Swiss Franc’s Euro-Peg Post Mortem

Currencies / Fiat Currency Jan 31, 2015 - 11:16 AM GMTBy: Frank_Shostak

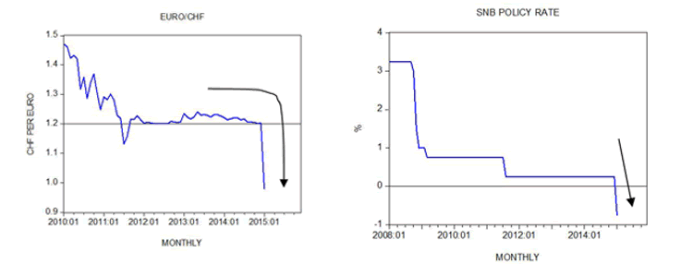

On January 15, 2015 the Swiss National Bank (SNB) announced an end to its three-year-old cap of 1.20 franc per euro. (The SNB introduced the cap in September 2011.) The SNB has also reduced its policy interest rate to minus 0.75 percent from minus 0.25 percent. The Swiss franc appreciated as much as 41 percent to 0.8517 per euro following the announcement, the strongest level on record — it settled during the day at around 0.98 per euro

On January 15, 2015 the Swiss National Bank (SNB) announced an end to its three-year-old cap of 1.20 franc per euro. (The SNB introduced the cap in September 2011.) The SNB has also reduced its policy interest rate to minus 0.75 percent from minus 0.25 percent. The Swiss franc appreciated as much as 41 percent to 0.8517 per euro following the announcement, the strongest level on record — it settled during the day at around 0.98 per euro

With Money Creation, It’s All Relative

We suggest that the key factor in determining a currency rate of exchange is relative monetary pumping. Over time, if the rate of growth of the money supply in country A exceeds the rate of growth of the money supply in country B then that country’s currency rate of exchange will come under pressure versus the currency of B, all other things being equal.

Whilst other variables such as the interest rate differential or economic activity also drive the currency rate of exchange, they are of a transitory and not of a fundamental nature. Their influence sets in motion an arbitrage that brings the rate of exchange in line with the influence of the money growth differential.

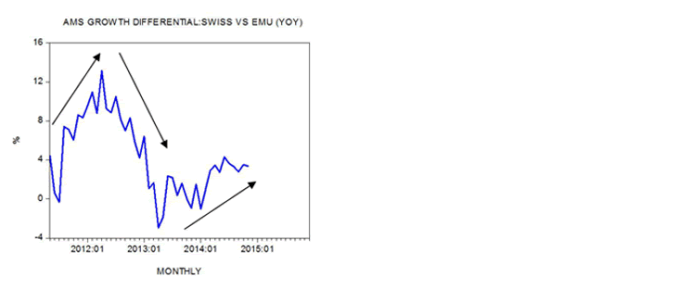

We hold that until now the rise in the money growth differential between Switzerland and the European Monetary Union during July 2011 and April 2012 was dominating the currency rate of exchange scene. (It was pushing the franc down versus the euro.) The setting of a cap of 1.20 to the euro to supposedly defend exports was an unnecessary move since the franc was in any case going to weaken. The introduction of the cap however prevented the arbitrage to properly manifest itself thereby setting in motion various distortions. (Note again the money growth differential was weakening the franc versus the euro.)

A fall in the money growth differential between April 2012 and April 2013 is starting to dominate the currency scene at present, i.e., it strengthens the franc against the euro. So from this perspective it is valid to remove the cap and allow the arbitrage to establish the “true” value of the franc. (This reduces the need to pump domestic money in order to defend the cap of 1.20.) Observe that as opposed to 2011, this time around, by allowing the franc to find its “correct” level the SNB — it would appear — has decided to trust the free market.

Note that since April 2013 the money growth differential has been rising — working toward the weakening of the franc versus the euro — and this raises the likelihood that the SNB might decide again some time in the future on a new shock treatment.

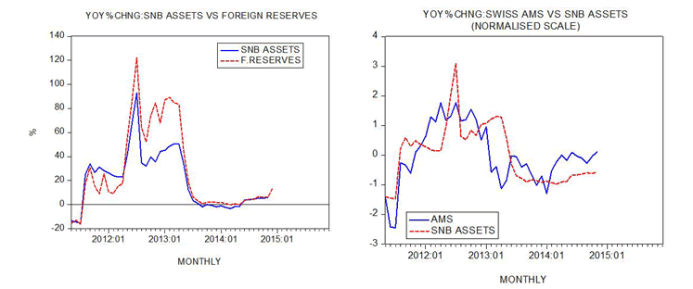

We hold that by tampering with the foreign exchange market the SNB sets in motion fluctuations in the growth momentum of money supply (AMS), and this in turn generates the menace of boom/bust cycles. (Note the close correlation between the fluctuations in the growth momentum of foreign exchange reserves, the SNB’s balance sheet, and AMS.)

Also, observe that by introducing the cap and then removing it — contrary to its own intentions — the SNB has severely shocked various activities such as exports. Note that the SNB is supposedly meant to generate a stable economic environment.

Frank Shostak is an adjunct scholar of the Mises Institute and a frequent contributor to Mises.org. He is chief economist of M.F. Global. Send him mail. See Frank Shostak's article archives. Comment on the blog.![]()

© 2015 Copyright Frank Shostak - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.