Gold and Silver Heading for Imminent Deflationary Crash?

Commodities / Gold & Silver Jun 01, 2008 - 08:43 AM GMTBy: Mick_Phoenix

Welcome to the Weekly Report. This week we look at the end of the western world as we know it. Well okay if not the end then it's the beginning of the end. My interest over the past few weeks has switched from stocks into bonds. Interesting things are happening to bonds and we should take note. We round off this week with a look at the Dow and a new indicator.

Welcome to the Weekly Report. This week we look at the end of the western world as we know it. Well okay if not the end then it's the beginning of the end. My interest over the past few weeks has switched from stocks into bonds. Interesting things are happening to bonds and we should take note. We round off this week with a look at the Dow and a new indicator.

First up though is gold. Has CA become a gold bug? Well no, for me gold is a commodity that has its intrinsic worth tied to inflationary expectations, as someone expecting a deflationary end to the western world you can imagine I use gold, rather than hold gold. What got me thinking more about gold was a recent email I received:

Hi Mick,

When you have a moment, will you be kind enough to let me know what is the best asset or currency to have on hand during deflation?

Sue

Sue raises a very good point at just the right moment and as I cogitated upon a reply I realized it was much more complicated matter than you would think. Fortunately I have been following a strategy that takes into account the possibility of deflation. Here is my reply:

Good question Sue!

Firstly, what follows is my opinion on my approach, its not intended as advice to anyone.

I hold gold (physical) and I have been hedged with a short from just under $1000, this is a twofold strategy. It protects the fiat profit on the physical and allows me to realise that profit when I buy back the short at lower levels. It also saves inflated, cheaper dollars now to realise them in profit as more expensive dollars later. I treat dollars like an asset, no different from oil for instance, the price of dollars will fluctuate.

In a deflation you want to find fiat currencies that have a low debt service for its Nation issuer, eg, Swiss franc. Highly indebted sovereign states will struggle with higher nominal yield payments on debt.

In the not too distant future, there may well be an opportunity to lock in high yields in top rated debt.

Yes, I have seen that short hit $848 and bounce to the $930s and not taken a profit. This isn't a trade for the short term. Either it gets closed if gold rises back to the short breakeven area or when I decide that the end of the western world as we know it has happened. I suspect the "or" maybe more difficult to judge than the "if".

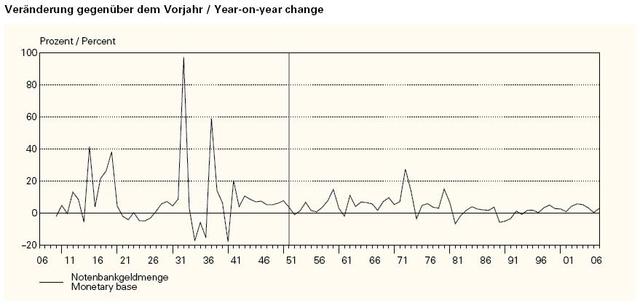

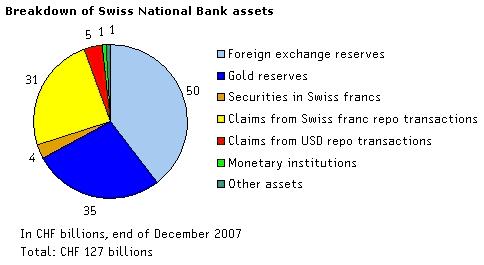

Why do I like the Swiss franc? Compare these two charts:

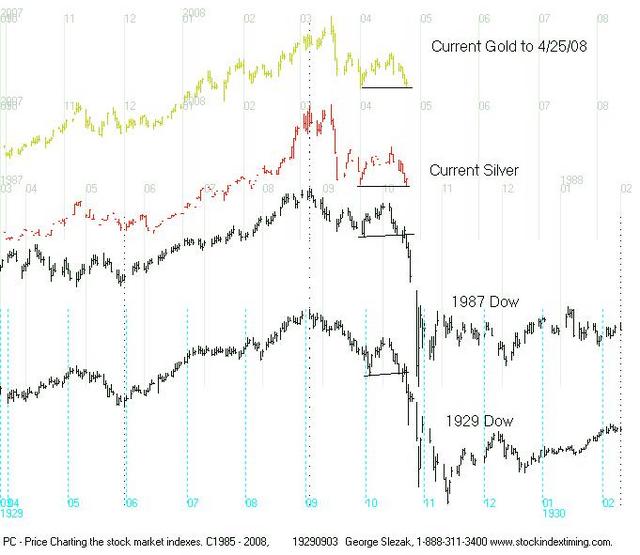

What then has me bearish on gold and reinforces my deflationary outlook? The following chart is from a member of Livecharts who has spotted a rather delicious set up. Here is Sarah's chart:

With thanks to Sarah and Stockindextiming.com

So that was the situation back in late April, let's have a look at a daily gold chart up to the present:

I have concentrated more on the end of the pattern shown by the horizontal lines drawn on the first chart and the support/resistance area at $885. What do we see; ahhh yes in the 1929/87 examples there is a rise in price after the initial break through support. Gold did the same; it broke through $885 at the end of April and early May and then bounced from $848, rose to a minor top around $936 and then took out $885 again. Looking at the closing price, you can see why I consider gold to be the top priority this week. (The arrows are for subscribers, they pinpoint support and resistance in advance of the event, last week I highlighted the moving average as the support area to watch).

Now comparing patterns from differing instruments in different times (I happen to like fractals) is not an exact science, the relationship can break down at any moment. Right now I would need to see gold close above $885 and preferably above the MA at $902 on a weekly basis before thinking about a bullish outlook. I see no reason to change my current position, if the fractal pattern continues then gold has a long way down to go and the descent is imminent.

Do I have any other data that helps support my bearish gold stance?

To read the rest of the Weekly Report visit www.CAletters.com and sign up to the 14 day free trial

By Mick Phoenix

www.caletters.com

An Occasional Letter in association with Livecharts.co.uk

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.