HFT Illegal? A Remarkable Proposition

Stock-Markets / Market Regulation Feb 16, 2015 - 04:40 PM GMTBy: GoldSilverWorlds

A remarkable new paper by a Cornell law professor and CFTC staff counsel suggests that many aspects of high frequency computer trading (HFT) may be, in fact, illegal under various provisions of basic commodity law. Heretofore, it was generally assumed that HFT was legal, but disabused and impacted markets in disruptive manner on occasion. Many, like myself, never looked on HFT favorably, but few have tried to make the legal case against it. The author, Gregory Scopino, writes in his personal capacity and not on behalf of the CFTC. Not a short or easy read (at 90 pages), I feel Scopino makes a well-researched case and even offers answers to questions asked of me by readers, such as definitions for commodity terms and the like. Please take the time to scan the document.

A remarkable new paper by a Cornell law professor and CFTC staff counsel suggests that many aspects of high frequency computer trading (HFT) may be, in fact, illegal under various provisions of basic commodity law. Heretofore, it was generally assumed that HFT was legal, but disabused and impacted markets in disruptive manner on occasion. Many, like myself, never looked on HFT favorably, but few have tried to make the legal case against it. The author, Gregory Scopino, writes in his personal capacity and not on behalf of the CFTC. Not a short or easy read (at 90 pages), I feel Scopino makes a well-researched case and even offers answers to questions asked of me by readers, such as definitions for commodity terms and the like. Please take the time to scan the document.

If you would prefer a brief interpretation, try this.

There are many points to draw from this paper and I’ll offer my most salient takeaway. By looking at what is accepted by “everyone” as legally appropriate activity with a different perspective, the activity can instead look highly inappropriate and even illegal. Scopino looked at HFT not through the universal perspective of something that’s here to stay and that we must get used to; to looking at it through an interpretation that it might violate existing law. His conclusion appears to be that much of HFT is not properly aligned with existing commodity law. Not being a lawyer, I can only agree with him by what I’ve observed firsthand about the disruptive and manipulative effect of HFT. Not explicitly stated in the paper is my suggestion that only the one percent of market participants actively engaged in HFT seem to be for it, while the 99% of market participants not engaged in HFT wish it didn’t exist.

About the only difference I hold with Prof. Scopino is that he suggests that certain aspects of HFT may be manipulative on their face, where I consider HFT to be a manipulative price tool employed to extend the larger ongoing price manipulation in silver. He suggests HFT may be the manipulation; I claim the commercials first rig the price of silver (up or down) through HFT in order to force the technical funds and other price momentum speculators to buy or sell so that the commercials can take counterparty positions. I’ve alleged that the manipulation in silver existed long before HFT arrived on the scene some years ago, although I fully admit that HFT has made it easier for the silver commercial manipulators.

I was taken with something in the paper that is generally very hard to find – a good definition of the word “manipulation.” It’s a word, as you know, that I tend to overuse. Here is the definition in question (page 655) –

“The phrase price manipulation . . . means the elimination of effective price competition in a market for cash commodities or futures contracts (or both) through the domination of either supply or demand and the exercise of that domination intentionally to produce artificially high or low prices. Price manipulation is kindred to the exercise of monopoly power to dictate prices that would be unachievable in a truly competitive environment. The existence of price manipulation is largely a factual question involving determinations whether the requisite domination or of monopoly exists, whether an artificial price is caused by the exercise of that power and whether the dominant party specifically intended to bring about that artificial price.”

While Prof Scopino is referring to HFT only, I hope you recognize that “no competition, domination, monopoly and dictating prices” are words frequently used by me to describe the control of the 8 big short traders in COMEX silver. This definition clearly states that price manipulation first revolves around the factual question of whether the domination or monopoly exists, followed by the willful and successful exercise of that domination.

First things first – does a monopoly exist on the short side of COMEX silver? There would be no question of monopoly if one to eight traders controlled 100% of one side of any market; then it would be easy to prove manipulation as it would be self-evident. Conversely, if no one trader held more than 1% of any market, it would be absurd to allege manipulation by means of a dominant concentrated position. So, we know the range of domination (concentration) lies between 1% and 100% of market share. Because no one could argue that a 100% concentration by one or a small number of traders would not constitute manipulation on its face, it would never be allowed to exist despite any intent by the CFTC to ignore such an absurd market share. Therefore, the definition of domination or monopoly given above presupposes that some level less than 100% could determine manipulation. Otherwise no anti-manipulation statute would make sense.

Therefore, the question comes down to what degree of concentration, openly stipulated to be less than 100%, would constitute manipulation? The answer is not some specific hard number written in stone, like 30% or 70%; if it was that simple we wouldn’t need a body of law or a federal agency to safeguard against manipulation. Instead, the answer has to be some reasonable percentage supported by other evidence of artificial pricing. That is precisely the circumstance in silver.

For starters, the facts of concentration are not in dispute because they come from the CFTC in the form of the weekly Commitments of Traders Report (COT). Concentration data is available and accurate and the CFTC compiles and publishes the data because it is the early warning system for manipulation. The problem is that the agency, at least in silver, stops at compiling and publishing the concentration data and refuses to consider the results. It’s as if a thousand incoming enemy ICBM’s were detected to hit the US on the NORAD missile defense system and the operators ignored the radar and clocked out for lunch.

The CFTC doesn’t publish concentration data just to give me something to write about; the system was set up to detect and eliminate the concentration that is a necessary component of domination, control and monopoly. What should the CFTC do with the concentration data in silver? At a minimum, it should consider its own data in relative and practical terms.

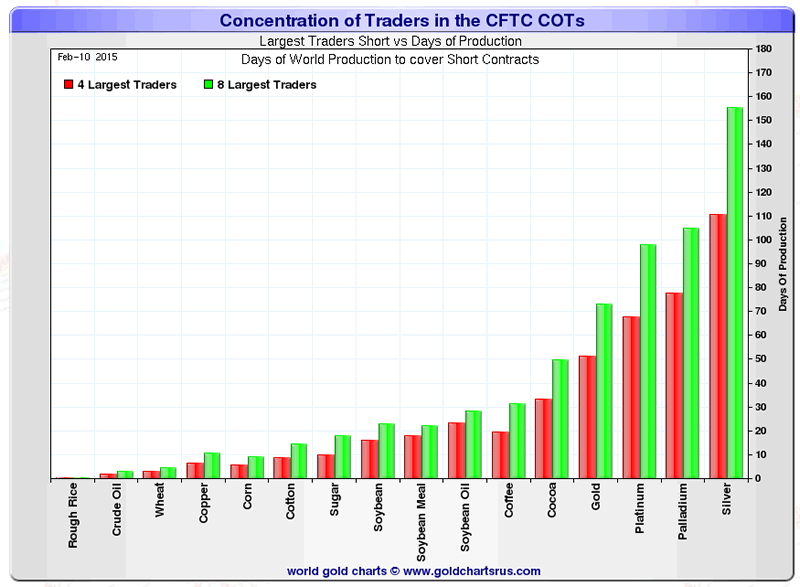

The trick is to convert the concentrated short positions published by the CFTC into the equivalent real world quantities the short positions represent and do that for every regulated physical commodity, including COMEX silver. After all, commodity law has established that a commodity’s price should be determined by changes in actual supply and demand and that futures trading must not dictate prices to the real world. Every physical commodity, from oil to cotton to copper to silver has easy to establish world annual production and consumption data. By converting the concentrated short positions of the four and eight largest traders in every regulated commodity futures market to what that represents in terms of actual days of world production, this normalizes the data in a reasonable and practical manner that allows an apples vs apples comparison for every commodity.

It’s not just that silver always has the largest concentrated short position in terms of days of world production of all commodities, in some cases standing with an equivalent short position fifty times larger than in some commodities, like crude oil or wheat. One has to look at the total picture – the rarity of a commodity priced below its average primary cost of production and documented net physical investment buying coupled with the most extreme relative concentrated short position of all physical commodities.

Add into the mix the certain knowledge the extraordinary and easily proved circumstances that in 2008 the former largest holder of the concentrated short position in silver (and gold), Bear Stearns, needed to be bailed out and acquired by JPMorgan, most likely because of losses Bear Stearns suffered on its massive silver and gold short positions. Since then it has been easy to track what JPMorgan has been up to because its concentrated silver short position has remained so large and manipulative.

What makes Prof. Scopino’s paper remarkable is that he is stating the obvious in the case that HFT may violate the law. And what could be more obvious than the documented case for manipulation in silver by virtue of a concentrated short position that can’t be explained in legitimate terms and stands far above any other short position?

Please don’t think I am depending on any action, immediate or otherwise, by the CFTC to Scopino’s paper, despite his affiliation with the agency. Likewise, there is zero chance of the agency ever doing anything about the silver manipulation. What’s great about the paper is that states, in legal terms, what the vast majority of market participants already know – that HFT appears manipulative on its face. If that is correct, the remedy must be a legal resolution.

It’s different with the silver manipulation where no legal resolution is likely, but as and when enough market participants and investors realize what the world’s largest concentrated short position has done to the price, the resolution will come when that newfound knowledge results in enough physical silver buying to break the back of the short paper manipulators.

This article is based on a commentary of Ted Butler’s premium service at www.butlerresearch.com which contains the highest quality of gold and silver market analysis. Ted Butler is specialized in precious metals market analysis for over four decades.

Source - http://goldsilverworlds.com/physical-market/ted-butler-a-remarkable-proposition/

© 2015 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.