Deflation Bonanza! And the Fool's Mission to Stop It

Economics / Deflation Jan 21, 2015 - 11:14 AM GMTBy: Mike_Shedlock

Of all the widely believed but patently false economic beliefs is the absurd notion that falling consumer prices are bad for the economy and something must be done about them.

Of all the widely believed but patently false economic beliefs is the absurd notion that falling consumer prices are bad for the economy and something must be done about them.

The recent move in the Swiss franc puts a spotlight on the issue. For example, on Sunday, in Swiss Peg Removal: Did Anyone Win? I commented ...

One widely recognized "big loser" is the tourism industry. For sure, hotel prices in Switzerland rose as much as 40% overnight compared to prices elsewhere.But Swiss grocery shoppers buying food imports from France, Spain, and the rest of Europe benefit mightily.

Which of those is more important? I suggest the benefit to Swiss shoppers is more important, at least in the grand scheme of things. Moreover, those consumers will have more money to spend on other things ... like restaurants, travel and hotels.

Shopping Bonanza!

On Monday came a Wall Street Journal story that exactly matched my prediction: Soaring Franc Creates Bonanza in Swiss Stores.

The soaring Swiss franc that caused howls in financial markets is creating a bonanza in stores, where shoppers are suddenly getting discounts on everything from vegetables to party dresses.

On Monday, Basel-based Coop said it was cutting prices on more than 200 types of fruit and vegetables imported from the European Union. The supermarket chain, Switzerland's second-largest retailer behind Migros, said further price cuts for imported fish, poultry and cheese were also in the works.

Coop isn't the only retailer going into bargain mode. Furniture chains, travel agencies and fashion companies are among the retailers slashing prices to rope in shoppers.

"For us housewives, this is welcome news for our daily shopping," said Anita Mueller, who was perusing sales on Banhofstrasse, Zurich's main thoroughfare, on Monday morning.

Even luxury stores are passing on the savings. The window of Grieder & Cie., a high-end department store in Zurich's shopping district, bore a message informing shoppers their money would go further.

"Due to the sudden rise of the Swiss franc against the euro and to give us time to adjust our prices to the move, we are now offering a 20% discount on all of our non-reduced goods for an indefinite time," the message read.

Swiss consumers are also taking advantage of their improved buying power by crossing into Germany. BVB, the transportation authority in Basel, added more trams to the border town of Weil am Rhein to accommodate the rush of Swiss bargain hunters looking to take advantage of their muscular Swiss francs.

TUI Suisse, one of Switzerland's biggest tour operators, cut prices by 15% on vacation packages to sunny destinations around Mediterranean Sea. Tours of Greece, Spain, Turkey, Italy and Portugal are all included in the sale, which is dubbed the "euro discount." TUI Suisse, which has branches in many shopping malls across Switzerland, is also lowering prices on trips to Morocco and Egypt for departures through the summer.

Don't Cry For Exporter Yet

In Swiss Peg Removal: Did Anyone Win? I also commented ...

"Conventional wisdom is that Swiss exporters will be crucified and importers will benefit. Certainly there is an initial shock. But long-term, look at it this way: The price of materials used in exports (metals in watches and Swiss-made machinery) will get cheaper. ...

So, don't cry for exporters just yet.

US Dollar vs. Swiss Franc

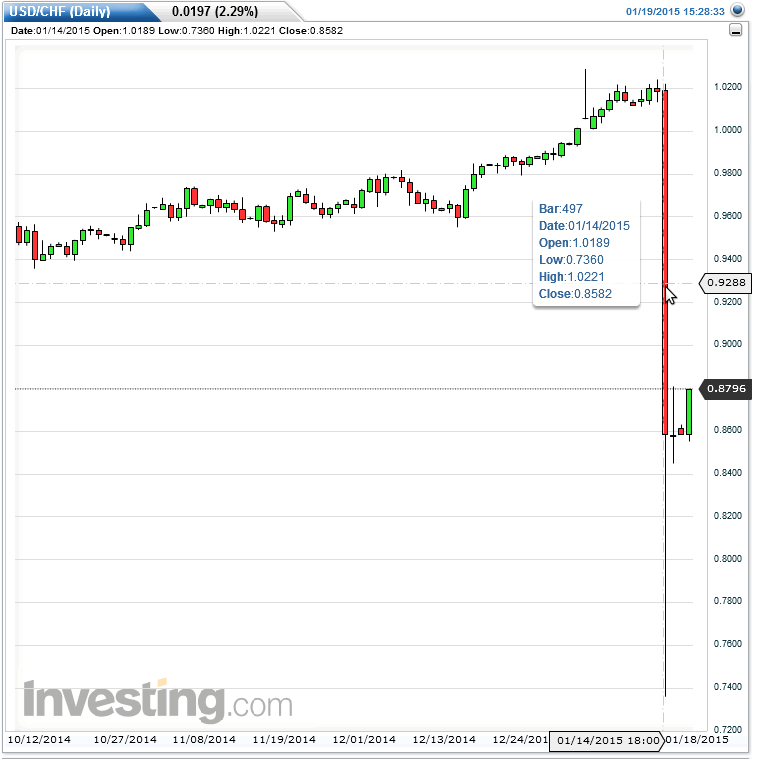

Last Thursday, the value of the Swiss Franc related to the US dollar soared as much as 28 percent. About half of that has been recovered.

Swiss exporters will find they can import commodities about 14% cheaper than early last week. They do lose out current inventories of goods, but this is not the widely-believed export disaster story except for the initial stock market carnage.

Guess What?

Shoppers are shopping! They are even booking extra trains to Germany to do so. Fancy that! Other travel is up as well. Gee who coulda thunk?

The widespread belief is that when prices fall, shoppers will wait and wait and wait. I Have been mocking that view for years.

Economic Challenge to Keynesians

Let's once again review my Challenge to Keynesians "Prove Rising Prices Provide an Overall Economic Benefit"

Challenge to KeynesiansI challenge Keynesians and Monetarists to prove rising prices provide an overall economic benefit.

Sure, those with first access to money benefit (the banks, the already wealthy, and government bodies via taxation). But that is at the expense of everyone else.

The absurd underlying notion behind the battle cry for inflation is that if prices fall people will stop buying things and the economy will collapse.

Reality Check Questions

- If price of food drops will people stop eating?

- If the price of gasoline drops will people stop driving?

- If price of airline tickets drop will people stop flying?

- If the handle on your frying pan falls off or your blow-dryer breaks, will you delay making another purchase because you can get it cheaper next month?

- If computers, printers, TVs, and other electronic devices will be cheaper next year, then cheaper again the following year, will people delay purchasing electronic devices as long as prices decline?

- If your coat is worn out, are you inclined to wait another year if there are discounts now, but you expect even bigger discounts a year from now?

- Will people delay medical procedures in expectation of falling prices?

- If deflation theory is accurate, why are there huge lines at stores when prices drop the most?

Bonus Question

If falling prices stop people from buying things, how are any computers, flat screen TVs, monitors, etc., ever sold, in light of the fact that quality improves and prices decline every year?

Krugmanites Cheer Abenomics

The idea that falling consumer prices will lead to a downward spiral is absurd. Everyone in Japan would have died long ago if that was true.

Instead of accepting the gift of falling prices (a clear benefit to consumers), Japan fought it every step of the way with the Krugmanites cheering every step of the way.

Japan Deflation Fighting Results

- Japan has gone from being the largest creditor nation in the world to being the largest debtor nation in the world

- Japan now has the largest debt-to-GDP ratio of any developed country, roughly 250% of GDP.

- Japan has totally and completely squandered every bit of its savings.

- Keynesians cheered every step of the way, amazingly concluding, Japan failed because it did not spend enough!

Keynesian Theory vs. Practice

Keynesian theory says consumers will delay purchases if prices are falling. In practice, all things being equal, it's the opposite.

If consumers think prices are too high, they will wait for bargains. It happens every year at Christmas and all year long on discretionary items not in immediate need.

Central Banking's Grand Experiment

In spite of the above, and ignoring the total failure of both Monetarism and Keynesianism in Japan for decades, on January 15, Bloomberg author Barry Ritholtz came out in praise of Central Banking's Grand Experiment.

I took the other side of the debate in Grand Experiment Failure; Bankers Prefer Bubbles; Europe is not USA; Final Epitaph.

In praise of the Fed (and with a pointed finger at the ECB), Ritholtz proposed this tombstone epitaph for Bernanke "At least we tried".

I responded ...

And here's the irony: "At least we tried [to create inflation]" is not only the essence of the rising income inequality problem that Fed Chair Janet Yellen (and countless others) moan about, it's also the very essence of the ever-increasing debt problem the world faces.Final Epitaph

Ritholtz offered his epitaph. Here's mine. It's in regards to today's central bankers in general, written from the perspective of future historians.

"These fools thought the world needed 2% inflation, thought they could end the business cycle and recessions, and thought they could steer the global economy like a car on a curvy, mountainous roadway. The actual result was a series of economic bubbles of increasing magnitude, culminating with the currency crises of [date]."

Addendum:

Lacy Hunt at Hoisington Management pinged me with this interesting thought: "Academic research indicates that QE in the US contracted rather than expanded economic activity, just as it did in Japan. Thus, Steen could have made the even stronger case that since it didn't work in the US or Japan, it will not work in for the ECB."

To that I will add, I am positive Lacy is correct. Any alleged economic benefit of QE was a monetary illusion coupled with enormous "temporarily" hidden costs.

- Bubbles in equities and junk bonds

- Expansion of wealth inequality

- Massive increase in debt 100% guaranteed to slow future growth

Contrary to widespread popular belief, constant meddling in free markets never provides long-term economic benefits.

Asset Deflation vs. Consumer Price Deflation

Central Bankers to the Rescue - Not.

The fear of falling consumer prices is absurd.

Ironically, by fighting routine price deflation, central banks create asset inflation, pent-up volatility (the Swiss franc is a prime example), speculative bubbles of increasing amplitude (housing is a prime example), and income inequality.

When those asset bubbles break, banks are inevitably in trouble over loans made on speculative assets (for example housing bubbles or more recently loans made on wells that need $90 oil to be profitable).

Then, the central bankers inevitably try to ease the shock, further encouraging moral-hazard speculation. The pattern repeats over and over creating bubbles of ever-increasing magnitude.

Musical Tribute

In spite of central bank foolishness, a musical tribute is in order.

Simpler Epitaph for Central Bankers

In retrospect, my above proposed tombstone epitaph for central bankers is far too long. I now propose a far simpler gravestone engraving "We F'd Up".

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2014 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.