The Truth About This Stock Market "Meltdown" Indicator

Stock-Markets / Stock Markets 2015 Jan 20, 2015 - 12:56 PM GMTBy: Money_Morning

We talk about why you should always be in the stock market (and NOT for the same reasons Wall Street wants you in, either). That's because being in the markets allows you tap into the inevitable growth that comes from capitalism and, by implication, humanity's upside.

We talk about why you should always be in the stock market (and NOT for the same reasons Wall Street wants you in, either). That's because being in the markets allows you tap into the inevitable growth that comes from capitalism and, by implication, humanity's upside.

Lately, though, people are beginning to doubt the premise behind that Total Wealth tactic.

That's due partly to recent trading action (which is unsettling), and partly due to the hype surrounding various indicators that are almost "guaranteed" to show a looming meltdown (which is unnerving).

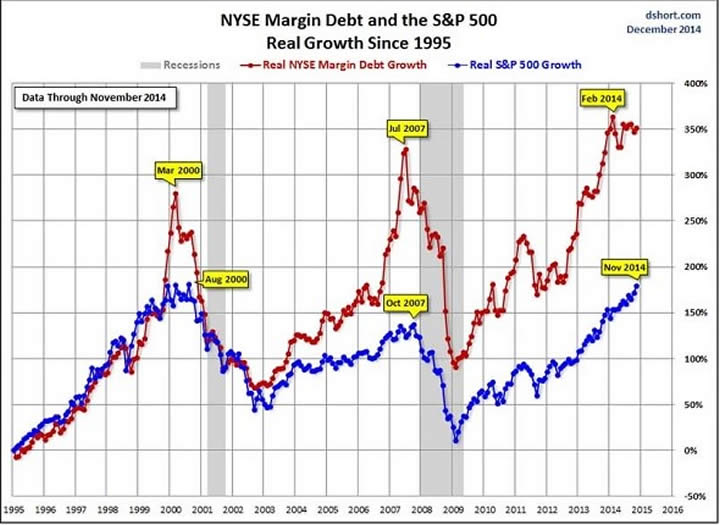

Right now the scary indicator making the rounds is record "total margin debt." Chances are you've probably seen the emails, too.

According to the New York Stock Exchange, investors have borrowed more than $457 billion against their brokerage accounts as of November 2014 – a new record. The social meme – the mantra, if you will – is that so much debt is unsustainable, and that it potentially undermines the entire market.

I get that… debt is a four-letter word after all, especially when it comes to the central bankers and Wall Street fat cats. But this is different.

In fact, I'd even go so far as to chalk this up to another case of "it isn't what it seems."

Here's the truth about this "meltdown" indicator.

Putting $457 Billion of Debt into Context

Total margin debt isn't a statistic that's calculated out of thin air. In that sense, it's really nothing new.

Every New York Stock Exchange Member Firm is required to report total outstanding borrowing held against client accounts on a monthly basis and has been since passage of the SEC's rule 606 in 2005. That way, the exchanges and regulatory agencies can track potential exposure and liquidity problems by determining who is leveraged up to their eyeballs and who is not.

This is important because it is the brokers and ultimately the financial intermediaries who will have to make good on any default. You could argue that lately this risk has been shifted onto the American public and I wouldn't disagree – but let's save that for another time.

The thinking is that margin debt goes up because investors are becoming more aggressive and using that money to buy additional securities. That somehow it's an irrational acceptance of risk or complacency.

In reality, though, there's nothing unusual about margin levels that have risen to where they are today. I'd even go so far as to say that while it's imprudent, it's not illogical. When money costs nothing, people are going to borrow as much as they can. And you can thank the Fed for that little gem, via its zero-interest-rate policies.

I know the chart below looks scary but, again, everything is not what it seems…

Source: Advisor Perspectives & Doug Short.com

I say that because what these terrifying Internet email chains never bother to disclose is that all that money isn't necessarily used to buy stocks.

In fact, the money can be used any way the account holder wants – to buy a home, pay for college, an upcoming trip, or to buy more stock. As long as there is acceptable collateral posted, there are really very few restrictions.

The other thing to think about is that margin is cheaper than it's ever been thanks to the Fed's emphasis on cheap money. Not only that, but brokerage competition is more intense than ever before, so the terms are more attractive to clients who want to borrow than they've been at any other time in history.

And, finally, the S&P 500 is up 187% from March 2009 lows. Seeing a corresponding rise in margin at the same time is absolutely consistent with the Fed's policies. That's because the Fed has done the impossible and inflated everything – collateral and debt alike.

So the next time you see one of those panic-inducing emails and your breathing starts to quicken, take a look at the following chart of total NYSE margin as a percent of total market capitalization.

Source: GaveKal Capital

What it's telling you is that total margin debt is less than 3% of total market capitalization. That's practically a rounding error. What's more, it shows you that the debt-adjusted returns we've seen over the past few years are par for the course.

To be fair, I'll leave it to you to decide if this is sustaining or sustainable. Charts or not, I could make the argument either way.

And that brings me to my favorite part of each column – what to do with your money.

The Key Takeaway from the Margin Debt Debate

Rising margin debt is clearly not a data point you want to watch in isolation, nor is it something you want to ignore. But keep things in perspective.

Growing up in a household where you don't buy something unless you can pay for it, debt is not my preferred way of doing things. I don't like it and never have. But that's just me.

If anything gives me pause about the level of margin debt, it's the fact that millions of Americans don't share that attitude. Not surprisingly, I view the rising margin debt as implicit social acceptance that "somebody else" will bail the system out again if it collapses.

That means risk management is vitally important, beginning with your trailing stops. Just because everybody else is apparently throwing risk to the wind and willing to go into hock for the privilege of doing so doesn't mean you need to.

It's also proof positive of something else that we talk about a lot – namely that the big money is going to be made ahead by those companies answering needs humanity can't do without and that debt cannot disrupt at any level. (That's a big part of what makes a trend "unstoppable.")

Not only are they more stable, but such companies tend to recover faster if there is a major correction, no matter what the cause.

For example, both American Water Works Company Inc. (NYSE: AWK) and Becton, Dickinson and Co. (NYSE: BDX) saw losses in 2008-2009 that were minor compared to those suffered by the major indexes.

AWK taps into the Demographics and Scarcity/Allocation trends, while BDX also hits two of our trillion-dollar trends at once: Medicine and Demographics.

Source : http://moneymorning.com/2015/01/19/the-truth-about-this-meltdown-indicator/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.