Top in Dow? Stock Market Mid-Term Outlook

Stock-Markets / Stock Markets 2015 Jan 19, 2015 - 07:16 AM GMTBy: Joseph_Russo

Have the equity markets finally peaked? In our view, they should have never carried on as they have - but with psychopaths at the helm of the financial sphere, you just never know what the future will bring.

It's been a long, long time since financial markets have actually reflected what's taking place in mainstream economies, and as such, it's been a similarly long time since we've even bothered to try and correlate the two.

Beyond this misfortunate decoupling of reality and the broken equations of logic it fosters, all that remains as a reliable gauge for measuring the progress of financial markets is price and trend. Fortunately, at the end of the day, price and trend trump everything less.

The following is a small sample of what you will find in Elliott Wave Technology's FREE Mid-Term Outlook. You can register to get the balance of this edition and future issues of the Mid-Term Outlook from the Elliott Wave Technology homepage.

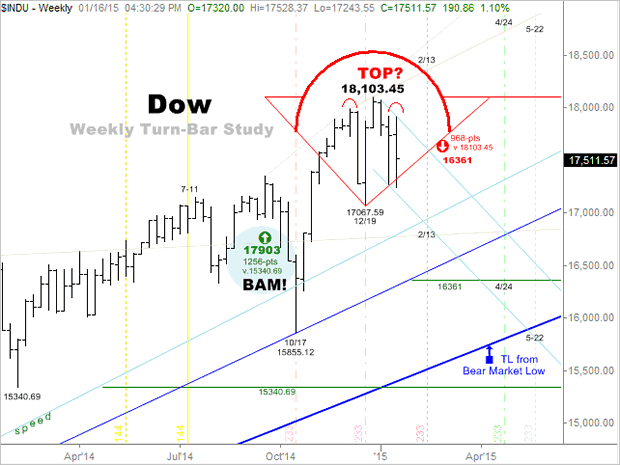

DOW: Weekly Turn Bar Study

Vertical dashed lines on this sample chart of the Dow mark potential timing points for turn-week pivot highs or lows. The margin of allowance for such turn pivots is one or two bars.

The next plausible turn week for the Dow occurs the week ending February 13. We shall identify additional potential turn-periods in forthcoming issues.

Furthermore, so long as 18,103.45 holds top, sustained trade and closes below the rising red trendline so noted - will target a near-term downside price target of 16,361 - which from Friday's close, is a rather mild 6.5% correction and a still quite modest 9.62% correction from the all time print high for starters.

Once again, you can register to get the balance of this edition and future issues of the Mid-Term Outlook from the Elliott Wave Technology homepage.

Until Next Time,

Trade Better/Invest Smarter

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2015 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.