The Most Important Thing You Should Do to Make Money in 2015

Stock-Markets / Investing 2015 Jan 22, 2015 - 12:48 PM GMTBy: Investment_U

Marc Lichtenfeld writes: Last Thursday, the front page headline of the USA Today Money section read “Stock Plunge Digs Deeper.” Above it was a graphic showing that since December 31, 15 days earlier, the Dow Jones Industrials had fallen 2.2%.

Marc Lichtenfeld writes: Last Thursday, the front page headline of the USA Today Money section read “Stock Plunge Digs Deeper.” Above it was a graphic showing that since December 31, 15 days earlier, the Dow Jones Industrials had fallen 2.2%.

Plunge?

The article went on to recount the prior day’s trading when the Dow fell 187 points, or 1.1%. A poor showing for sure, but hardly anything to get excited about.

This is standard operating procedure for mainstream financial media. Ever since the dot-com days when stock trading became America’s favorite pastime and Maria Bartiromo was the Money Honey, TV and most newspapers, magazines and websites try to scare you into watching more, reading further and clicking through.

Either you’re going to miss out on the next great profit opportunity or, more often, they paint portraits of collapse and chaos, so you better keep reading or else you’ll get annihilated in the carnage.

Markets do crash. Oil certainly has in the past few months. Stocks crashed in 2007. It happens. But usually, it doesn't.

And talking about a 2.2% plunge is not only inaccurate, but irresponsible. Reading that kind of garbage is dangerous to your financial health.

When investors ingest this nonsense, they get scared and often act when they should be sitting tight. In fact, jumping in and out of markets is about the worst thing you can do for your financial health.

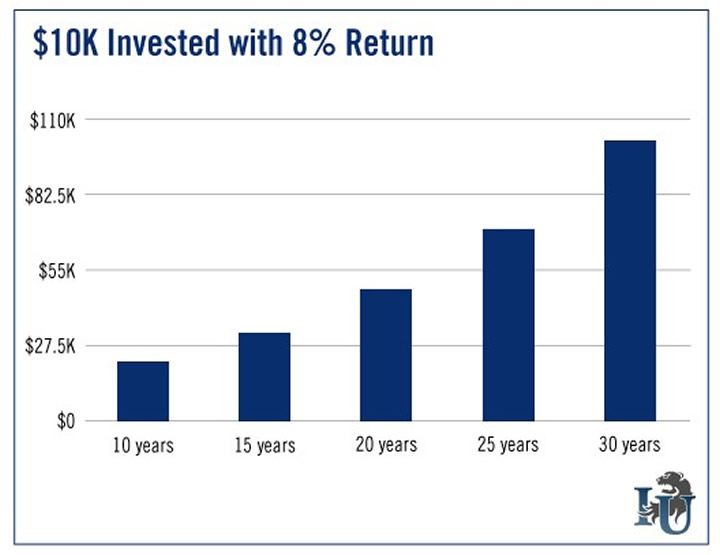

Consider that a $10,000 investment, earning a market average 8% per year, more than doubles to $21,589 in 10 years if you just leave it alone. In 15 years, the money more than triples to $31,721. If you invest for 20 years, your initial $10,000 stake is worth $46,609. In 25 years... it’s $68,484. And in 30 years, your money has gone up over 1,000% to $100,626.

Notice a pattern? The longer you leave the money in, the more money you make each year. That’s because of compounding. (On a related note, Investment U offers a slew of free investment calculators - including one that calculates compound interest - on our site here.)

Think of it this way. One hundred dollars invested at 10% is worth $110 in a year. The following year your $110 earns 10% and becomes $121. Then $133, $146, $160... You make more money every year than you did the year before, even though the growth rate remains the same.

Last week, Investment U’s Chief Investment Strategist Alexander Green emphasized that the most important factors to making money in the market are how much you save, how long you let your money compound, and how well you manage your expenses and taxes and a few other items.

Paying attention to financial media was not on his list.

That’s because the media’s job is to get you to keep tuning in or reading so they can serve you ads. The scarier they make the situation sound, the more likely you’re going to tune in.

After all, if The New York Times, Fox News and other media outlets reported that millions of people went to work today, drove home without incident, had dinner with their families, watched a little TV, hugged their kids and went to bed, you likely wouldn’t tune in the next day. Nor should you. That’s some boring news. But it’s reality for most of the world.

By focusing on imminent death, destruction and 2% market plunges, they keep you coming back for more.

But it becomes a problem if your investment decision-making process starts to be affected. If it does, there is no doubt you will get in the market near the top and out near the bottom.

People are emotional beings and when we’re fed loads of optimism or pessimism, it’s hard not to be influenced.

But as Alex said, one of the most important keys to building wealth is how long you’re invested - not getting in and out repeatedly.

If you need a second opinion, consider legendary investor Jesse Livermore, who famously said, “It never was my thinking that made the big money for me, it was always my sitting.”

Ignore headlines of 2% market plunges and follow another of Livermore’s sayings. “Be right and sit tight.”

Good investing,

Marc

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.