Debt and Deflation: Three Financial Forecasts - There's More Than Falling Prices

Economics / Deflation Jan 23, 2015 - 12:32 PM GMTBy: EWI

Editor's note: You'll find the text version of the story below the video. Join Elliott Wave International's free State of the U.S. Markets online conference to get prepared for the major moves in U.S. stocks, commodities, gold, USD and more for 2015 and beyond. Register now and get instant access to a free video presentation from market legend Robert Prechter and regular email updates with insights from our most recent publications and presentations from our key analysts.

Editor's note: You'll find the text version of the story below the video. Join Elliott Wave International's free State of the U.S. Markets online conference to get prepared for the major moves in U.S. stocks, commodities, gold, USD and more for 2015 and beyond. Register now and get instant access to a free video presentation from market legend Robert Prechter and regular email updates with insights from our most recent publications and presentations from our key analysts.

Join our free, online State of the U.S. Markets Conference.

Inflation ruled from 1933 to 2008.

Yet in the just-published Elliott Wave Theorist, Bob Prechter's headline says, "Deflation is Starting to Win."

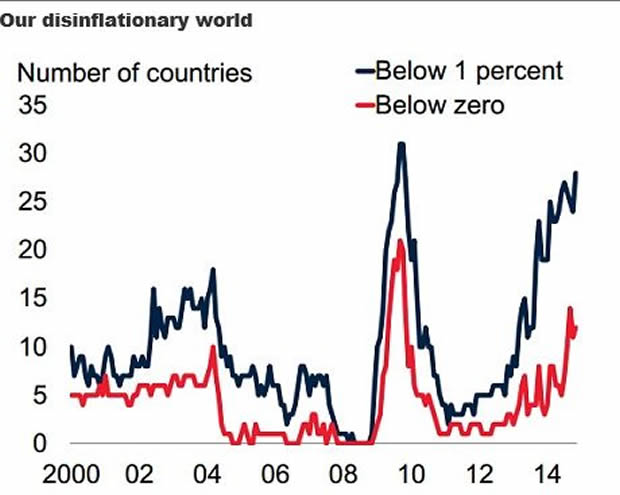

Take a look at this chart from The Telegraph:

... the number of countries experiencing 'lowflation' has been steadily rising from 2011 (blue line). The eurozone tipped into outright deflation in December, with Germany, Britain and the US also seeing prices rise at near record lows.

The Telegraph, January 14

But as Prechter explains, falling prices are an effect of deflation.

Deflation is not a period of generally falling prices; it is a period of contraction in the total amount of money plus credit. Falling prices in an environment of stable money is indeed a good thing. In fact, in a real-money system, it is the norm, because technology makes things cheaper to produce. But when debt expands faster than production, it becomes overblown, then wiped out, and prices rise and fall in response.

The Elliott Wave Theorist, January 2015

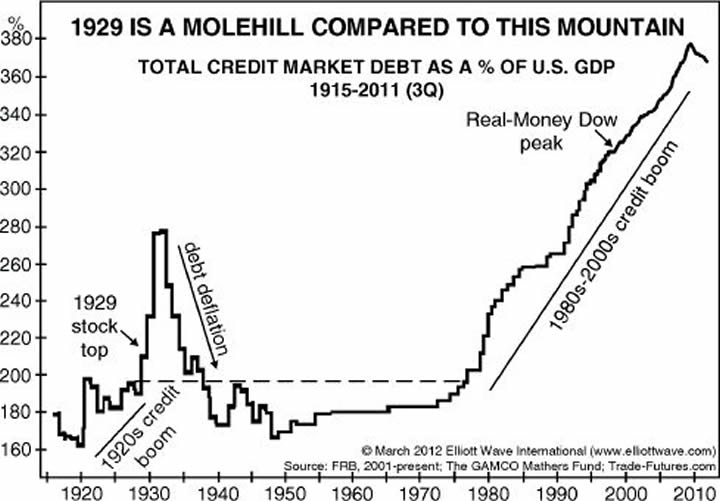

So a major debt buildup is a precondition of deflation. Do we see this today? The third edition of Conquer the Crash shows the answer.

Total dollar-denominated debt has skyrocketed since 1990. The upward trend turned slightly down during the 2007-2009 financial crisis, but has since crept higher.

How fast and how far can this nearly $60 trillion in debt dwindle?

It's instructive to review the collapse of the 1920s credit bubble.

On the left side of the chart, note how debt deflation needed nearly a decade to unwind.

Today's mountain of debt is far higher than in 1929, yet our indicators suggest that the next debt deflation could unfold much more rapidly.

The third edition of Conquer the Crash provides 157 forecasts. Here are three:

- Real estate values will begin to fall again, ultimately more than they did in the 1930s.

- Hedge funds, mutual funds, money-market funds, managed accounts and brokerage accounts will go out of favor -- many will go out of existence.

- Financial corporations previously bailed out by the Fed and the U.S. government will fail again, as will new ones.

Join Elliott Wave International's free State of the U.S. Markets online conference to get prepared for the major moves in U.S. stocks, commodities, gold, USD and more for 2015 and beyond.Register now and you can instant access to a free video presentation from market legend Robert Prechter and regular email updates with insights from our most recent publications and presentations from our key analysts. Join us now -- it's free. |

This article was syndicated by Elliott Wave International and was originally published under the headline Debt and Deflation: Three Financial Forecasts. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.