Possible Stock Market Pop-n-drop in Store For SPX

Stock-Markets / Stock Markets 2015 Jan 26, 2015 - 03:42 PM GMT SPX futures opened at 6:00 pm last night down 15 points. It sank another 10 points before catching a bid and recovering all the loss. The Premarket is currently up 2 points. The overnight action suggests a potential target near 2075.00.

SPX futures opened at 6:00 pm last night down 15 points. It sank another 10 points before catching a bid and recovering all the loss. The Premarket is currently up 2 points. The overnight action suggests a potential target near 2075.00.

ZeroHedge reports, “Surprise! The weakness overnight in US equity futures has been eradicated in its best USDJPY-driven fashion. S&P, Dow, and Nasdaq futures have all managed to float higher on a sea of Crude and JPY carry exuberance to fill the overnight gap perfectly... except now that they have, USDJPY and Crude have turned down...We suspect the word "contained" will win CNBC-Bingo today...”

Last week’s low in TNX at 17.00 was not deep enough to satisfy the Ending Diagonal pattern, IMO. I have revised the Wave pattern to accommodate a further rally in Minor Wave B before a Minor Wave C takes TNX to approximately 15.00. On that note, I am not sure how high Wave B should go. It certainly may go as high as the mid-Cycle resistance at 23.77, but I suspect that the 50-day Moving Average at 21.33 may snag the high in this move.

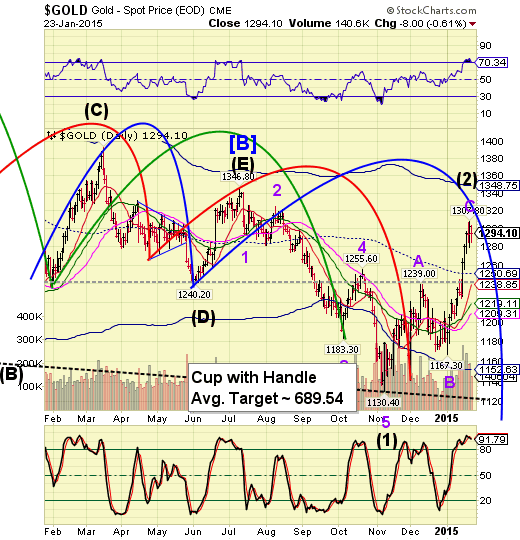

Gold futures declined to 1276.90 at 7:00 am., bolstering my claim that a retracement high is in. It is currently trading at 1284.80.

Goldman Sachs takes the cake, blaming the Central Banks for not being more bearish on gold. What a pile of misdirection.

Crude futures fell to 44.36 before finding support and bouncing back up to the 45 handle. This also supports the idea that the correction needs a little more time. The Cycles Model suggests that, if this is so, WTIC may bounce back to its 50-day Moving Average at 53.49 before heading lower.

This may be further bolstered by the report from Bloomberg, observing that, “Hedge funds boosted bearish wagers on oil to a four-year high as U.S. supplies grew the most since 2001.”

More to come after the open.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.