Are Plunging Petrodollar Revenues Behind the Fed’s Projected Rate Hikes?

Interest-Rates / US Interest Rates Jan 22, 2015 - 12:35 PM GMTBy: Mike_Whitney

Why is the Fed threatening to raise interest rates when the economy is still in the doldrums? Is it because they want to avoid further asset-price inflation, prevent the economy from overheating, or is it something else altogether? Take a look at the chart below and you’ll see why the Fed might want to raise rates prematurely. It all has to do with the sharp decline in petrodollars that are no longer recycling into US financial assets.

Why is the Fed threatening to raise interest rates when the economy is still in the doldrums? Is it because they want to avoid further asset-price inflation, prevent the economy from overheating, or is it something else altogether? Take a look at the chart below and you’ll see why the Fed might want to raise rates prematurely. It all has to do with the sharp decline in petrodollars that are no longer recycling into US financial assets.

“Energy-exporting countries are set to pull their ‘petrodollars’ out of world markets this year for the first time in almost two decades, according to a study by BNP Paribas. Driven by this year’s drop in oil prices, the shift is likely to cause global market liquidity to fall, the study showed…This decline follows years of windfalls for oil exporters such as Russia, Angola, Saudi Arabia and Nigeria. Much of that money found its way into financial markets, helping to boost asset prices and keep the cost of borrowing down, through so-called petrodollar recycling.This year, however, the oil producers will effectively import capital amounting to $7.6 billion. By comparison, they exported $60 billion in 2013 and $248 billion in 2012, according to the following graphic based on BNP Paribas calculations:‘At its peak, about $500 billion a year was being recycled back into financial markets. This will be the first year in a long time that energy exporters will be sucking capital out,’ said David Spegel, global head of emerging market sovereign and corporate Research at BNP.

In other words, oil exporters are now pulling liquidity out of financial markets rather than putting money in. That could result in higher borrowing costs for governments, companies, and ultimately, consumers as money becomes scarcer.” (Petrodollars leave world markets for first time in 18 years – BNP, Reuters)

Can you see what’s going on?Now that petrodollar funding has dried up, the Fed needs to find an alternate source of capital to keep the markets bubbly and to shore up the greenback. That’s why the Fed has been talking up the dollar (“jawboning”) and promising to raise rates even though the economy is still pushing up daisies. According to the Fed’s favorite mouthpiece, Jon Hilsenrath:

“Federal Reserve officials are on track to start raising short-term interest rates later this year, even though long-term rates are going in the other direction amid new investor worries about weak global growth, falling oil prices and slowing consumer price inflation…

Many Fed officials have signaled they expect to start lifting their benchmark short-term rate from near zero around the middle of the year. Recent developments in the economy and markets have caused some trepidation among Fed officials and, if sustained, could cause them to delay acting. However several have indicated recently they still expect to move this year and are withholding judgment on delay.” (Fed Officials on Track to Raise Short-Term Rates Later in the Year, Jon Hilsenrath, Wall Street Journal)

And we’re hearing the same from Reuters: “The Federal Reserve is still on track for a potential mid-year interest-rate increase, a top Fed official said on Friday, citing strong U.S. economic momentum and a falling unemployment rate.”Notice the sudden change in tone from dovish to hawkish? Expect that to intensify in the months ahead as the major media tries to spin the data in a way that serves the Fed’s broader objectives. Like this article in Bloomberg titled, “Yellen Signals She Won’t Babysit Markets in Turmoil”:

“Janet Yellen is leaving the Greenspan ‘put”’behind as she charts the first interest-rate increase since 2006 amid growing financial-market volatility.The Federal Reserve chair has signaled she wants to place the economic outlook at the center of policy making, while looking past short-term market fluctuations. To succeed, she must wean investors from the notion, which gained currency under predecessor Alan Greenspan, that the Fed will bail them out if their bets go bad — just as a put option protects against a drop in stock prices.“The succession of Fed puts over the years has led to a wide range of distortions in financial markets,” said Lawrence Goodman, president of the Center for Financial Stability, a monetary research group in New York. “There have been swollen asset values followed by sharp declines. This is a very good time for the Fed to move away.

“Let me be clear, there is no Fed equity market put,” William C. Dudley, president of the New York Fed, the central bank’s watchdog on financial markets, said in a Dec. 1 speech in New York.” (She’s No Greenspan: Yellen Signals She Won’t Babysit Markets in Turmoil)

“There’s no Fed equity put”?That’s ridiculous. Then how does one explain the way the Fed has launched additional rounds of QE every time stocks have started to sputter? And how does one explain the Fed’s $4 trillion balance sheet all of which was spent on financial assets?Let’s face it, Central bank intervention has been the only game in town. It’s not just the main driver of stocks. It’s the only driver of stocks. Everyone knows that. Yellen is going to do everything in her power to keep stocks in the stratosphere just like her predecessors, Greenspan and Bernanke. The only that’s going to change, is her approach.As for the economy, well, just a glance of the headlines tells the whole story. Like this gem from CNBC last week:

“U.S. consumer prices recorded their biggest decline in six years in December and underlying inflation pressures were benign,…The Labor Department said on Friday its Consumer Price Index fell 0.4 percent last month, the largest drop since December 2008, after sliding 0.3 percent in November. In the 12 months through December, CPI increased 0.8 percent…Darkening prospects for the global economy could also complicate matters for the U.S. central bank.

Inflation is running below the Fed’s 2 percent target, despite a strengthening labor market and overall economy.” (Consumer Price Index drops 0.4% in December, in line with estimates, CNBC)

Think about that for a minute: Consumer prices just logged their biggest drop since the freaking slump of 2008 and, yet, the Fed is still babbling about raising rates.Talk about lunacy. Not only has the Fed not reached its inflation target of 2%, but it’s abandoned the project altogether. Why? Why has the Fed suddenly stopped trying to boost inflation when the yields on benchmark 10-year US Treasuries have just plunged to record lows (1.70%) and are blinking red? In other words, the bond market is signaling slow growth and zero inflation for as far as the eye can see, but the Fed wants to raise rates and slash growth even more?? It doesn’t make any sense, unless of course, Yellen has something else up her sleeve. Which she does.Now get a load of this shocker on retail sales in last week’s news. This is from Bloomberg:

“The optimism surrounding the outlook for U.S. consumers was taken down a notch as retail sales slumped in December by the most in almost a year, prompting some economists to lower spending and growth forecasts.

The 0.9 percent decline in purchases …. extended beyond any single group as receipts fell in nine of 13 major retail categories.

…

Treasury yields and stocks fell as a deepening commodities rout and the drop in sales spurred concern global growth is slowing……average hourly earnings falling 0.2 percent in December from the month before in the first drop since late 2012. That limits the amount of spending consumers can undertake without dipping into savings or racking up debt.” (U.S. Retail Sales Down Sharply, Likely Cuts to Growth Forecasts Ahead, Bloomberg)

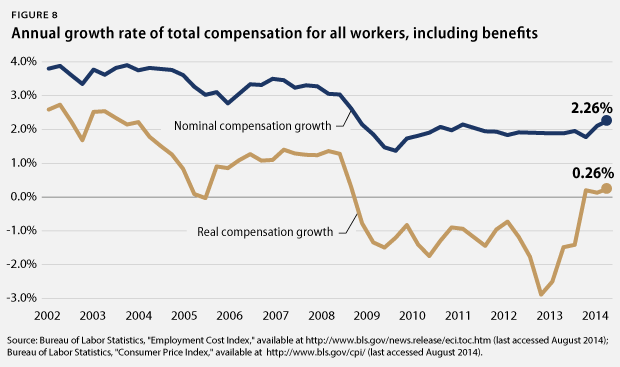

Remember when everyone thought that low oil prices were going to save the economy? It hasn’t worked out that way though, has it? Nor will it. Falling oil prices usually indicate recession, crisis or deflation. Take your pick. They’re usually not a sign of green shoots, escape velocity, or sunny uplands.And did you catch that part about falling wages? How do you expand a consumer-dependent economy, when workers are seeing their wages shrivel every month? In case, you haven’t seen the abysmal stagnation of wages in graph-form, here’s a chart from American Progress:

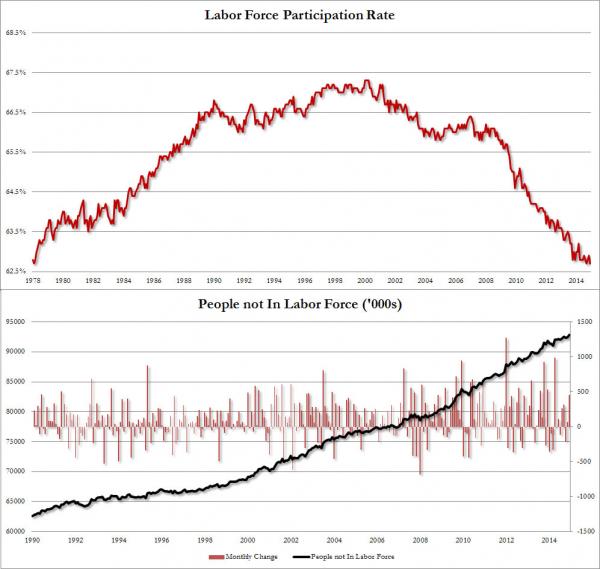

Negative real wage growth means the amount of slack in the market is still considerable.So while stock prices have doubled or tripled in the last 6 years, wages have basically been flatlining. That’s a pretty crummy distribution system, don’t you think. Unless you’re in the 1 percent of course, then everything is just hunky dory.But at least Yellen can find some comfort in the fact that unemployment continues to improve. In fact, just two weeks ago unemployment dropped to an impressive 5.4%, the lowest since 2007. So if we forget about the fact that wages are stagnating, that management has nabbed all the productivity-gains for the last 40 years, and that another 451,000 workers dropped off the radar altogether in December, then everything looks pretty rosy. But, of course, it’s all just a bunch of baloney. Take a look at this from Zero Hedge:

“Another month, another attempt by the BLS to mask the collapse in the US labor force with a seasonally-adjusted surge in waiter, bartender and other low-paying jobs. Case in point… the labor participation rate just slid once more, dropping to 62.7%, or the lowest print since December 1977. This happened because the number of Americans not in the labor forced soared by 451,000 in December, far outpacing the 111,000 jobs added according to the Household Survey, and is the primary reason why the number of uenmployed Americans dropped by 383,000.

(Labor Participation Rate Drops To Fresh 38 Year Low; Record 92.9 Million Americans Not In Labor Force, Zero Hedge)

So, yeah, unemployment looks great until you pick through the data and see it’s all a big fraud. Unemployment is only falling because more and more people are throwing in the towel and giving up entirely.Finally, there’s the rapidly-expanding mess in the oil patch where the news on layoffs and cut backs gets worse by the day. This is from Wolf Richter at Naked Capitalism:

“Layoffs are cascading through the oil and gas sector. On Tuesday, the Dallas Fed projected that in Texas alone, 140,000 jobs could be eliminated. Halliburton said that it was axing an undisclosed number of people in Houston. Suncor Energy, Canada’s largest oil producer, will dump 1,000 workers in its tar-sands projects. Helmerich & Payne is idling rigs and cutting jobs. Smaller companies are slashing projects and jobs at an even faster pace. And now Slumberger, the world’s biggest oilfield-services company, will cut 9,000 jobs.” (Money dries up for oil and gas, layoffs spread, write-offs start, Wolf Richter, Naked Capitalism)

And then there’s this tidbit from Pam Martens at Wall Street on Parade:

“In a December 15 article by Patrick Jenkins in the Financial Times, readers learned that data from Barclays indicated that “energy bonds now make up nearly 16 per cent of the $1.3 trillion junk bond market — more than three times their proportion 10 years ago,” and “Nearly 45 per cent of this year’s non-investment grade syndicated loans have been in oil and gas.” Raising further alarms, AllianceBernstein has released research suggesting that the deals were not fully subscribed by investors with the potential that “as much as half of the outstanding financing from the past couple of years may be stuck on banks’ books.” (The perfect storm for Wall Street banks, Russ and Pam Martens, Wall Street on Parade)

How do you like that? So nearly half the toxic energy-related gunk that was bundled up into dodgy junk bonds (and is likely to default in the near future) is sitting on bank balance sheets. Does that sound like a potential trigger for another financial crisis or what?And, no, I am not trying to ignore the fact that third quarter GDP came in at a whopping 5 percent which vastly exceeded all the analysts estimates. But let’s put that into perspective. According to economist Dean Baker, the growth spurt was mainly “an anomaly” …”driven by extraordinary jump in military spending and a big fall in the size of the trade deficit that is unlikely to be repeated.” Here’s more from Baker:

“As usual, just about everything we’ve heard about the economy is wrong. To start, the 5.0 percent growth number must be understood against a darker backdrop: The economy actually shrank at a 2.1 percent annual rate in the first quarter. If we take the first three quarters of the year together, the average growth rate was a more modest 2.5 percent.” (Don’t Believe What You Hear About the US Economy, Dean Baker, CEPR)

So, the economy is growing at a crummy 2.5 percent, but Yellen wants to raise rates. Why? Does she want to shave that number to 2 percent or 1.5 percent? Is that it? She wants to go backwards?Of course not. The real reason the Fed wants to raise rates, is to attract foreign capital to US markets in order to keep stocks soaring, keep borrowing costs low, and reinforce the dollar’s role as the world’s reserve currency. That’s what’s really going on. The petrodollars are drying up, so US markets need a new source of funding. Direct foreign investment, that’s the ticket, Ducky. All the Fed needs to do is boost rates by, let’s say, 0.5 percent and “Cha-ching”, here comes the capital. Works like a charm every time, just ask former Treasury Secretary Robert Rubin whose strong dollar policy sent stock prices into orbit while widening the nation’s current account deficit by many orders of magnitude. (We never said the plan didn’t have its downside.)The Fed’s sinister plan to raise interest rates (sometime by mid-2015) will push the dollar’s exchange rate higher thus triggering capital flight in the emerging markets which are already struggling with plunging commodities prices and an excruciating slowdown. The investment flows from the EMs to US financial assets and Treasuries will offset the loss of petrodollar revenue while expanding Wall Street’s ginormous stock market bubble. As for the emerging markets, well, they’re going to take it in the shorts bigtime as one would expect. Here’s a clip from an article by Ambrose-Evans Pritchard that lays it out in black and white:

“The US Federal Reserve has pulled the trigger. Emerging markets must now brace for their ordeal by fire. They have collectively borrowed $5.7 trillion in US dollars, a currency they cannot print and do not control. This hard-currency debt has tripled in a decade, split between $3.1 trillion in bank loans and $2.6 trillion in bonds. It is comparable in scale and ratio-terms to any of the biggest cross-border lending sprees of the past two centuries…Officials from the Bank for International Settlements say privately that developing countries may be just as vulnerable to a dollar shock as they were in the Fed tightening cycle of the late 1990s, which culminated in Russia’s default and the East Asia Crisis. The difference this time is that emerging markets have grown to be half the world economy. Their aggregate debt levels have reached a record 175pc of GDP, up 30 percentage points since 2009…”

This time the threat does not come from insolvent states. They have learned the lesson of the late 1990s. Few have dollar debts. But their companies and banks most certainly do, some 70pc of GDP in Russia, for example. This amounts to much the same thing in macro-economic terms. ” (Fed calls time on $5.7 trillion of emerging market dollar debt, Ambrose-Evans Pritchard, Telegraph)

The Fed has been through this drill so many times before they could do it in their sleep. (” U.S. interest-rate hikes in 1980s and 1990s played a role in financial crises across Latin America and East Asia.” Foreign Policy Magazine) They’ve learned how to profit off every crisis, particularly the one’s that they themselves create, which is just about all of them. In this case, most of the loans to foreign businesses and banks were denominated in dollars. So, now that the dollar is soaring, (“The dollar’s value has risen about 15 percent relative to the euro and the yen just since the summer.” NPR) the debts are going to balloon accordingly (in real terms) which is going to push a lot of businesses off a cliff forcing sovereigns to step in and provide emergency bailouts.Did someone say “looming financial crisis”?Indeed. Bernanke’s “easy money” has inflated bubbles across the planet. Now these bubbles are about to burst due to the strong dollar and anticipated higher rates. At the same time, the policy-switch will send hundreds of billions of foreign capital flooding into US markets pushing stocks and bonds through the roof while generating mega-profits for JPM, G-Sax and the rest of the Wall Street gang. All according to plan.Naturally, the stronger dollar will weigh heavily on employment and exports as foreign imports become cheaper and more attractive to US consumers. That will reduce hiring at home. Also the current account deficit will widen significantly, meaning that the US will again be consuming much more than it produces. (This took place under Rubin, too.) But here’s what’s interesting about that: According to the Bureau of Economic Analysis: “Our current account deficit has narrowed sharply since the crisis…The U.S. current account deficit now stands at 2.5 percent of GDP, down from more than 6 percent in the fourth quarter of 2005.” (BEA)Great. In other words, Obama’s obsessive fiscal belt-tightening lowered the deficits enough so that Wall Street can “party on” for the foreseeable future, ignoring the gigantic bubbles they’re inflating or the emerging market economies that are about to be decimated in this latest dollar swindle.

If that doesn’t make you mad, I don’t know what will.

By Mike Whitney

Email: fergiewhitney@msn.com

Mike Whitney lives in Washington state. He is a contributor to Hopeless: Barack Obama and the Politics of Illusion (AK Press). Hopeless is also available in a Kindle edition. He can be reached at fergiewhitney@msn.com.

© 2014 Copyright Mike Whitney - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Whitney Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.