Stock Market Kicked Can May Have Bounced Against a Wall

Stock-Markets / Stock Markets 2015 Feb 13, 2015 - 09:34 AM GMT Here’s a new one. Micro Wave iii is 1.5 times the size of Micro Wave i. You would think that Micro Wave v would be 1.5 time the size of Micro Wave iii, but no…at 2089.04 Micro Wave v is 2X the size of Micro Wave iii! I have not seen such a combination before. Such is the life of an analyst in these times…full of surprises.

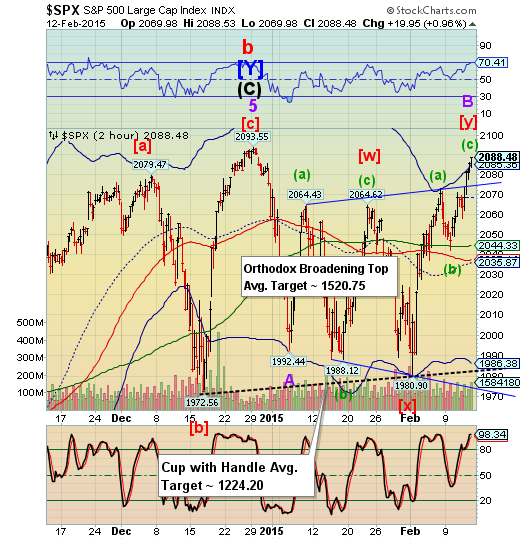

Here’s a new one. Micro Wave iii is 1.5 times the size of Micro Wave i. You would think that Micro Wave v would be 1.5 time the size of Micro Wave iii, but no…at 2089.04 Micro Wave v is 2X the size of Micro Wave iii! I have not seen such a combination before. Such is the life of an analyst in these times…full of surprises.

So the Orthodox Broadening Top trendline has been exceeded today, although a drop back beneath the trendline at 2075.00 would bring the formation back into focus. Usually the Broadening Tops aren’t considered nullified until the price has exceeded the trendline by 1% or more. We’re probably going to have an uncomfortable night of it, but read the next entry below to get some focus on what is going on.

Here’s another surprise. The hourly chart only covers the past 30 calendar days, so you miss the bigger picture looking at the smaller details… not that they’re not important, but it apparently pays to step back a bit. So a 2-hour chart with a 3-month look-back is a handy way to start.

Today’s view startled me because the Triangle formation is so clear in the 2-hour chart, but it was missed even on the daily chart until now. While today puts us into the turn window for SPX, tomorrow is a Primary Cycle turn date for the VIX.

It’s interesting how this is coming together. While the SPX has an Orthodox Broadening Top, which is nothing more than an inverted triangle Wave B, the VIX sports a regular Triangle Wave B. The behavior of a Triangle is to delay, or as it has been said, kicking the can. Unfortunately, the can is about to hit a wall.

We’ll discuss the ramifications of this at a later time. Suffice it to say that VIX has a better than even chance of bettering the Head & shoulders neckline at 32.00 in Wave C. How quickly that happens is anyone’s guess.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.