Stock Market George Lindsay's 8-year Interval Cycle

Stock-Markets / Cycles Analysis Jan 28, 2015 - 10:49 AM GMTBy: Ed_Carlson

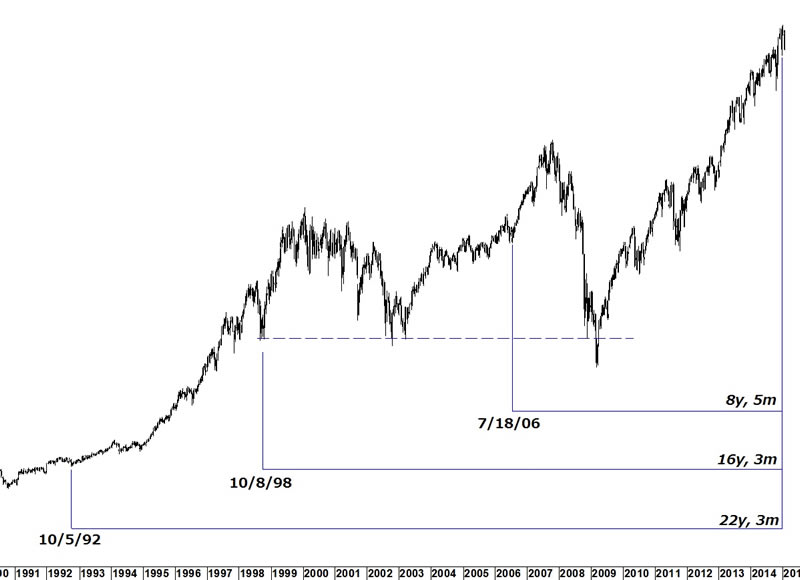

The late technician, George Lindsay described an 8-year interval as part of his 22-year Overlay (An Aid to Timing, SeattleTA Press, 2012). He wrote that the high (or "moment of truth") at the end of the interval is often followed by a harsh 2-3 month decline followed by an approximate 5-month rally in equities.

The late technician, George Lindsay described an 8-year interval as part of his 22-year Overlay (An Aid to Timing, SeattleTA Press, 2012). He wrote that the high (or "moment of truth") at the end of the interval is often followed by a harsh 2-3 month decline followed by an approximate 5-month rally in equities.

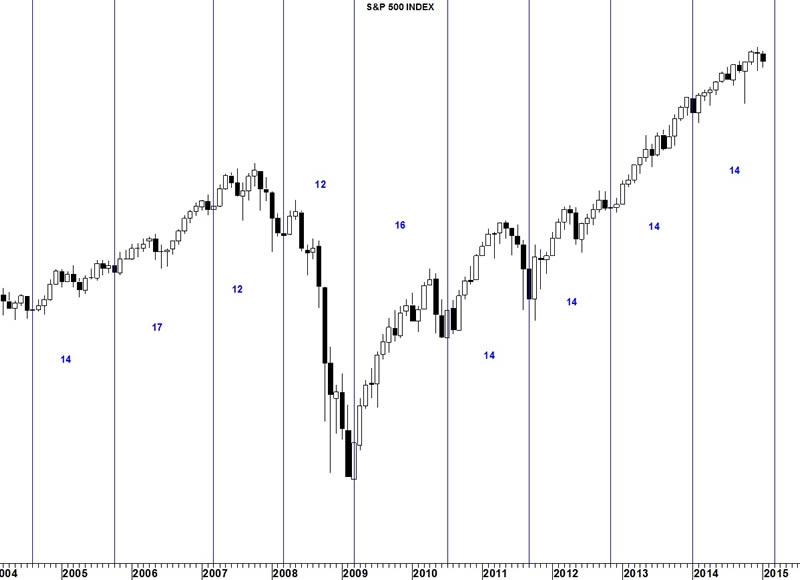

With the Dec 2014 high marking 8years, 5months since the low in July 2006 (and fitting the template for the 22year Overlay) a 2-3 month decline would match expectations for a 14m low in March.

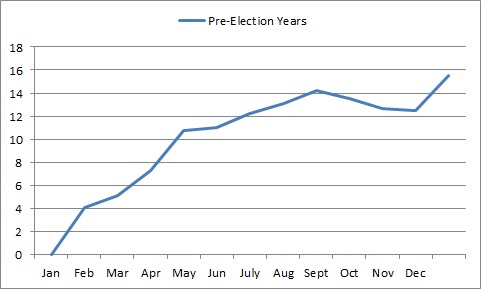

A 5-month rally from March comes very close to the seasonal expectation for a high in early Sept in pre-election years (chart: 1943-2011).

To get your copy of the January Lindsay Report from SeattleTA, please click here.

Ed Carlson, author of George Lindsay and the Art of Technical Analysis, and his new book, George Lindsay's An Aid to Timing is an independent trader, consultant, and Chartered Market Technician (CMT) based in Seattle. Carlson manages the website Seattle Technical Advisors.com, where he publishes daily and weekly commentary. He spent twenty years as a stockbroker and holds an M.B.A. from Wichita State University.

© 2015 Copyright Ed Carlson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.