Five Stock Market Questions Wall Street Hopes You’ll Never Ask

Stock-Markets / Stock Markets 2015 Jan 21, 2015 - 03:31 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: Last week I heard from long-time reader Ms. Florence D. A sharp 87-years young, she’s facing a situation that’s all too common for many investors who were seduced by Wall Street’s overreliance on the “never lose money” mantra.

Keith Fitz-Gerald writes: Last week I heard from long-time reader Ms. Florence D. A sharp 87-years young, she’s facing a situation that’s all too common for many investors who were seduced by Wall Street’s overreliance on the “never lose money” mantra.

Now she’s got a few money-losing commodity and financial stocks on hand (not ones I recommended, fortunately) and is wondering if it’s time to “hire advice on each dog.”

I think so.

Good counsel is absolutely vital when it comes to building Total Wealth.

Obviously, you can get some of that from me each week, especially when it comes to identifying trends, spotting opportunities, and helping you pick your trades. That’s because many times Wall Street simply cannot tell you what I can, nor can they offer the fiercely independent analysis I do. There are huge conflicts of interest that are well documented thanks to the Financial Crisis, and it’s not in Wall Street’s best interest to have you thinking independently.

That said, there comes a time in every investor’s career when having the right advisor in your corner can mean the difference between huge profits and devastating losses. That’s because he or she will help you make decisions that are uniquely dependent on your personal situation. Examples include money moves needed to minimize taxes, leaving a legacy for your children and grandchildren or simply planning for life’s major events.

But how do you find the right professional from amongst tens of thousands?

That’s what we’re going to talk about today.

Finding the right advisor comes down to five questions.

Everyone seems to forget the last one…

Big brokerage houses are turning up the heat.

According to the Wall Street Journal, the pressure is higher than ever to win more clients and assets. Merrill Lynch, for example, will double what it calls strategic growth awards for its 14,000 advisors. The first $10 million in new assets is worth 0.10% of that amount in 2015 versus 0.05% of that in 2014. Any advisor adding at least two new client relationships will see awards triple. UBS, Morgan Stanley and Wells Fargo are all making similar changes.

Put bluntly, they’ve put a bounty on YOUR money.

And that’s a problem because it makes finding an advisor who is truly aligned with your interests a challenging undertaking. Not impossible mind you but complicated nonetheless.

I recommend you run through this checklist with him or her right up front. But if you already have a financial advisor, you can ask these questions today too.

1) Do My Investments Match My Risk Tolerance and Expectations?

No doubt this will cause pushback from more than a few financial professionals. But I just don’t believe any investor needs to suffer the ravages of a bear market.

I don’t care if you have $5,000 or $500,000 to invest – the principles remain the same.

No financial advisor worth his or her salt would let a client liquidate into a bear market. And the good ones ensure that their clients have enough cash and ultra-safe investments on hand so they don’t have to.

If your advisor has you leveraged to the eyeballs, or fully invested in such a way that you can’t endure the bumpy trading we’ve got right now much less a protracted downturn, it’s time to find a new advisor.

I don’t care if it’s an up market or a down market, the best advisors will help you pick investments that match your goals within your financial time frame.

The problem faced by many investors today is that they’ve always thought in terms of returns rather than risks. That’s backwards, especially at a time when the riskiest investments – bonds – were supposed to be the most secure.

This is compounded by the fact that many investors – having lost big twice in the last decade – remain underinvested and are faced with playing catch-up in a market that is arguably toppish right now. They never should have stepped off the court in the first place.

As you know from prior Total Wealth columns, it pays to stay the course no matter what the headlines.

In a study of 7.1 million retirement accounts, Fidelity discovered that those who sold their stock mutual funds between October 2008 and March 2009 (the period of greatest volatility we’ve seen yet), more than 50% had not reinvested as of June 30, 2011.

Those who stayed in the markets, and in stocks specifically, saw the value of their accounts rise 50% on average. Those who sat on the sidelines saw an average increase in their accounts of… wait for it… just 2%.

I’m sure those numbers haven’t changed very much even now.

2) How Do My Total Returns Stack Up?

Many investors are after the next hot stock or the next sure thing, and focus on the percentage returns of specific choices. Understandably, they love being up 25%, 50%, 100%, or more. I do, too.

Call me crazy, but I prefer not losing money in the first place.

That’s why I’d rather invest with the idea of managing my total returns than throwing darts at specific stocks that may hit… or miss. Over time, I know that greater returns are possible that way.

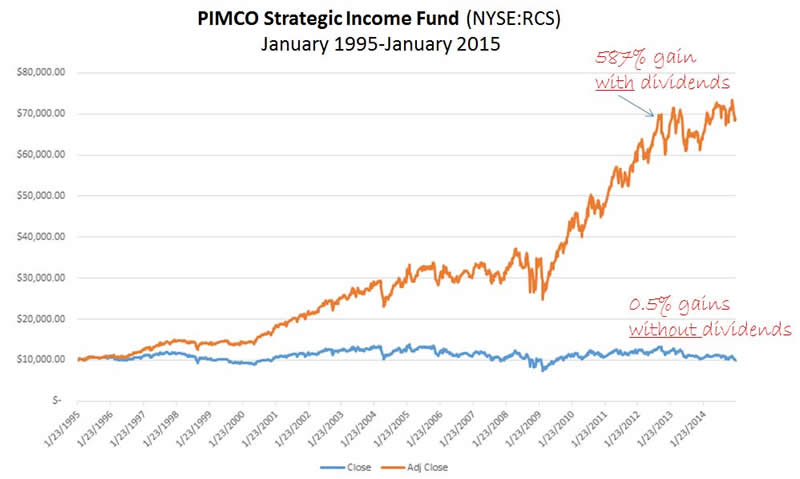

What people don’t realize is that successful investing is a matter of continuous performance. Not instantaneous performance. It’s one of the reasons I emphasize income and, in particular, the right dividend stocks as part of the Total Wealth approach.

For all the lip service people pay to this, very few realize that dividend and reinvestment can account for 85%-90% of total stock market returns over time.

In some cases, the dividends are so steady and increase so much that you actually make more in dividends than you paid to buy the stocks that produce them.

The same is true with fixed income, where it’s the income that has made a graphic difference in total returns despite rates dropping to all-time lows and hovering there even today.

Ask anybody who’s invested in the PIMCO Strategic Income Fund (NYSE: RCS) over the past 10 years. It’s the yield – the income and reinvestment – that’s made a world of difference over time.

Take a look:

Figure 1: Source Fitz-Gerald Research Publications, Yahoo Finance

I disagree.

The markets are almost always at or near all-time highs. That’s how they work, considering they have a powerful upward trend over the long term.

To put this into perspective, consider this fact. Markets achieve new highs an average of once every 18 days, according to research by Ric Edelman, President of Edelman Financial. I know that sounds like a loaded statement and it is. But I told you this to make a point – even the lows of 2003 and 2008 were all-time highs compared to the markets in 1990.

My point is that young or old, you want to learn to work with time, instead of trying to cheat it at every opportunity.

And the right advisor can help you do that effectively.

For instance, if you’re a few years into retirement, you probably want to consider having some bonds running around so that you can rebalance if and when the markets give you a chance and head south. If you’re like Florence and concerned about leaving a legacy for your nine grandchildren (congratulations by the way, Florence!), perhaps a strategic move to preserve principle is more in order under the same market scenario.

3) Under What Conditions Will You Sell?

Many advisors actually have no idea on this one. Not only that, but they don’t want you to sell. It’s one of Wall Street’s dirty little secrets.

Think about it…

Selling is not in their best interest. Wall Street makes their money from your money. They want you in the game, so they will do everything they can to keep you playing.

This includes creating all kinds of fancy dashboards and gee-whiz programs as a means of drawing you in. You’ve seen the commercials. You know what I’m talking about.

At times, they’ll shift gears and highlight some sort of total care package as in “we care for your money.”

But trust me, benevolence is not in their vocabulary.

If your financial advisor can’t lay out very specific reasons for when and what you would sell, move on. Knowing when to cut losses – and explaining clearly when to do so – is the hallmark of a worthwhile financial advisor. This can be an elaborate plan, but also something as simple as a 25% trailing stop.

It really doesn’t matter, as long as they have a plan and can clearly articulate it to you without any hemming and hawing when you ask.

4) When Will We Buy?

This is very closely related to “when do we sell.” And again, most advisors don’t have a clue. You’d think at least they would have this one covered, but most don’t.

And that’s unfortunate because there are two broad considerations to deal with here. And both of them have a direct impact on your money.

First, timing the market is a bad idea. According to Barron’s, 85% of all buy/sell decisions are incorrect. That’s because emotional bias drives bad decisions, particularly when it comes to attempts to time the markets.

As for how much this will cost you… try 268% over 20 years.

The latest DALBAR data shows that the return of an average investor trying to time the market is a pathetic 2.53% per year, versus the S&P 500 return of 9.02% over the same time period.

More than 90% of portfolio volatility comes from structure. Get that right, and chances are good that you’ll come out way ahead of the game, especially if you use something like our proprietary 50-40-10 portfolio.

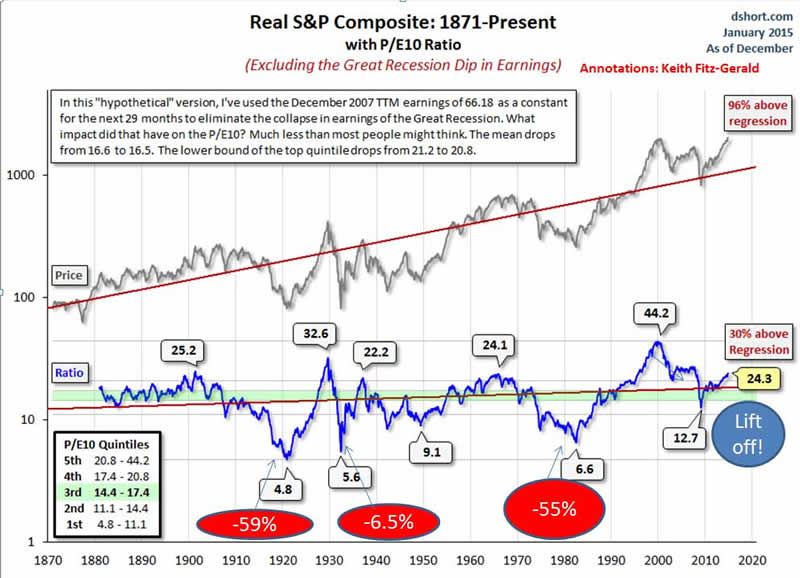

Second, the markets have a decidedly upward bias over time. That means that outstanding performance is a matter of identifying relative weakness and wading into it, rather than running the other way.

For instance, take a look at this chart.

It is simple.

Investors who buy into the markets without understanding the big picture get hammered trying to chase returns. Yet, investors who buy when things are gloomiest tend to build legendary wealth.

You can argue that you’ll never see this in your lifetime, but you’d be dead wrong. Most investors will see 2-5 specific periods in their investing lives where the relative valuations favor more buying than selling.

That’s why I’d fire any advisor who does not recommend cautious additions to your portfolio when everyone else is running for the hills. At the very least, they should ask you to consider rebalancing periodically to capitalize on prices that would otherwise not be so low.

5) Finally, How Are You Being Compensated?

I don’t believe in paying people for performance they don’t deliver.

SO I am not crazy about paying ginormous account management fees if I’m not getting good results. You shouldn’t be, either.

Over time, the typical 1%-2% management fees charged by many big investment houses and managers can really be a drag on performance that bleeds your retirement of much-needed momentum and future results.

I think fee-only advisors are a much better choice. They sit on your side of the table and have your vested interests in mind.

Further, because they are independent, they disclose all conflicts of interest in advance (or at least they should) and are not beholden to investment banking, ratings, or other nonsense that lurks unbeknownst to most investors. They don’t have a financial stake in your investments.

I think that’s especially important at the moment for one simple reason – many of the conflicts that are inherent in today’s investment world are directly the result of conflicted choices. They are presented under the guise of comprehensive planning by brokerage firms that would like you to believe they perform the same functions as investment advisors. They don’t.

What if you don’t work with an advisor right now? Hire one… and don’t delay.

I know that may seem expensive, but it’s a matter of perspective.

Putting $50,000 into a mutual fund charging a 3% load works out to 10 hours of professional, fee-only investment advisor’s time – and that’s at an hourly rate of $150!

Given the risks in today’s markets and the inherent problems with Wall Street – not the least of which are pronounced conflicts of interest – I think that is money well-spent.

Best regards until Friday,

Keith

Source : http://totalwealthresearch.com/2015/01/five-questions-wall-street-hopes-youll-never-ask/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.