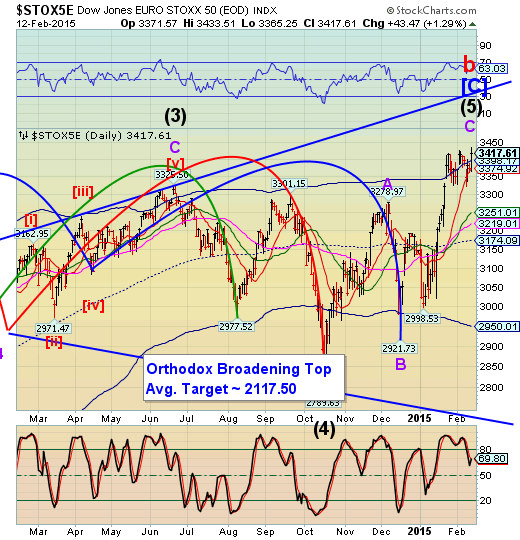

EuroStoxx May be Completing Stock Market Top Pattern

Stock-Markets / Stock Markets 2015 Feb 13, 2015 - 01:40 PM GMT STOXX may have completed an Ending Diagonal Minor Wave C of Intermediate Wave (5) this morning on its 189th day of the current Master Cycle with a nominal new high this morning. This can be attributed to the European GDP positive surprise reported this morning.

STOXX may have completed an Ending Diagonal Minor Wave C of Intermediate Wave (5) this morning on its 189th day of the current Master Cycle with a nominal new high this morning. This can be attributed to the European GDP positive surprise reported this morning.

However, Greek bank liquidity is deteriorating rapidly. About 12 billion Euros were withdrawn from Greek banks in January and probably even more so after the snap election. It appears that we are on the cusp of some major changes in Europe, starting today or this weekend.

TNX appears to have lost its challenge of the 50-day Moving Average and may be about to go into full reversal. That means money is shifting again. Usually the shift into bonds precedes the rotation out of stocks, so this may be a harbinger of what will be happening today.

The SPX Premarket is up about 4 points as I write, but that may change after the open. The only scheduled news event today is the Consumer Sentiment report, due at 10:00 am. A new high will not change any of the chart patterns, so I am not taking a position one way or the other. I don’t think I will change the current pattern, even if it does, since B Waves can be longer than their corresponding A Waves, which have already happened on the Cycle Wave level.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.