“Forgive Us Our Debts” – Only Way To Prevent Economic Meltdown

Economics / Global Debt Crisis 2015 Feb 06, 2015 - 03:12 PM GMTBy: GoldCore

- Europe and western world is in a debt-fuelled deflation which is spiralling out of control

- Europe and western world is in a debt-fuelled deflation which is spiralling out of control

- Global debt has risen a massive $57 trillion or more than 25% in 7 years since the crisis of 2008

- Managed debt forgiveness is essential now to avoid chaos of defaults, mass unemployment depression and economic collapse

The bully tactics employed by the ECB against the newly elected government in Greece demonstrates once again how the ECB and the entire European project puts the interests of banks and political elites over those of the average citizen.

Certainly, it is necessary to take a tough stance regarding fiscal responsibility and discipline. Very few people suggest otherwise.

However, the ECB maintains a different set of standards when it comes to supporting the banking system as demonstrated by its imminent initiation of quantitative easing (QE).

QE has failed in Japan and only had a degree of success in the UK and the U.S. Even Alan Greenspan admitted that it has been a “terrific success” for the rich but had failed to meet its stated objectives.

In time, deflation will likely lead to even greater QE and “emergency” QE debt monetisation. This will likely lead to high inflation and stagflation. Given the dollar’s current status as global reserve currency – this would quickly become a global phenomenon.

Where was the discipline in the run up to the 2008 prelude-crisis when major northern European banks were pumping vast amounts of liquidity and irresponsibly lending into obviously overheated property sectors of economies like Ireland, Greece, Spain, Portugal and Italy?

What consequences were suffered by Goldman Sachs when it was revealed in 2008 that the bank had aided the profligate Greek government to cook the books, legally of course, so as to facilitate it in borrowing €1 billion from the ECB which it could not afford?

Goldman went on to buy insurance on Greek debt demonstrating its complete lack of faith in its own actions and its ability to profit from poor advice proffered to clients and the public.

Not only was there no sanction against Goldman, rather one of its own, Mario Draghi, replaced Jean Claude Trichet as Chairman of the ECB.

Two years later Mario Monti, who also had very close ties to Goldman, was appointed without election to replace Silvio Berlusconi as Prime Minister of Italy following his forced resignation.

While the people of the peripheral PIIGS nations were told that the book stops with them and they were responsible for the losses of private institutions in their countries, banks who facilitated the binge were rewarded with even greater influence as the unelected technocrats further consolidated power.

Why the book should stop with the country of the profligate borrower and not that of the profligate lender or European agencies who are supposed to manage the currency is an important point.

It is a point which is breeding a festering resentment towards the European project.

The new government in Greece has made it clear that it intends to get Greece back on its feet through cuts in spending. However, it insists that those cuts cannot be made at the expense of the most vulnerable in Greece. It therefore rejects the dictats of the Troika.

Finance minister Varoufakis has consistently displayed a will to reach a fair and practical settlement and a willingness to cooperate with Europe. The reforms he proposes cannot be made overnight.

Greece is in a depression. Many European countries are in recession. Europe as a whole, including Germany, is experiencing deflation. Should deflation take hold, Europe will likely experience full blown depression.

Clearly, as Greece’s government points out, it can not be business as usual.

The euro looks increasingly like a failed currency. It has been in crisis and caused hardship for the people it is supposed to serve for the greater part of the time it has been in existence.

The Greek government is trying to open discussion as to how the European project can be reformed to benefit all its citizens. The response by the ECB on Monday night is telling. The status quo of debt-riddled nations is not up for negotiation even as the EU hurtles towards the cliff edge.

At the heart of the entire crisis is the problem of debt. Europe is mired in debt. The western world is mired in debt. Even China is mired in debt.

The Guardian reports that “Global debt has grown by $57 trillion in seven years following the financial crisis” – a rise of more than 25%. China now has a greater debt to GDP ratio than even the U.S.

Average Europeans are choking on debt. The reason Europe is now in deflation is because not many people or businesses can afford to take on new debt.

This means that – given paper and electronic currency has no intrinsic value and comes into existence as a debt – without new borrowing, the money to repay interest on existing loans simply does not exist. This causes the weakest of existing loans to go into default which removes even more money from the system.

The process feeds on itself resulting in a depression. The problem is then compounded by excess industrial capacity forcing business to lower prices, cut costs and make workers unemployed.

Time is running out for Europe, Europeans and the world. We can wait for the system to crash into the brick wall or we can take the responsible approach and discuss contingency plans.

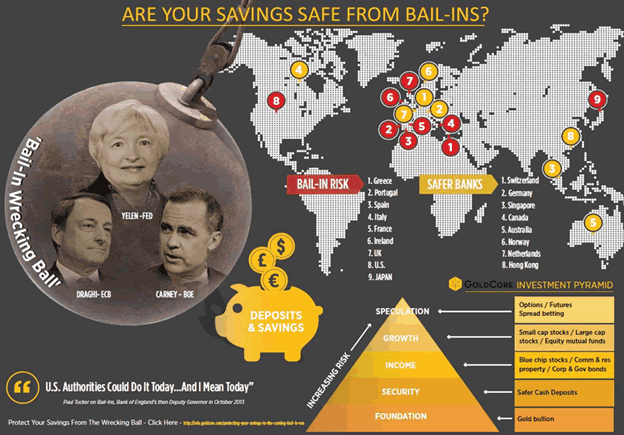

If these measures are left to unelected and demonstrably incompetent bureaucrats behind closed doors, when the time comes we can expect bail-ins of deposits, capital controls, high taxes with cuts to public services and repression as the burden is shifted once again onto the citizenry.

We should applaud the new Greek government for their courage in pushing for reform in Europe. This is not an advocacy for left-wing politics. In another time and place we might find ourselves opposed to Syriza and we do not agree with all their policies.

However, in this time and place, centrist governments dominate the political landscape and take orders from Brussels to intervene protecting the interests of financial institutions and banks at the expense of their suffering electorates.

We need more parties like Syriza in power in Europe. We urgently need debate as to how to manage the unavoidable catastrophe which fast approaches. We believe a managed program of debt forgiveness is essential to avert the economic chaos that would ensue from mass defaults and depression.

“Prepare for the worst but hope for the best …”

Protecting Deposits in the Coming Bail-in Era Click here

DAILY MARKET UPDATE

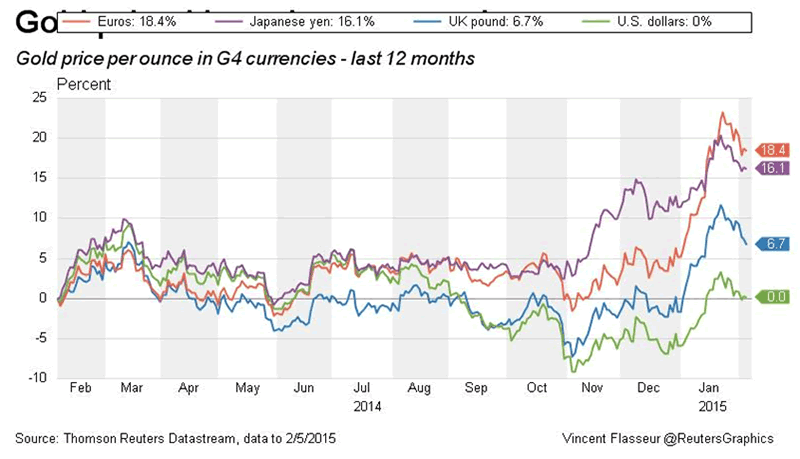

Today’s AM fix was USD 1,264, EUR 1,103.64 and GBP 824.74 per ounce.

Yesterday’s AM fix was USD 1,263.75, EUR 1,106.71 and GBP 828.80 per ounce.

Yesterday, gold and silver were mixed. Gold gained 0.36 per cent or $4.90 yesterday, closing at $1,270.20, while silver fell 0.35 percent or $0.06, closing at $17.30.

In Asian trading, Singapore gold moved sideways and this trend continued in European trade. Gold is marginally higher ahead of US nonfarm payroll numbers and unlikely to make big moves until the NFP number is released at 1330 GMT.

Gold remains on track to end the week down just over 1%. The range this morning has been pretty narrow, less than $7/oz, ahead of this afternoon’s non-farm payrolls data.

Silver is also flat,while, platinum and palladium are marginally higher.

Sentiment towards gold continues to improve and this is seen in the ETF gold demand numbers. Holdings at SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, rose to 24.86 million ounces on yesterday, the highest since September.

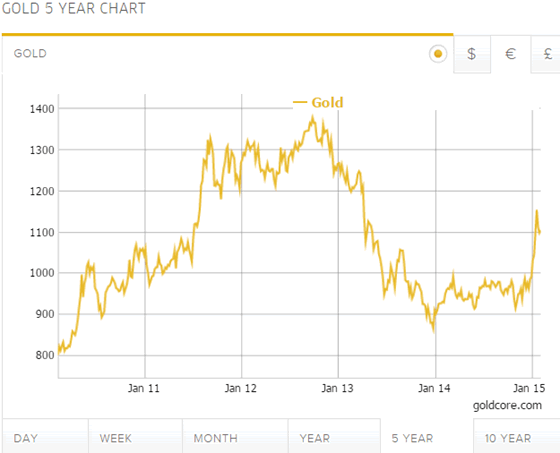

Gold in Dollars – 5 Years (GoldCore)

Gold should be supported by the continuing Greek debt saga and deepening tensions between the U.S. and NATO and Russia.

Greece’s new Finance Minister clashed openly with his powerful German counterpart after blunt talks in Berlin. German Finance Minister Wolfgang Schaeuble said he had told Greece’s Yanis Varoufakis it was not realistic to make electoral promises that burdened other countries, and they had “agreed to disagree.”

Greece’s borrowing costs have leapt and bank shares plunged following the ECB’s decision to stop funding the country’s lenders. Greek banks were already struggling with big outflows of deposits and stealth bank runs are believed to be continuing.

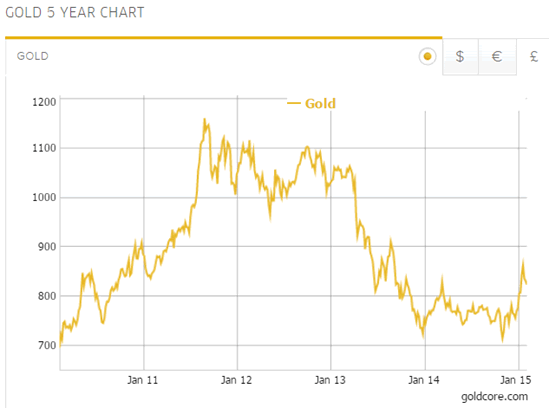

Gold in Euros – 5 Years (GoldCore)

Nato is to bolster the alliance’s military presence in Eastern Europe in response to increased fighting in eastern Ukraine between government forces and pro-Russia rebels. Six bases are being set up and a 5,000-strong “spearhead” force established.

The U.S. is now talking about arming Ukraine which will further inflame the situation and likely lead to an escalation in the conflict.

German Chancellor Angela Merkel says she and French President Francois Hollande will “use all our power” on their visit to Moscow to try and stop the bloodshed in eastern Ukraine.

Speaking Friday before flying to Russia for talks with President Vladimir Putin, Merkel said she could not say whether she and Hollande, who were in Kiev for talks Thursday with the Ukrainian government, would be able to achieve a new cease fire.

Gold in British Pounds – 5 Years (GoldCore)

Geopolitical risk remains high with relations between Russia and the U.S. and NATO continuing to deteriorate.

NATO sabre rattling was seen yesterday when the former head of Nato warned that Vladimir Putin has dangerous ambitions beyond Ukraine and aims to test Western resolve in the Baltic states. Anders Fogh Rasmussen, the former secretary-general of the Atlantic alliance, said the Kremlin’s true goal is to shatter NATO solidarity and reassert Russian dominance over Eastern Europe.

The very uncertain geopolitical backdrop is supportive of gold. Another incident such as the tragic shooting down of the civilian airline could be a catalyst to a wider conflict.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.