Bitcoin Price Edging Closer to $200

Currencies / Bitcoin Feb 06, 2015 - 04:56 PM GMTBy: Mike_McAra

In short: speculative short position, stop-loss at $257, take-profit at $153.

In short: speculative short position, stop-loss at $257, take-profit at $153.

The new EU regulations on value added tax (VAT) might be unfavorable for companies willing to accept Bitcoin, we read on CoinDesk:

(…) the European Union introduced new Value Added Tax (VAT) laws on 1st January this year.

As a consequence of this legislation, companies selling electronic goods or services to customers within the EU are now legally required to record the country of residence of their customers (…).

(…)

(…) according to some tax lawyers, such as Richard Croker, head of corporate tax at London-based law firm CMS, these new VAT laws are consequently disadvantageous for anonymous (or pseudonymous) methods of payment such as bitcoin.

Speaking to CoinDesk, he said:

“Due to the inability to identify a buyer or his location, taking payments in bitcoin might be partially incompatible with these new laws. Whether it's a total drag on the market I don't know, but it's certainly a disincentive for companies to accept bitcoin.”

This might not be the best news for Bitcoin but it certainly is no reason for despair either. The new rules might make it harder to accept Bitcoin but we would have to wait for their specific implementation. It might turn out that the proof of residence won’t be as onerous as it may seem.

Another thing is that there’s still no uniform EU law on cryptocurrencies. There’s been talk of the European Commission willing to implement regulations on Bitcoin but we haven’t seen any such laws passed yet as the process might be quite lengthy.

Clear rules for Bitcoin could make it more attractive to retailers as they wouldn’t be left in the dark as to how Bitcoin transactions should be taxed or what kind of supervisory authority would be exercised over them. We’ll have to wait for the European Commission to move but we don’t expect the rules to stop the development of the Bitcoin system.

For now, we focus on the charts.

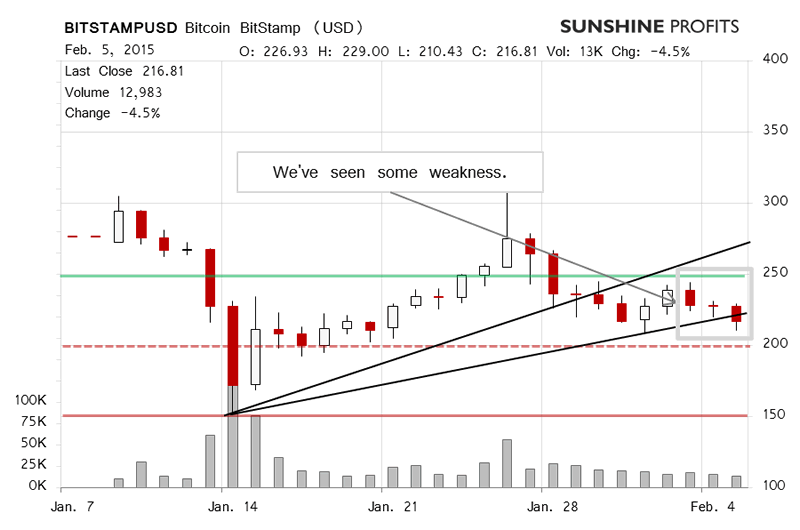

On BitStamp, we saw a little bit more depreciation yesterday but the move in and of itself is not a signal that a new decline has started. At least not yet. The volume was similar to what we had seen one day earlier and our general comments from yesterday remain valid:

(…) lack of action might be deceptive, since Bitcoin is still below a possible trend line (black line in the above chart) and below $250 (solid green line). We haven’t really seen a breakout which suggests that the next big move might be to the downside.

We saw some action following the publication of the alert but today Bitcoin has remained largely flat (this is written around 9:00 a.m. ET). The volume hasn’t been very significant, and this is one of the reasons for which the situation doesn’t really look very different today. Another is that Bitcoin might have just closed below yet another possible trend line (lower black declining line).

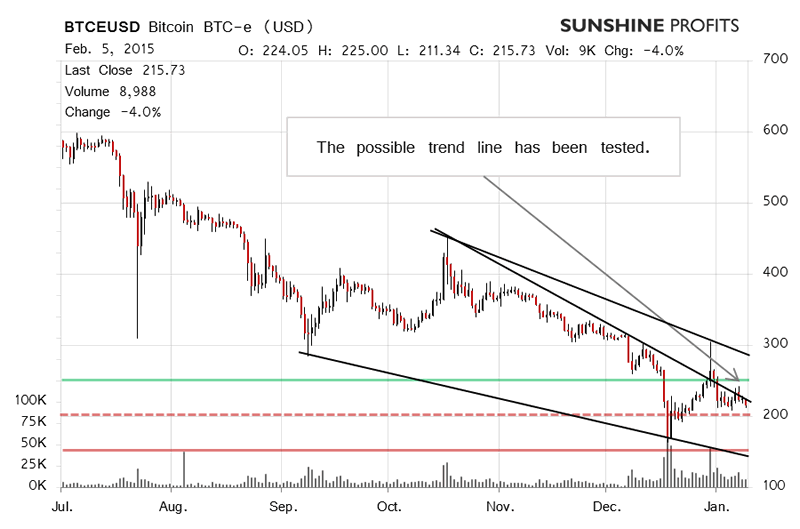

On the long-term BTC-e chart we continue to see Bitcoin at one of the possible declining trend lines. Recall our comments from three days back:

Whether Bitcoin moves up from here, pauses or declines might signal the direction of the next big move. A move up would be bullish but only if Bitcoin moves above $250 and stays there. Sideway trading or a decline could herald yet another decline. Right now it seems to us that Bitcoin might drift sideways and this could be followed by depreciation. As such, it seems that the current short-term positions are still the way to go.

Bitcoin moved slightly lower yesterday and it’s been largely flat today, which possibly confirms the bearish outlook. Right now it seems that $200 (dashed red line) might be the level that would trigger further declines. Our hypothetical trading positions are already profitable (with Bitcoin on BitStamp at $217.50; transaction costs not included) and we think they might become even more profitable in the future.

Summing up, we still support short speculative positions in the market.

Trading position (short-term, our opinion): short position, stop-loss at $257, take-profit at $153.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.