Does Bitcoin Low Volume Suggest Future Price Action?

Currencies / Bitcoin Feb 10, 2015 - 04:30 PM GMTBy: Mike_McAra

Bitcoin Trading Alert originally published on February 10, 2015, 12:33 PM.

Bitcoin Trading Alert originally published on February 10, 2015, 12:33 PM.

In short: speculative short position, stop-loss at $257, take-profit at $153.

A new partnership might bring Bitcoin closer to airlines, we read on CoinDesk:

Universal Air Travel Plan (UATP), a payment network owned by major international airlines such as American Airways, British Airways and Lufthansa, has partnered with bitcoin payment processor Bitnet.

The integration allows over 260 of UATP’s airlines to accept bitcoin through Bitnet, starting today. Introduced in 1936, UATP is credited with issuing the first-ever charge card. As of 2014, the company processes around $14bn in payments from corporate customers, travel agents and retail consumers.

Additional UATP merchants include JetBlue, Qantas, US Airways and United Airlines.

(…)

Though no airlines will accept bitcoin at launch, Khan [vice president of solutions strategy at Bitnet], expects the partnership will do much to encourage these businesses to enter commercial agreements with his firm.

"It's putting a foundation in place that enables this global network of airlines to have a much lower barrier to entry if they wish to accept bitcoin," he added.

UATP will not charge added fees for bitcoin processing, however, it did confirm that Bitnet is compensating it for the ability to process transactions through its network.

It will be curious to see if this partnership will actually help Bitcoin enter the airline market. It doesn’t mean that any airlines will accept bitcoins right away, it only makes it possible for airlines to start taking Bitcoin.

What is important is that we’re hearing about new businesses accepting Bitcoin or existing payment systems encompassing Bitcoin almost every day. This is encouraging. On the other hand, Bitcoin is still relatively unknown and there are relatively little places where you can actually spend your bitcoins on goods and services. This suggests that much work needs to be done in developing the cryptocurrency and making it more popular.

If Bitcoin is to change global payments, the currency is still in the very early stage of doing that. But startups are continually working on new features and uses for Bitcoin, so we expect the system to develop over the next couple of years.

For now, we focus on charts.

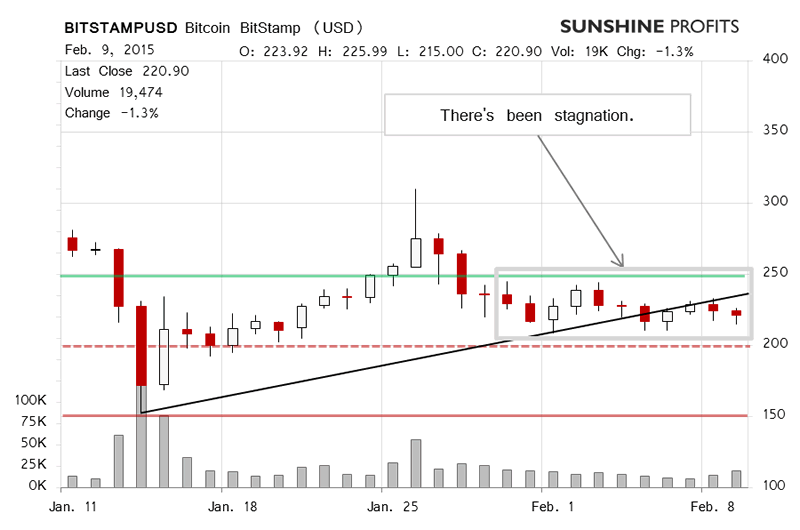

On BitStamp, we didn’t see much action yesterday. The volume was higher than on the day before, the highest volume since Jan. 31. The volume might hint at more action in the future but the lack of movement as far as the price is concerned suggests that our yesterday’s commentary is still up to date:

(…) the action has been pretty much similar (…), with no significant daily swings. The volume might end up being visibly higher than yesterday but so far it doesn’t seem very strong. We might also see a third daily close below yet another possible rising trend line (the lower black line).

We also see that so far February has been mostly a month of stagnation. Both the price and the volume have been relatively muted. The facts that Bitcoin has stayed below $250 and possibly below short-term trend lines, show that the current situation remains unchanged, which would still suggest a bearish short-term outlook. The possibility of yet another slip below a possible trend line might make the outlook even more bearish than it is now.

And we saw yet another close below the possible trend line. It is a bearish hint but not a very strong one just now.

Today (this is written around 12:15 p.m. ET), we’ve seen very little price action and the volume has been muted, visibly lower than what we saw in the last couple of days. This lack of action suggests that the next big move might be in the direction of the general trend right now, which is down.

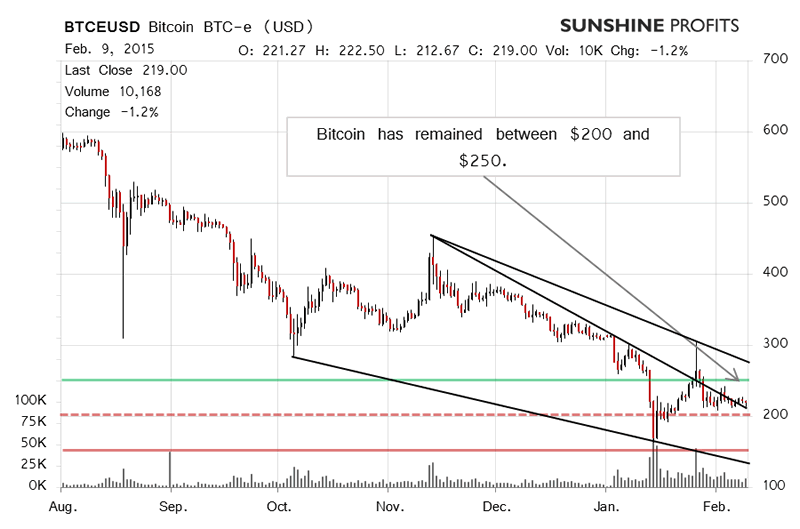

On the long-term BTC-e chart, we still see Bitcoin at one of the possible declining trend lines. Actually, Bitcoin might have moved above this line but not in a strong move which suggests that this is not as significant as it might look at first sight, at least not just now. Our yesterday’s comments remain valid:

On the chart we see that one of the possible declining trend lines might be tested at this time. We still would have to see another daily close above this line but at this time even such a close wouldn’t seem enough to change the short-term outlook in our opinion. It looks like Bitcoin has fallen from around $300 and there hasn’t really been an indication of a change in trend. Currently, we think we would have to see a move above $250 to consider reversing our hypothetical position.

On the other hand, Bitcoin is still below $250 (green line) and not that far from $200 (dashed red line) and a move below this line could trigger a further move down.

The current combination of no strong moves and possibly decreased volume (currently it looks like the volume will end up being lower than yesterday) suggests that we might be in for a continuation of the general trend to the downside.

Summing up, we think that speculative short positions are still the way to go.

Trading position (short-term, our opinion): short position, stop-loss at $257, take-profit at $153.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.