Messin' With My Financial Brain

Stock-Markets / Stock Markets 2015 Jan 21, 2015 - 10:37 AM GMTBy: Doug_Wakefield

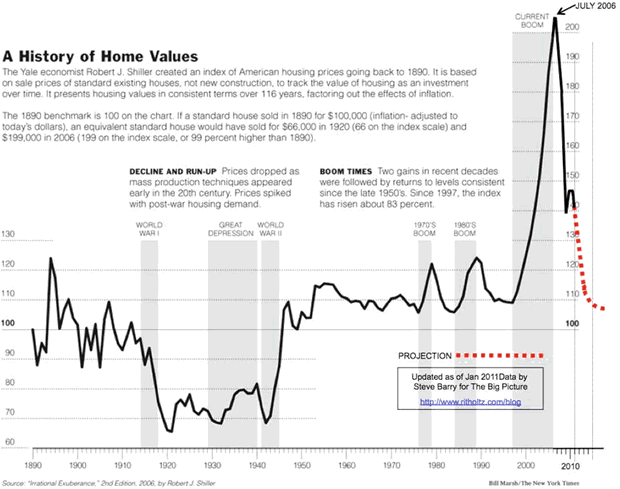

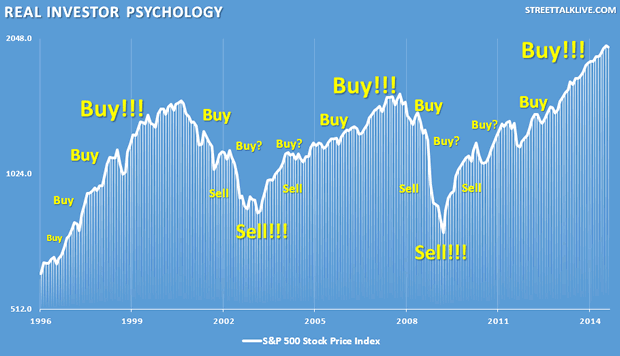

Why is it that unlike anything else we purchase in our daily life, our brains are naturally hardwired to believe that when investment prices move higher, we must make purchases or hold on rather than start selling and reducing our position? The higher price go, the stronger the belief they will continue rising.

Why is it that unlike anything else we purchase in our daily life, our brains are naturally hardwired to believe that when investment prices move higher, we must make purchases or hold on rather than start selling and reducing our position? The higher price go, the stronger the belief they will continue rising.

Car dealerships have year-end sales. Black Friday sales have now been pushed back into Thursday. Want to find cheaper prices for your airfare, hotels, and rental cars? No problem.

Yet, when it comes to gaining wealth, we are most convinced AFTER prices have soared for years, that NOW is the time to buy, BUY, BUY!!

Yet this bubble is different than the last one, or the ones before it. I know of no other time in history where the idea of Money for Nothing based on zero interest rates has lasted for 6 years. If you know of one, I want to know.

The very idea of "we can inflate" (inflation - a continuing rise in the price level usually contributed to the volume of money and credit), has been used relentlessly by central bankers to "overcome deflation" (a contraction in the volume of money or credit that results in the general decline in prices) as proof that with enough debt and time, things can return to "normal". This continues to produce ever-larger crowded trades across the global spectrum, larger in size than any bubble before it. No on need go far to look for signs of a massive drag on the global economy from this "experiment".

Crowds of Humans Leading or Following?

Every headline of "investors buy" or "investors sell" is actually incorrect, since humans would never watch prices plummet or catapult in minutes, only to immediately trade at a previous low or high for hours. This can only be explained by the fact that ALL humans, whether managing billions or thousands, are being lead by the actions of the dominant traders in world markets, the speed of light trading programs otherwise known as high frequency trading.

Equity Market Structure Literature Review, Part II: High Frequency Trading, US Securities and Exchange Commission, March 18, 2014

"The SEC's Concept Release on Equity Market Structure recognized that HFT is one of the most significant market structure developments in recent years. It noted, for example, that estimates of HFT typically exceeded 50% of total volume in U.S.-listed equities and concluded that, 'by any measure, HFT is a dominant component of the current market structure and likely to affect nearly all aspects of its performance.'"

Even this corner of the market has been impacted by the Chicago Mercantile Exchange (CME) offering discounts for central banks to trade futures. You can't make this stuff up. I do wonder if the discounts offered in 2014 were extended for this year, and has contributed to recent extreme volatility?

"What is the Central Bank Incentive Program? - The Central Bank Incentive Program (CBIP) allows Central Banks to receive discounted fees for their proprietary trading of CME Group products. Program participants receive discounted fees on CME, CBOT, and NYMEX products and COMEX futures products for electronic trading only. CBIP participants will receive discounted fees through Dec 31, 2014." [CME Group, Central Bank Incentive Program, Questions and Answers, July 2013]

Chasing the Final Dollar

In a world where the FOMO, or fear of missing out, is more powerful than one's understanding of historic changes and warnings at the system level, piling in has proved very costly as we start 2015.

Overcoming the Fear of Missing Out, Huffington Post, Nov 7 '14

No place is it more overpowering, than when central bankers promise that allowing financial assets to deflate is not an option, while central bankers also tell you that strangely enough, risk levels have surpassed those of previous bubbles.

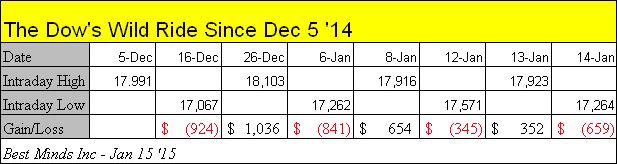

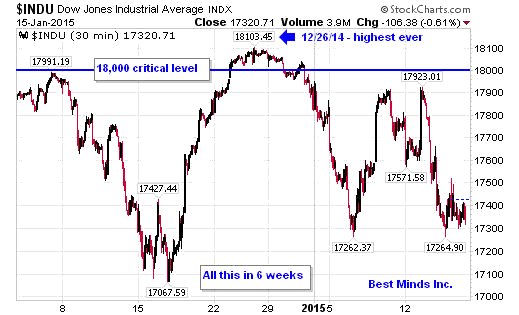

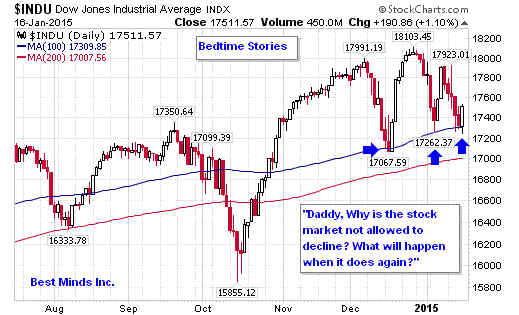

Was the final "all time high" in US stocks achieved during the last days of 2014, the Dow reaching 18,000 and the Wilshire 5,000 topping 22,000, or will the global stocks break out after the ECB's release on January 22nd, ignoring all of those "little" nasty risks that keep growing?

The question we all seem left with as we start off 2015 is "Do today's central bankers with THEIR high-speed computers trading futures alongside their electronic money creating machines have infinite powers to always bring back "calm" in global markets, stopping "risk on" assets from deflating, or could the lessons from history still have their place in this brave new world?

One thing is for certain. The Nirvana Trade is way into overtime.

Vanguard Sets Record Funds Inflow, MarketWatch, Jan 5 '15, Investors gave stock pickers a resounding vote of no confidence in 2014, pouring $216 billion -- a record inflow for any mutual-fund firm -- into Vanguard Group, the biggest provider of index-tracking products, according to preliminary figures from the mutual-fund group.

ETF industry booms in record-breaking year, Financial Times, Jan 11 '15, Investors ploughed record amounts of cash into exchange-traded funds last year as the expansion of the ETF industry accelerated worldwide.

Numerous records for ETF inflows were set in 2014 by providers, and across asset classes and geographies. This was helped by a massive surge in December, when investors allocated $61.5bn of new cash, a monthly record.

Speeding Can Bring Serious Injuries

Many pieces of information pour through our brains weekly. The emotional intensity of the last few weeks has proven different from the last 3 years, as we have watched powerful swings in both directions in stocks. This is not abnormal, but perfectly normal when one considers that the longer we trust in "more debt and intervention to the rescue", the greater the instability from herding.

The following was pulled from pages 65 and 66 in my paper, Riders on the Storm: Short Selling in Contrarian Winds:

"On Monday morning, the fallacy of composition that Dr. Jacobs had debated with his colleagues was now to take place. No more marketing. No more debating, just the hard cold reality of the markets.

'From 9:30-9:40 a.m., program selling constituted 61 percent of NYSE volume. Between 11:40 a.m. and 2:00 p.m., portfolio insurers sold about $1.3 billion in futures, representing about 41 percent of public futures volume (Brady Comm. 1988:36). In addition, portfolio insurers sold approximately $900 million in NYSE stocks. In stocks and futures combined, portfolio insurers had contributed over $3.7 billion in selling pressure by early afternoon.

From 1:10 - 1:20 p.m., program selling constituted 63.4 percent of NYSE volume and over 60 percent in two intervals from 1:30 to 2:00 p.m. In the last hour and a half of trading, insurer sold $660 million in futures. The DJIA sank almost 300 points in the last hour and a quarter of trading.'" [Capital Ideas and Market Realities: Option Replication, Investor Behavior, and Stock Market Crashes (1999) Bruce Jacobs, Co-founder and Principal of Jacobs Levy Equity Management, pg 73]

And the power of computers alongside the herding behavior by crowds hasn't changed since 1987, as attested by the Securities and Exchange Commission's joint paper with the Commodity Futures Trading Commission, Findings Regarding the Market Events of May 6, 2010, released on September 30, 2010:

LIQUIDITY CRISIS IN THE E-MINI

The combined selling pressure from the Sell Algorithm, HFTs and other traders drove the price of the E-Mini down approximately 3% in just four minutes from the beginning of 2:41 p.m. through the end of 2:44 p.m. During this same time cross-market arbitrageurs who did buy the E-Mini, simultaneously sold equivalent amounts in the equities markets, driving the price of SPY also down approximately 3%.

Still lacking sufficient demand from fundamental buyers or cross-market arbitrageurs, HFTs began to quickly buy and then resell contracts to each other - generating a "hot-potato" volume effect as the same positions were rapidly passed back and forth. Between 2:45:13 and 2:45:27, HFTs traded over 27,000 contracts, which accounted for about 49 percent of the total trading volume, while buying only about 200 additional contracts net.

At this time, buy-side market depth in the E-Mini fell to about $58 million, less than 1% of its depth from that morning's level. As liquidity vanished, the price of the E-Mini dropped by an additional 1.7% in just these 15 seconds, to reach its intraday low of 1056. This sudden decline in both price and liquidity may be symptomatic of the notion that prices were moving so fast, fundamental buyers and cross-market arbitrageurs were either unable or unwilling to supply enough buy-side liquidity.[pgs 6 & 7, italics and underlining my own]

Will things smooth out next week and the next leg of the global equities bubble continue with the ECB's announcement? Has the start of 2015 been a harbinger that all the many "highest in history" or "worst in 30 years" warnings seen in Q4 '14 are now coming home to roost?

We must all wait and see. One thing is for certain; merely creating another scheme to drive down sovereign debt yields to produce even more "lowest yields on record" days, will not change the hard cold realities facing the REAL global economy.

Off To The Races - European Court Gives Green Light to QE, Oxford World Financial Digest, Jan 14 '15

"The first stage in a trilogy of critical European events this month has just been completed. The European Court of Justice (ECJ) has given its preliminary decision concerning the legality of European Central Bank bond buying, deciding that the practice was legal "in principle" and that the ECB just needed to meet some guidelines, such as explaining its rationale."

Shrinking European Banks Will Cause Massive Credit Gaps, Oxford World Financial Digest, Jan 14 '15

"The Financial Times has published a very interesting article about how new regulations in the European banking sector might lead to a huge contraction in lending, and thus growth, across the continent. The European economy has never moved away from bank-based extension of credit as has the US economy. Therefore, there is no Fannie Mae or Freddie Mac for mortgages, and companies still overwhelmingly rely on bank loans for financing. With new rules being put in place, lending profitability will drop by about 66% for the banks, so they will have little incentive to continue in such businesses."

The idea of "unlimited money" was a bogus creation from the start. I have found that the majority of traders, whether bearish or bullish, understand that the "free money" is building more and more problems across the system. They look for short term gains from moves, and never follow a "leave it alone and my retirement will be fine" type of behavior. This, when combined with the information shown above, means that with every delay of game, the pressure only grows. Eventually, a lot of people are going to get hurt very badly.

Confidently promoting a short-term illusion for crowds must by its very nature, produce highly volatile times ahead. Few will profit from what is coming. Most, like previous bears, will be caught unprepared mentally to take action as the environment changes.

Being a Contrarian

I have found that using the "nirvana trade", one has been able to profit from being a contrarian as volatility has picked up greatly since mid 2014. These are shorter-term trades, like those following the bullish crowd, and should be considered by anyone concerned with the massive number of risks being revealed across the financial and economic system.

If you looking for a true contrarian take, and are seeking to gain insight into how the defensive side of this game can prove profitable in bubble land, I cannot think of a better time to subscribe to The Investor's Mind.

The cost for procrastination continues to rise. The value for good research is extremely low in comparison to the speed in which wealth can be destroyed. Click here to start the next six months reading the newsletters and trading reports as we come through this incredible year.

On a Personal Note

I have recently started a blog called, Living2024. It is a personal blog, not business. I wanted to have a place to write some deeper stories about where this entire drama seems to be taking us all. I hope you will check it out.

Doug Wakefield

President

Best Minds Inc., a Registered Investment Advisor

2548 Lillian Miller Parkway

Suite 110

Denton, Texas 76210

www.bestmindsinc.com

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Copyright © 2005-2011 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as advice to buy, sell, hold, or sell short. The safest action is to constantly increase one's knowledge of the money game. To accept the conventional wisdom about the world of money, without a thorough examination of how that "wisdom" has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of individuals, and at any time may or may not agree with those individual's advice. Challenging one's thinking is the only way to come to firm conclusions.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.