The ECB Fears Deflation, But You Should Not

Interest-Rates / Eurozone Debt Crisis Feb 04, 2015 - 04:05 PM GMTBy: Frank_Shostak

The European Central Bank (ECB) is planning to pump 1.1 trillion euros into the banking system to fend off price deflation and revive economic activity. The ECB president and his executive board are planning to spend 60 billion euros per month from March 2015 to September 2016.

The European Central Bank (ECB) is planning to pump 1.1 trillion euros into the banking system to fend off price deflation and revive economic activity. The ECB president and his executive board are planning to spend 60 billion euros per month from March 2015 to September 2016.

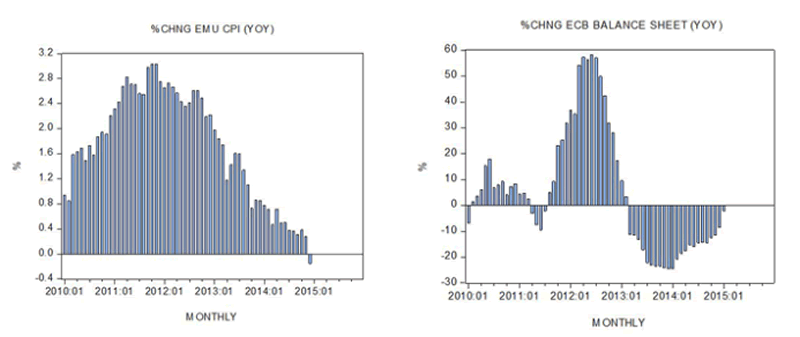

Most experts hold that the ECB must start acting aggressively against the danger of deflation. The yearly rate of growth of the consumer price index (CPI) fell to minus 0.2 percent in December 2014 from 0.3 percent in November, and 0.8 percent in December 2013.

Many commentators are of the view that the ECB should initiate an aggressive phase of monetary pumping along the lines of the US central bank. Moreover the balance sheet of the ECB has in fact been shrinking. The yearly rate of growth of the ECB balance sheet stood at minus 2.1 percent in January against minus 8.5 percent in December. Note that in January last year the yearly rate of growth stood at minus 24.4 percent.

ECB balance sheet — monthly

The Fear: People Might Save Instead of Spend

Why is a declining rate of inflation bad for economic growth? According to the popular way of thinking, declining price inflation sets in motion declining inflation expectations. This, in turn, is likely to cause consumers to postpone their buying at present and that in turn is likely to undermine the pace of economic growth.

But, in fact, in order to maintain their lives and well-being, individuals must buy present goods and services. So from this perspective a fall in prices as such is not going to curtail consumer outlays. Furthermore, a fall in the growth momentum of prices is always good for the economy.

A Fall in Prices Can Mean an Expansion of Real Wealth

For example, an expansion of real wealth for a given stock of money is going to manifest in a decline in prices (remember a price is the amount of money per unit of real stuff), so why should this be regarded as bad for the economy?

After all, what we have here is an expansion of real wealth. A fall in prices implies a rise in the purchasing power of money, and this in turn means that many more individuals can now benefit from the expansion in real wealth.

What If Prices Fall As a Result of a Bust?

Now, if we observe a decline in prices on account of an economic bust, which eliminates various non-productive bubble activities, why is this bad for the economy?

The liquidation of non-productive bubble activities — which is associated with a decline in the growth momentum of prices of various goods previously supported by non-productive activities — is good news for wealth generation.

The liquidation of bubble activities implies that less real wealth is going to be diverted to malinvestments from wealth generators. Consequently, this will enable investors to lift the pace of wealth generation. (With more wealth at their disposal they will be able to generate more wealth.)

So, as one can see, a fall in price momentum is always good news for the economy since it reflects an expansion or a potential expansion in real wealth.

Hence, a policy aimed at reversing a fall in the growth momentum of prices is going to undermine — not strengthen — economic growth.

We hold that the various government measures of economic activity reflect monetary pumping and have nothing to do with true economic growth.

An increase in monetary pumping may set in motion a stronger pace of growth in an economic measure such as gross domestic product. This stronger growth, however, should be regarded as a strengthening in the pace of economic impoverishment.

It is not possible to produce genuine economic growth by means of monetary pumping and an artificial lowering of interest rates. If this could have been done, world poverty would have been erased by now.

Frank Shostak is an adjunct scholar of the Mises Institute and a frequent contributor to Mises.org. He is chief economist of M.F. Global. Send him mail. See Frank Shostak's article archives. Comment on the blog.![]()

© 2015 Copyright Frank Shostak - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.