Stock Market SPX at a Critical Juncture

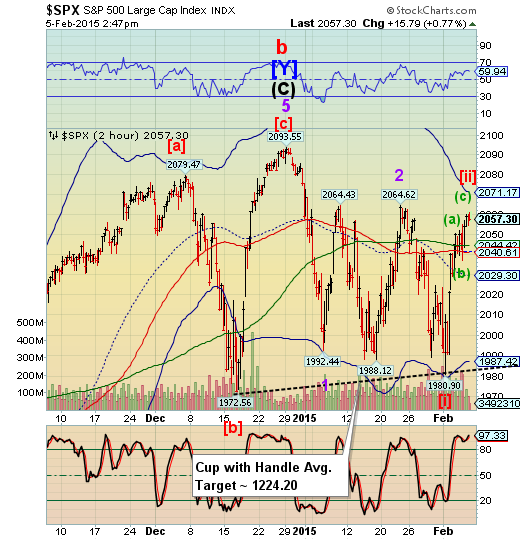

Stock-Markets / Stock Markets 2015 Feb 06, 2015 - 02:06 AM GMTWe have arrived at a critical juncture with SPX. Should it exceed the two prior tops at 2064.43 and 2064.62, there may be a need for a reassessment of the Elliott Wave pattern. However, the Cycles Model si still insisting on a significant low between February 16—18.

Currently we can see two 9-wave impulses down, the first from the November 29 high and the second from the January 23 high. Each top-to-top Cycle averaged 8.6 days, giving us exactly 25.8 days as of today’s high at 2:12 pm. The next 8.6 hours will be critical, since the next Cycle is the panic phase, provided the 200-day Moving Average and Lip of the Cup with Handle is broken.

We have other problems in the U.S., including a shutdown of our supply chain from the West Coast ports.

The dollar (not shown) is tumbling as money shifts back over to Europe. The Euro spiked higher but is colliding with Cycle Bottom resistance at 114.63. If this is Wave 3 of (3), then the Euro will lose the battle with resistance there very soon. The decline in the Euro may become much more pronounced as the ECB folds to Greece’s demands.

The resumption of the decline may involve stocks as banks in Europe and the US realize that they will be taking quite a haircut on their Greek Sovereign bonds. At that point liquidity may be a real issue for all markets.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.