Bitcoin Price Rebound Might Be Coming to an End

Commodities / Bitcoin Jan 24, 2015 - 10:53 AM GMTBy: Mike_McAra

Briefly: no speculative positions.

Briefly: no speculative positions.

News broke that the Winklevoss brothers, twins who battled Facebook founder Mark Zuckerberg in court, are out there to create a fully-regulated Bitcoin exchange. As a matter of fact, they're already working on it and their team seems to have made some progress, we read in a DealBook article:

Now two of the biggest boosters of the virtual currency, Cameron and Tyler Winklevoss, are trying to firm up support by creating the first regulated Bitcoin exchange for American customers -- what they are calling the Nasdaq of Bitcoin.

(...)

The brothers, who received $65 million in Facebook shares and cash in 2008 after jousting with its founder, Mark Zuckerberg, have hired engineers from top hedge funds, enlisted a bank and engaged regulators with the aim of opening their exchange -- named Gemini, Latin for twins -- in the coming months.

(...)

[The exchange staff has] been creating Gemini's security infrastructure and trading engine from scratch, and already have a test model of the exchange running. They are planning to be ready to open the exchange as soon as they win regulatory approval from New York state's top financial regulator, Benjamin M. Lawsky, the superintendent of the state's Department of Financial Services.

This is definitely good news for U.S. customers since a regulated exchange could possibly alleviate some of the concerns over the security, particularly in light of the Mt. Gox debacle and the BitStamp problems. Ultimately, this will be a question of whether the Gemini team will be able to come up with reliable security measures.

The next months will show if the exchange actually will start operating as quickly. The advent of another marketplace, particularly one regulated by U.S. authorities could also popularize the cryptocurrency in the country. We'll also see if it might have any effect on the level of transaction fees currently observed on Bitcoin exchanges.

For now, let's take a look at the charts.

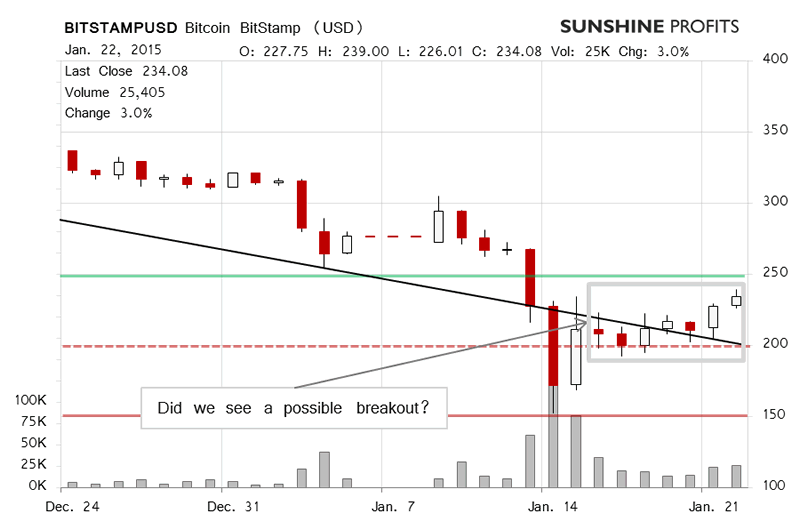

On BitStamp, we saw yet another day of appreciation yesterday. This was on increased volume but not by very much compared with the day before. It was also another day with a daily close above a recent possible declining trend line (marked in black in the above chart). Yesterday, we wrote:

First of all, Bitcoin moved just under 8% higher yesterday, a visible move but not necessarily one that would make anybody raise their brow, given the kind of volatility Bitcoin has consistently managed to display.

Secondly, this was a third day with a close above the possible declining trend line, which combined with an increase in volume is more of a bullish development. But if we look at the actual volume level yesterday, it was not very high by Bitcoin standards.

On the other hand, none of the moves up were strong enough to propel the cryptocurrency above $250 (solid green line in the chart). Today (this is written before 11:00 a.m. ET), we've seen more appreciation but it hasn't really reached this level. Taking the recent developments into account, we would be inclined to think that Bitcoin is still in a downtrend, that the short-term outlook has improved and a move to $250 might follow but this hasn't really been strong enough to suggest any significant change.

Yesterday, not much actually changed after our alert was published. Today, we've seen some depreciation but it hasn't been strong (this is written around 11:00 a.m. ET). Perhaps more importantly, the volume has been lower than yesterday. One way to read that would be that we're seeing a pause within a move up. But we haven't actually seen Bitcoin above, or even close to $250. The situation, in our opinion, remains largely unchanged.

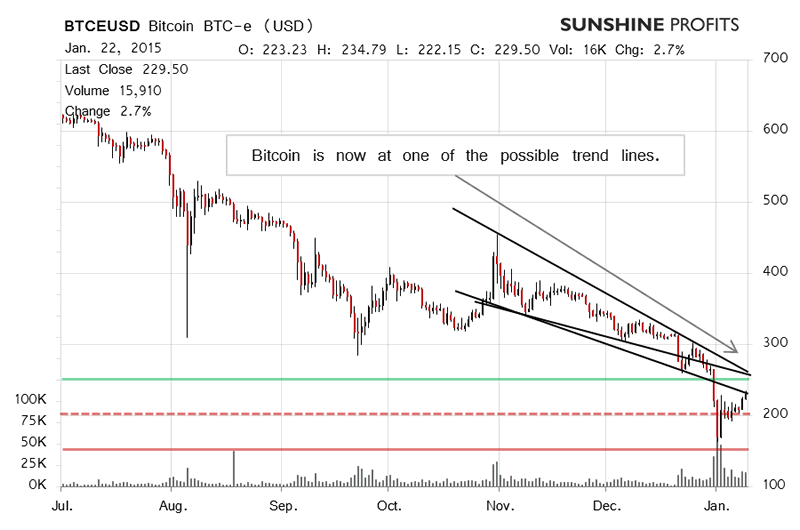

On the long-term BTC-e chart, Bitcoin just touched one of the possible trend lines. Is this an important sign? It might become one but we would have to see Bitcoin move above this level and possibly in the direction of $250 (solid green line). The lack of strong move suggests that the steam might be out of the market. Since the trend seems to be down now, it is possible that following the current period of appreciation Bitcoin will resume its move down.

$250 is, in our opinion, the all-important level to observe now. We think that Bitcoin might stagnate now or still move further up but these moves would be followed by more depreciation. At present, we're still more inclined to view the current situation as bearish but not bearish enough to open speculative positions.

Summing up, in our opinion no speculative positions should be held at this time.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.