Airline Stocks Continue to Nickel and Dime Passengers With Bag Fees

Companies / Sector Analysis Feb 14, 2015 - 03:22 PM GMTBy: Investment_U

Rachel Gearhart writes: In 2008, airlines justified the raise in baggage fees by blaming rising fuel costs. But in recent months, oil prices have been halved. And yet, baggage fees remain lofty.

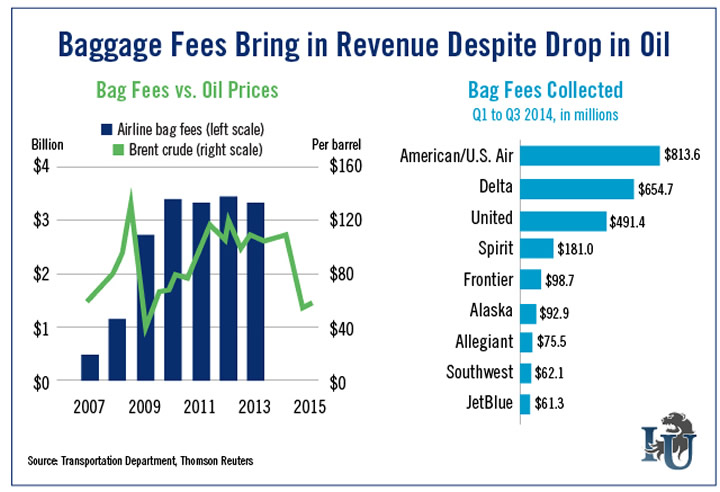

This week's chart looks at the amount of baggage-fee revenue collected by airlines compared to the price of Brent crude over the past eight years.

In the first three quarters of 2014, airline bag fees already totaled $2.65 billion before the busy holiday travel season that takes place in the fourth quarter. This indicates that bag revenue is remaining steady despite the drop in oil prices.

The bar graph on the right looks at the amount of baggage revenue collected by individual airlines.

You'd be hard-pressed to find a bigger benefactor of low oil prices than airliners. Between October 13, when the market bottomed, and December 31, 2014, Delta Air Lines (NYSE: DAL) gained 59% and American Airlines (Nasdaq: AAL) jumped 82%.

Last year, Delta and American Airlines each used about 4 billion gallons of jet fuel. With oil prices now half of what they were for the majority of 2014, airlines have the potential to cut their expenses significantly. Analysts project that, if oil prices remain low this year, airlines will be able to cut their operating expenses by about 16%.

Low oil prices should ensure airlines spend less...

But, as any frequent flier knows, that isn't stopping them from charging more.

As oil prices continue to be volatile, look for discount airliners such as Spirit Airlines (Nasdaq: SAVE) to start picking up more revenue from irritated and economically savvy passengers.

Editor's Note: For the last few months, Resource Strategist Sean Brodrick has been working on a private briefing to bring Oxford Club Members a unique and highly profitable alternative investment. However, space is limited. To ensure that you receive an invitation to the upcoming briefing, click here.

Source: http://www.investmentu.com/article/detail/43552/oil-prices-airlines-baggage-fees

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.