State of the U.S. Markets 2015 Report and Online Conference

Stock-Markets / Stock Markets 2015 Jan 18, 2015 - 10:21 AM GMTBy: EWI

As you read this, Elliott Wave International are preparing to throw open the doors to one of their most exciting events of the year. EWI's State of the U.S. Markets 2015 Online Conference begins at noon Eastern time Tuesday, Jan. 20, and runs through noon Wednesday, Jan. 28. Registration is 100% free. And what you take away includes some of the most incisive macro-level forecasting you will find for U.S. markets. Period. The insights you will discover inside will prepare you for the major moves in U.S. stocks, commodities, gold, USD and more for the entire year ahead and beyond. Plus, when you sign up early for this 100% free, online event, you will get instant access to a new video from the legendary market forecaster Robert Prechter. Please continue reading for more, or follow this link to claim your free invitation right now »

As you read this, Elliott Wave International are preparing to throw open the doors to one of their most exciting events of the year. EWI's State of the U.S. Markets 2015 Online Conference begins at noon Eastern time Tuesday, Jan. 20, and runs through noon Wednesday, Jan. 28. Registration is 100% free. And what you take away includes some of the most incisive macro-level forecasting you will find for U.S. markets. Period. The insights you will discover inside will prepare you for the major moves in U.S. stocks, commodities, gold, USD and more for the entire year ahead and beyond. Plus, when you sign up early for this 100% free, online event, you will get instant access to a new video from the legendary market forecaster Robert Prechter. Please continue reading for more, or follow this link to claim your free invitation right now »

Dear Investor,

Here's the scoop...

Oil has been making headlines for weeks, and many pundits have rushed to explain, in retrospect, its stunning decline in price and how it impacts other markets, including U.S. stocks.

On Jan. 12, USA Today interviewed Saudi billionaire businessman Prince Alwaleed bin Talal. His very first comment was:

“Saudi Arabia and all of the countries were caught off guard. No one anticipated it was going to happen. Anyone who says they anticipated this 50% drop (in price) is not saying the truth.” [Emphasis added.]

Only problem is, someone not only anticipated it; they put it in writing.

Our friends at Elliott Wave International called for an all-time high in oil in June 2008, six years ahead of these explanations. That was when oil was at $140 per barrel, nearly three times its price today.

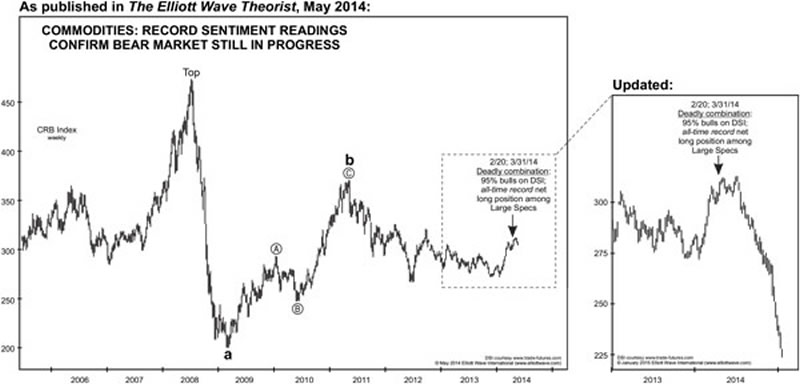

In May 16, 2014, they published an oil chart (see below) with the headline "Deadly Combination." It landed at a time when no one else was talking about oil like they are today.

On the contrary, 91% of traders were actually bullish on oil at the time, and Large Speculators had their biggest long position EVER.

Yet in the summer of 2014, when oil was above $100 per barrel, EWI predicted:

"… the multi-year outlook is for much lower prices."

Here is EWI's original chart, published on May 16, 2014:

Two months later, in July 2014, EWI Founder Robert Prechter published the third edition of his New York Times bestseller, Conquer the Crash. In it, his forecast for oil could not have been clearer:

"Wave c should carry the price of oil below the 2008 low."

The 2008 low is $34.50.

As I write you this letter, oil is down 4% on the daily session and priced at $48 per barrel. Meanwhile, gas prices are dipping below $2 per gallon nationwide. Compare that to the time of Prechter's 2014 forecast, when oil was TWICE today's price -- at about $100 per barrel.

Here is the updated version of the above chart -- with today's prices.

A quick glance shows how far oil has fallen: more than 50%.

Pretty interesting, huh?

That's not even the half of it!

Prechter is, in our opinion, chief among the very, very few financial analysts who were all over this story. (And most of the others are Bob's colleagues at EWI, the world's largest financial forecasting firm, or his friends in the industry.)

But Bob and his team have a lot more to say -- on stocks, gold, interest rates, currencies, economic trends and more. And if it is even half as accurate as their forecast for oil, it will pay off right now to lean in and listen.

Which is why we are excited to invite you to join us for EWI's upcoming free event: The State of the U.S. Markets Online Conference.

EWI has just released their much-anticipated annual report for subscribers, The State of the Global Markets -- 2015 Edition. And to celebrate the months of hard work put into pulling it off, they're inviting the public to come and preview the U.S. section of it -- 100% free -- plus brand-new videos and bonus resources from EWI's top analysts.

From now until Jan. 28, you can read and watch as Prechter and his team lay out their big-picture forecasts for the U.S. markets. Forecasts they expect to unfold over the next 12 months and beyond.

This is an incredibly valuable event -- not only because it gives away months of EWI's high-priced research for free; because it represents a full year's worth of opportunities from more than a dozen of the world's top financial analysts.

Please tune in to this event. You can bet we'll be checking in daily as new resources go online.

Click this link to claim your free invitation now.

See you inside!

Sincerely,

EWI

P.S. The event officially begins Jan. 20 and runs through Jan. 28, but if you sign up now, you'll get instant access to a great welcome video from Robert Prechter, which sets up the event nicely and shows you a little bit about the unique approach he uses to forecast major market moves like he has recently in oil, gold and other markets. Follow this link to claim your invitation and watch Prechter's video now.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.