Stocks Bear Market Lessons from History

Stock-Markets / Stocks Bear Market Jan 22, 2015 - 12:15 PM GMTBy: Submissions

Rajveer Rawlin writes: While the financial media is absolutely infatuated with stocks hitting new highs everyday, we would do well to pay attention to some ongoing bear markets:

Rajveer Rawlin writes: While the financial media is absolutely infatuated with stocks hitting new highs everyday, we would do well to pay attention to some ongoing bear markets:

1) Japanese stocks continue to languish under the effects of deflation following a well over 26 year old bear market, down over 50% from the highs set in 1989.

2) Despite some great innovation out of the U.S from the likes of Apple, Google, Facebook e.t.c the NASDAQ continues to remain in a 15 year bear market down over 10% from the highs in 2000.

3) Despite going parabolic yet again, Chinese stocks continue to remain in a 7 year bear market down well over 50% from the highs set in 2008.

4) US bank stocks are entering a 7 year bear market despite all the QE money and super low interest rates down over 40% from their highs set in 2008.

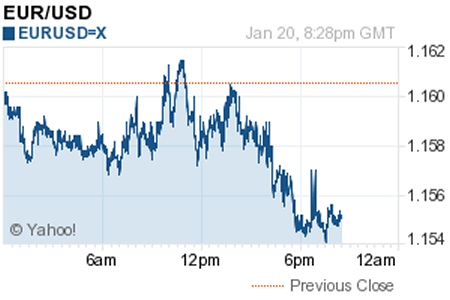

5) The Euro is also in a 7 year bear market down over 25% against the dollar from it's highs set in 2008.

6) Gold and gold ETF's continue to be in bear markets down well over 35% from their highs set in 2008.

7) The more recent casualty oil and oil ETF's are down well over 60% from their highs set in 2008.

It is well worth noting that it is no strange coincidence that there are major bear markets in several key asset classes and despite recent bear market rallies caused by the FED's QE for ever policies the hibernating bear is all set to emerge with a vengeance.

By Rajveer Rawlin

http://www.linkedin.com/pub/rajveer-rawlin/3/534/12a

Rajveer Rawlin received his MBA in finance from the University of Wales, Cardiff, UK. He is a Associate Professor in Finance in the Department of Management Studies Acharya Bangalore Business School. His research interests includes areas of Capital Markets, Banking, Investment Analysis and Portfolio Management and has over 15 years of experience in the above areas covering the US and Indian Markets. He has 9 publications in the above areas.

© 2015 Copyright Rajveer Rawlin - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.