Francs, Bonds, Barrels, and Bail-Ins

Stock-Markets / Credit Crisis 2015 Jan 23, 2015 - 12:20 PM GMTBy: Andy_Sutton

As recently as a few weeks ago, the European Union directed its member nations to draft their own independent legislation for dealing with the resolution of a failed G-SIFI (Globally Significant Financial Institution). At the same time, we have all sorts of seams opening in the currency, bond, and commodity markets. The Swiss Franc is now un-pegged from the Euro, there have been wild swings in the bond markets in Europe due to the aforementioned action, and oil is in an absolute free-fall. There are many geopolitical (and likely criminal) maneuverings behind all of these phenomena, however the chaos in the financial world thus far has been remarkable in that there hasn’t been much given everything going on.

As recently as a few weeks ago, the European Union directed its member nations to draft their own independent legislation for dealing with the resolution of a failed G-SIFI (Globally Significant Financial Institution). At the same time, we have all sorts of seams opening in the currency, bond, and commodity markets. The Swiss Franc is now un-pegged from the Euro, there have been wild swings in the bond markets in Europe due to the aforementioned action, and oil is in an absolute free-fall. There are many geopolitical (and likely criminal) maneuverings behind all of these phenomena, however the chaos in the financial world thus far has been remarkable in that there hasn’t been much given everything going on.

There has been news of some smaller brokerages biting the dust thanks to these swings, but yet nobody ‘big’ has gone down – yet. Are they that good? That insulated? That lucky? That’s for people of a higher pay grade to answer, but the bottom line is that the environment is absolutely RIPE for another Cyprus or MFGlobal. Will it happen this time around? Couldn’t tell you. Maybe it’ll be next time. Or maybe it’ll happen this time, but not impact the US. Since everyone already thinks America is bulletproof I am guessing most will go with the latter of the two possibilities.

I’ve been talking an awful lot again about the bail-in, but a reader pointed out that he still doesn’t understand exactly what it is, and, more importantly, how an institution gets into the position where it needs (or wants) one. He’s a smart one, this reader, so I figure if he’s got questions then so do a whole bunch of other folks and that’s perfectly all right. That’s why I do this. So this week I’m going to focus on some of the anatomy and try to give everyone a sense of the sorts of things that put a bank/broker or just a broker into a position where they’d seek to invoke the bail-in.

On the positive side, although not for those folks impacted, we have a live example of how the bail-in works, right here in America to use as a template. I don’t wish to further malign Mr. Corzine’s already shredded reputation, but as his penchant for fast travel suggests, he could probably outrun any criticism we might toss his way.

Anatomy of the Bail-In – The Mechanism

Let’s talk about a brokerage first since this is where MFGlobal was situated. Brokerages generally have two components – the brokerage side and the dealer side. Formally, they are referred to as broker-dealers by the regulators because of this. So there are two sides. One side you see when you walk in and talk to your broker and sit in his posh office and the other side, which you never see – and usually neither does the broker. It is this unseen side you need to worry about in this instance. Your hundred thousand dollar brokerage account isn’t very noteworthy in the grand scheme of things other than that the broker-dealer might use shares that you hold in your portfolio to lend out to other parties so they can short a particular stock. Hmm, that is kind of going against your best interests isn’t it?

Your broker calls you with a ‘hot tip’ or a ‘sure winner’ and you go with it, then they’re enabling short-sellers out the back door. Nice huh? And they all do it, but I digress.

The brokerage side deals with clients such as yourself, maybe some pension funds, trust funds, perhaps an institutional client or two depending on what they’re into and so forth. It is pretty benign. On the other side of the operation there is the dealer side and they can be into all kinds of stuff, which, thanks to the USFederal court system, can get you into a pile of trouble. To keep it overly simple, think of the dealer side of the broker-dealer arrangement as a giant client. The dealer operation has accounts, holds positions, buys and sells positions, and makes a market in all of the above. They might do this with regards to stocks and bonds as well as options and other derivatives. The dealer side can borrow money to do all of the above as well, usually from commercial banks. When they borrow money to engage in transactions it is called leverage.

Anatomy of the Bail-In – A Scaled-Down, Working Example

Let’s say the dealer has a million dollars in assets – cash and positions. If they make 10% in a quarter, they’ve added another $100,000. Ok, easy enough, but they want to make more than that. So let’s say they go out and borrow another $500,000 at 5% per annum and invest the whole enchilada for a quarter and make the same 10%. So now instead of $100,000 in earnings, they have $150,000 – a 50% increase. Their interest expense for the quarter is $6,250 so their gross profit on the loan is $43,750. They give the $500,000 back plus the $6,250 in interest and everyone is happy. Their assets have swelled to $1,143.750. So where they’d made 10% originally, using leverage, they turned that gain into a 14.375% gain. Not too shabby. Plus, remember they make a few bucks lending out the shares you bought on that hot tip so someone else can place a bet that your hot tip stock will go down. Again, this is overly simplistic, but you get the idea here. The borrowed money is cheap – in fact, 5% is probably on the very high side of what they pay in interest, but is a round number.

Let’s say now that things don’t work out. The invested $1.5 million goes down by 10% in a quarter. They lose $150,000 plus the $6,250 in interest and suddenly, when they give back the loan and the interest; they’re left with $843,750. This creates an obvious problem when all of their assets are already deployed. There’s red ink to the tune of $156,250. Generally, what will happen is another loan will be obtained or some assets sold off or maybe a little of both and the loss will be absorbed.

Anatomy of the Bail-In - Reality

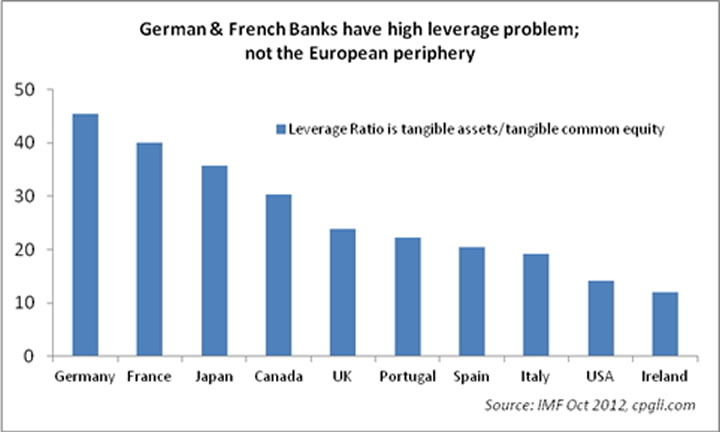

Now the illustrative example above uses a very tame leverage ratio. There was 50 cents of debt for every dollar of assets – or a ratio of .50:1. Understand that leverage ratios of 25:1 and even as high as 40:1 have not been uncommon. That means for the million dollars in the example above, there might be as much as $40 million in leverage (debt). So let’s use the 25:1 ratio and assume the same 10% loss. Suddenly the loss is 2.5X (a $2.5 million loss against a million in assets) the amount of the dealer’s assets rather than being .15X (a $150K loss against a million in assets) as in my example, not to mention the interest. Oops. Now the firm needs cash. They have a creditor to pay off. Well, how about those folks on the brokerage side? Well, gee whiz, they have $3 million in assets. Let’s just snag the $2.5 mil from there and use that to pay off the creditor. But that’s stealing and is illegal, right?

Wrong. Not anymore. That is precisely what happened in the case of MFGlobal, Sentinel Group, and Peregrine Financial – all to varying extents. The dealer side made bad bets and when it came time to pay off those bets, they went to their clients, raided the accounts, and then the injustices in the black robes gave it jurisprudence’s stamp of approval and the bail-in was on. Now we’ve got precedent and case law supporting overt theft. Instead of impeaching the judges, imprisoning them along with the principals of the firms who pulled the stunts to begin with, the establishment comes up with a new set of nomenclature (G-SIFI, bail-in, etc.) and begins the process of normalizing the idea of stealing something that doesn’t belong to them.

And perhaps the most ironic of all? The not-so-USFed, that shining knight on the white horse, buyer of last resort, standout of the bailout? It is in hock too and its leverage ratio is absolutely stunning. 77:1 at last count. Yes you read that right - 77:1. It was at 22:1 when the financial crisis started ripping through middle classes throughout the globe in 2008 and when you hear all these morons on television talking about how healthy US (and global for that matter) banks are, remember that someone is eating all these garbage mortgages, derivatives and other nuclear financial waste. It’s the central banks. Wait a second though; the central bank regulates the underlings, right? Maybe on the surface, but this is another bright and shining tidbit that illustrates who owns who. The not-so-USFed simply does what it is told.

A great question right now would be this: If everything is getting so much better then why are they still leveraging up at the ‘fed? Shouldn’t they be unwinding? They say they’re unwinding. But they’re not unwinding, they’re continuing to eat more and more garbage generated by their owners. Now this could go on quite a while, but not forever and it won’t end in a pretty fashion when it does end.

Anatomy of the Bail-In – Implications for ‘Depositors’

So that’s the broker-dealer version of the bail-in. The bank side isn’t much different in concept. Thanks to the repeal of the Glass-Steagall Act, which separated broker-dealer operations and the savings/loan operations of commercial banks, the same thing can happen to you if you have deposits in a commercial bank. The mechanism is precisely the same. The broker-dealer side conjures up some idiotic bet based on some computer program written by someone who thinks that the global financial system is nothing more than his or her personal playpen. In typical fashion, they win enough times to get cocky and of course as this happens, the greed kicks in and the bets get bigger. Eventually there’s a loser and by this time they’ve pumped for the goalposts and hiked the leverage ratio up to about 40:1 or even higher.

When it all crumbles and everyone starts scrambling, bear in mind that the law has now made your bank deposits available to do a bail-in and make good on that bad bet. And since you’re now an unsecured creditor rather than a depositor, you a) have no FDIC protection, and b) have no recourse. If you were a secured creditor, you might have a chance to recoup something, albeit not anywhere near what you’d lost, but at least a token. What happens next is your unsecured credit (think bondholders) is converted to equity and you become a stockholder in a failed bank. Congratulations. You woke up on a Friday morning having $25,000 in bank deposits and literally by the time the bank opens Monday you have x shares in a busted bank. And yes it can happen that fast. Anyone who doesn’t think it can, should remember Lehman in 2008. While it wasn’t a bail-in at that point, look at the velocity with which that outfit hit the mat, never to get up. Look at Cyprus. Friday afternoon there are tremors and by Monday morning, the banks are locked up like Fort Knox and the ATMs are out of money.

The US has already crafted its resolution mechanisms along with most of the G20. The EU has just ordered its member nations to the do the same. In my opinion, anyone who stores more than a trivial amount of cash in a commercial bank should be sentenced to spend the next month in Massachusetts figuring out how many of Tom Brady’s precious pigskins were improperly inflated.

The biggest problem with the above is that even if you understand the mechanism and what a firm might have to be engaged in to get themselves in trouble, it is very difficult to find out exactly what the dealer side of a broker-dealer firm is up to. They’re obviously secretive, claiming proprietary interests. Most will tell you their capital ratio though and that is a start. Your best bet if you insist on being in paper or even have decided that you’re willing to risk a small position in paper is to spread it out amongst several firms or, better yet, use the Direct Registration System so that your assets are held in your name at the issuer’s transfer agent rather than being held in street name at your broker. I realize the whole system is intertwined and something big enough to topple firm A might take firm B with it as well. However, that is an inherent risk for those who wish to engage in this activity.

Regarding the Direct Registration System, many companies stopped issuing paper certificates years ago, citing cost (funny, the shareholder usually was on the hook for that), but even if a firm doesn’t offer an actual certificate you can still have your shares held in your name at the issuer’s transfer agent. There is a popular misconception out there that you can’t do it unless the issuer will provide a paper certificate. All broker-dealers have a means by which you can DRS your positions. Many are reluctant to assist though because, frankly, not having your shares in street name in their ‘house’ costs them money. If DRS is something you are interested in and your broker is uncooperative, then find someone who will cooperate. The good news is that there are firms who are not obstructive in this regard.

Also an inherent risk is that even if you start to smell a rat that you won’t be able to extricate your assets in time. Much in the way banks are making people wait inordinate periods of time to get cash (if the paper itself is a con job then think about ‘electronic paper’ or digitized currency), firms can take up to 10 working days or more to effect transfers. In our fast-paced financial climate where the world can literally change in a weekend, 10 days might as well be 10 years. Also, those pesky daily limits on your ATM card, put in place for your own ‘security’ as you were told when you asked about it, could be lethal as was the case in Cyprus.

My goal here isn’t to make things sound hopeless; that is not the intent, but rather to present you with the risks involved when you engage in these very basic financial activities. Most people don’t even consider these risks because until recently they either didn’t exist as in the case of the bail-in or weren’t relevant as in the case of banks being so stingy with their cash withdrawal policies. This is one of those times when you simply MUST advocate for yourself because these other folks are firmly invested in your continued ignorance, apathy, and ultimately inaction.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.