Stock Market Back to Back January Drops in SP500 Always Meant Danger

Stock-Markets / Stock Markets 2015 Jan 30, 2015 - 12:51 PM GMTBy: Ashraf_Laidi

January will most likely be negative for US stock indices (S&P500), and will be the 2nd consecutive year of negative January performance.

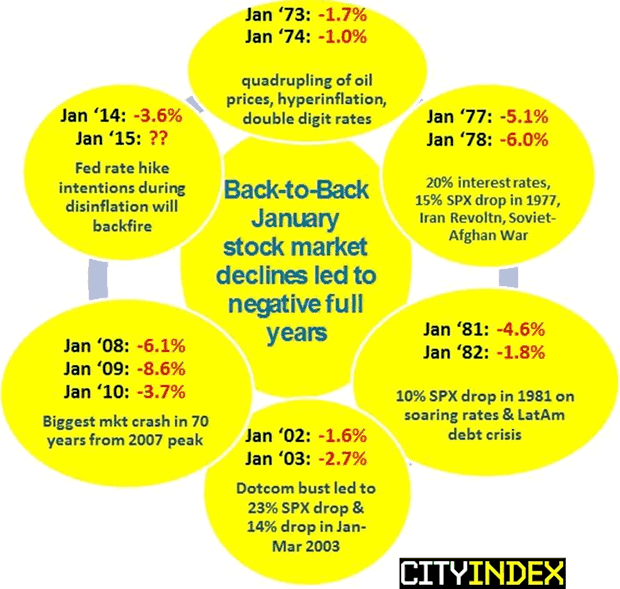

While many are familiar with the old adage "As January goes, so goes the rest of the year", we had pointed to the fact that negative January performances in the S&P500 have always led to high profile volatility and/or double digit declines in a single month that year.

What about back-to-back January declines?

While January equity declines have had major implications, back-to-back- declines in January have not only been less frequent, but have had more ominous implications for the general market, prevailing during some of the worst of geopolitical events & periods of economic disarray - as seen in the chart below.

We have already warned about the repercussions of emerging deflation from China and Europe as well as lingering expectations by most private economists that the Fed will raise interest rates. As long as such fantasy remains a possibility, the nightmare from Wall Street would not too far behind.

Best

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2015 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.