Stock Markets Gapping Down...

Stock-Markets / Stock Markets 2015 Jan 27, 2015 - 03:47 PM GMT As of 8:30 am SPX appears to have broken through hourly mid-Cycle support at 2037.79. The 50-day and Intermediate-term support are behind it. Short-term support at 2031.90 may temporarily delay the SPX decline, but if it opens beneath it, the final support may be hourly Cycle Bottom support at 1985.48.

As of 8:30 am SPX appears to have broken through hourly mid-Cycle support at 2037.79. The 50-day and Intermediate-term support are behind it. Short-term support at 2031.90 may temporarily delay the SPX decline, but if it opens beneath it, the final support may be hourly Cycle Bottom support at 1985.48.

There appears to be no organized resistance to this decline so far. USD/JPY is down to 117.56 this morning and falling. My report on the liquidity indexes make it clear that there may be no support from those resources, either.

As of 8:37, SPX futures are down 27.05 and may have surpassed Short-term support at 2031.90.

ZeroHedge reports, “Well that escalated quickly. While this morning's weakness in stocks is being pegged to earnings misses (and rightly so), the selling pressure started as Europe opened and Greek stocks and bonds accelerated their freefall. Greek stocks and bonds are now below ECB QE levels and WTI Crude back at a $44 handle as CAT CEO demands Fed does not raise rates due to the "fragile" US economy... The Dow is now 425 points off Friday's highs...”

10-year yields are down .58 this morning, evidence of a large move to the “safe haven” of treasuries.

ZeroHedge reports, “This happened exactly at 830ET when the Durable Goods orders data was supposed to be released…”

Was there a fat finger or do they know something we don’t?

The December Durable Goods Orders collapsed.

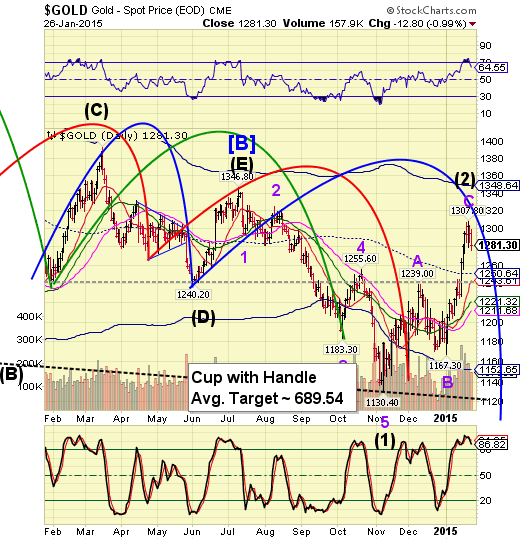

Gold futures traded down to 1273.30 in overnight action. Currently it’s price is at 1280.40. Selling pressure may pick up in the next day or so. Gold is on an aggressive sell at this point and may go to a confirmed sell beneath 1240.00.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.