at $153.

In short: speculative short position, stop-loss at $273, take-profit at $153.

A New York politician, Mark Levine, has proposed that the city accept Bitcoin as payment for fees and fines, we read on CoinDesk:

Last Thursday New York City councilman Mark Levine introduced a bill petitioning for the city to accept bitcoin as payment for fines and fees.

Levine opened up about the bill, which he says could be passed as early as June, in a new interview with CoinDesk, indicating that he believes New York City has a pressing incentive to begin accepting the payment method due to its cost advantages when compared to credit cards.

(…)

Levine added that if the city were to partner with an intermediary in accepting bitcoin, it would bear some costs, but that these would still be less than those charged by payment card providers.

While Levine is optimistic about an expedited timeline for the bill, he indicated that the end-of-June estimate is far from concrete.

“There’s a lot of uncertainty in the process,” he said.

This is yet another initiative by a politician to enable Bitcoin transactions with the government if not directly, then through an intermediary. If not in anything else, this move might make local politicians more aware of Bitcoin. Levine himself acknowledges that the process is very much uncertain and our take is that the government will not accept Bitcoin soon, since the legal status of the currency is still very much uncertain and government bodies are very careful to operate within the boundaries of the law.

The situation in New York is slightly different than in most other states since the local authorities have already embarked upon a mission to regulate Bitcoin and the proposed “BitLicense” has been released. So, one the license is actually implemented, we might actually see more Bitcoin bills being proposed.

For now, we focus on the charts.

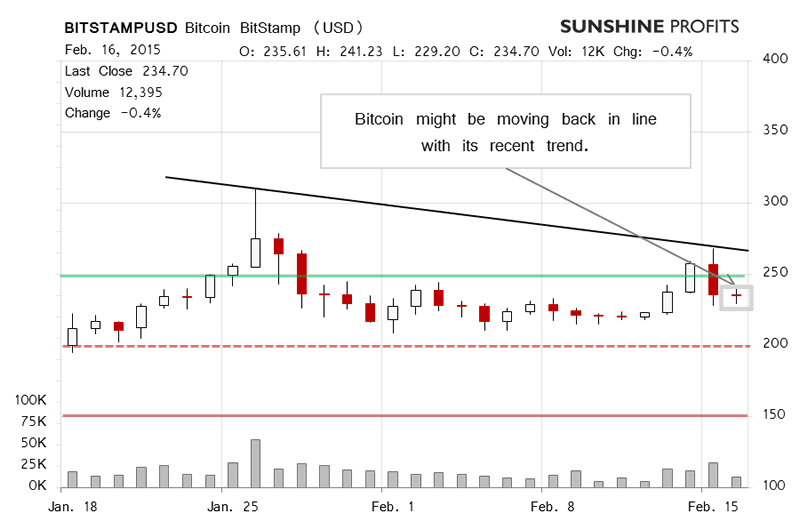

On BitStamp, we didn’t see much action yesterday. The price itself didn’t move much, especially in comparison with what we had seen earlier, and the volume was relatively weak, less than half of what it had been a day previously. This was the calm after the “storm” of Saturday and Sunday but overall Bitcoin stayed below both $250 (green line) and the recent possible declining trend line (black line). This opens the currency up to yet another move down, in our opinion. What we wrote yesterday holds today:

The developments of the weekend might look confusing at first but the action on Sunday is, in our opinion, telling here. The first attempt at $250 and we see a move down almost immediately and more than supported by volume. This might mean that the move up we saw on Friday and Saturday was no more than a counter-trend rally. As it is, it might turn out to be a local top, and one which is lower than the previous local top on Jan. 26.

Today the volume has been visibly lower than over the weekend (…) and the action has been slightly bearish, bearing more resemblance to what we saw before the weekend than during it. So, in spite of the move up we saw, the short-term outlook is now even more bearish than it was before the Saturday’s surge.

And the action today (this is written around 9:30 a.m. ET) has been slightly to the upside but the volume has been visibly lower than yesterday, not to mention the previous days. Our current take on that is that Bitcoin might be ready for yet another plunge.

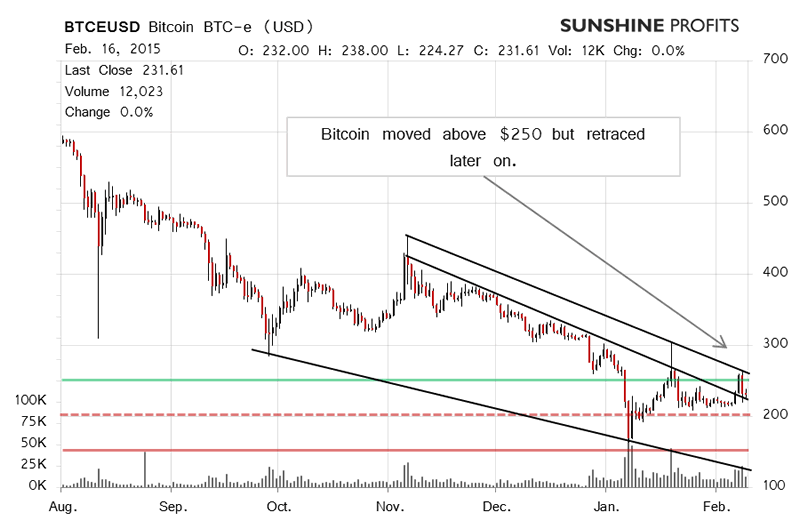

On the long-term BTC-e chart, we see that Bitcoin is currently at a lower possible trend line (the one based on November and January closing prices around local tops). As such, it seems that the move up has been denied and our yesterday’s comments are still up to date:

This might be an indication that the move up is over and that Bitcoin is back to its recent trend which is down. If anything, the move up followed by equally sharp depreciation made the situation more bearish in our opinion and it seems that the current price level might be a favorable entry point for a short speculative position.

Summing up, we think speculative short positions are more favorable now.

Trading position (short-term, our opinion): short position, stop-loss at $273, take-profit at $153.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.