Swiss Say No to QE

Stock-Markets / Quantitative Easing Jan 20, 2015 - 01:03 PM GMTBy: Harry_Dent

The markets have had an array of abrupt reactions to the Swiss National Bank’s (SNB) move to stop supporting the Swiss Franc against the euro from buying Swiss bonds.

The markets have had an array of abrupt reactions to the Swiss National Bank’s (SNB) move to stop supporting the Swiss Franc against the euro from buying Swiss bonds.

The euro has crashed further, stocks have taken minor hits and gold has broken to the upside (as we expected near term).

But the biggest impact is likely to be on Mario Draghi’s up-and coming decision to ignite another heavily telegraphed round of quantitative easing (QE) to the tune of $1.2 trillion plus.

But I’ll get back to that.

Few people realize that Switzerland, even more so than Japan, has been the most aggressive at QE and at expanding their central bank’s balance sheet by five times since January 2008.

Why would the normally conservative Swiss bank be so aggressive in stimulating and then reverse so sharply?

The Swiss like most European nations are big exporters, at 50% to 54% of GDP since 2006. A falling euro versus the Swiss franc, like in late 2007 when it was 1.67 euros to the franc, hurts export industries from watches to chocolates.

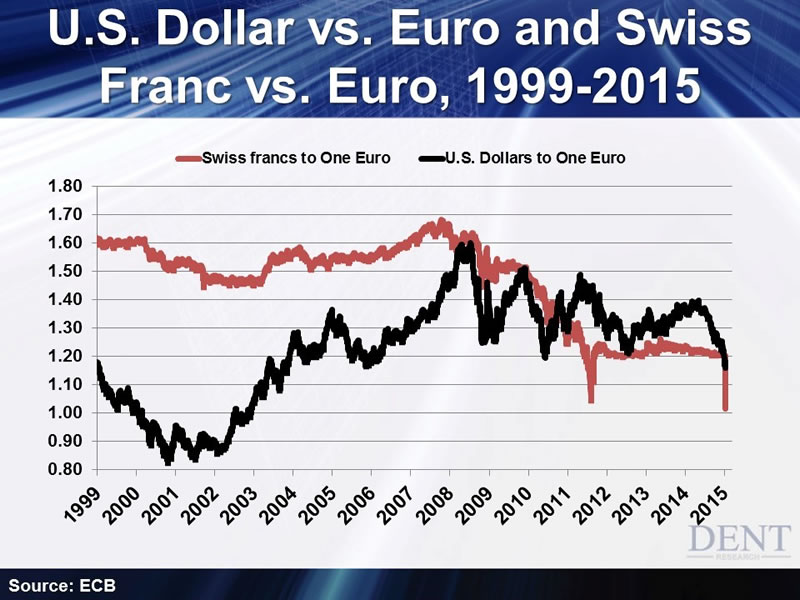

Hence, the Swiss have been pushing down the Swiss franc and bolstering the euro to peg at 1.20 to the franc, but at great expense, as Switzerland is David fighting Goliath. The chart below shows the euro versus both the Swiss franc and the U.S. dollar since 2007.

The euro peaked against the dollar in March of 2008 at 1.60. I remember that painfully as I was in Italy at the time paying top prices for everything. The euro has devalued 28% against the dollar since then. That would’ve killed Swiss exports if they hadn’t fought it.

But there is one big difference for the Swiss. Their largest industry is global banking and a falling currency means affluent depositors lose value… they don’t like that! By pegging it to the euro, those depositors are neutral but it also means that most depositors outside the euro lose value.

Swiss Versus the Euro

So, the Swiss couldn’t afford to single-handedly keep fighting the euro… and its banking sector needs to return to the safe haven status it’s always offered, especially now that it has had to give up much of its secrecy advantage.

The euro zone is heavily split over Draghi’s intention of strong QE. Germany and the other healthier northern countries — Austria, the Netherlands and Finland — are against another desperate round of QE.

Yes, that would benefit their exports, but they are doing well enough to value the long-term over the short-term benefits of desperately taking more financial drugs.

The Mediterranean countries are all flagging — France, Italy, Spain, Greece and Portugal. They desperately need escalating QE to keep their bond rates low (with the strongest rising deficits) and to continue to stimulate their exports and trade imbalances.

Here’s what is so important about the sudden Swiss move: the SNB just pre-empted Draghi.

The euro is falling without further QE as a Swiss withdrawal of that move is like an increase in stimulus for the euro. If Draghi adds insult to injury with a big jolt, the euro could be at parity in short order to the U.S. dollar.

Given that there is already a big rift over such QE, it makes it harder for Draghi to follow through — at all, or as strongly, as he has telegraphed.

Anyone that doesn’t think that European and global stock markets will tank if Draghi does not follow through is nuts.

The markets know that they can’t keep going up without continued QE. The U.S. is on hold for now, Japan is off the reservation on the excessive side. The ECB is the only major region that can keep upping the ante here.

The U.S. is the only market holding fast to the delusion that we’re at escape velocity and more QE is not needed. That will change in 2015 when our economy unexpectedly slows due to demographic trends, as will Germany’s and many others in Europe.

Germany has been leading the protest against the new surge in QE. A court just approved more QE and defined it as legal, so Draghi won that round.

But what if Germany is successful in blocking QE or keeping it minimal?

This decision is due around March, just when we have the strongest potential turning point in this year’s cycles.

A balk on European Central Bank’s QE and continued falling oil prices are likely to be the two triggers for the next global stock crash… and they are, of course, intertwined.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.